I’m a preternaturally good worrier, and as we bring to a close to this sensational quarter (at least the part that started on August 17th, so let’s call the most recent eighth of a year sensational), I am wringing my hands, as I always do, about what could go wrong. After all, the bears have been dominating in a way unseen since 2008.

The percentage of stocks above their 200-day moving average is lower than it was even in mid-June.

The Dow Jones Composite is at a new multi-year low, and could easily bounce back to the gap formed last week, which is quite a bit higher.

Likewise, the NASDAQ Composite is near a major supporting trendline and a major Fibonacci retracement.

The S&P 100 has almost perfectly tagged a multi-decade trendline.

The Russell 2000 is also near major Fibonacci support and looks like a double-bottom with June 16th.

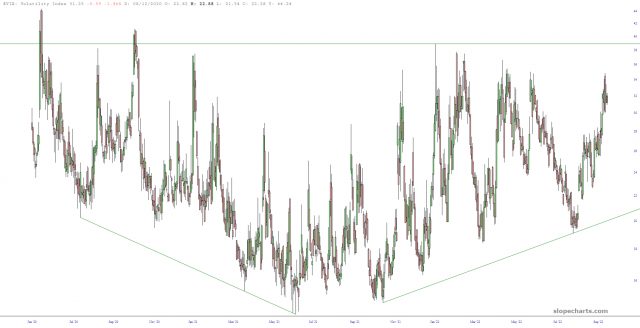

And the VIX normally poops out in the lower 30s before collapsing back into teen-land.

Since I’m worried, it probably means October is going to be an amazing month for the bears, and I’ll partly miss out (Paging Dr. IYR. Please pick up the white courtesy telephone). All the same, as much as I’d love the market to go down EVERY day until the end of time, it just ain’t gonna happen, and we need to see when the bad guys are going to come after us again.