How the mighty have fallen. We went from this in 2018………..

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

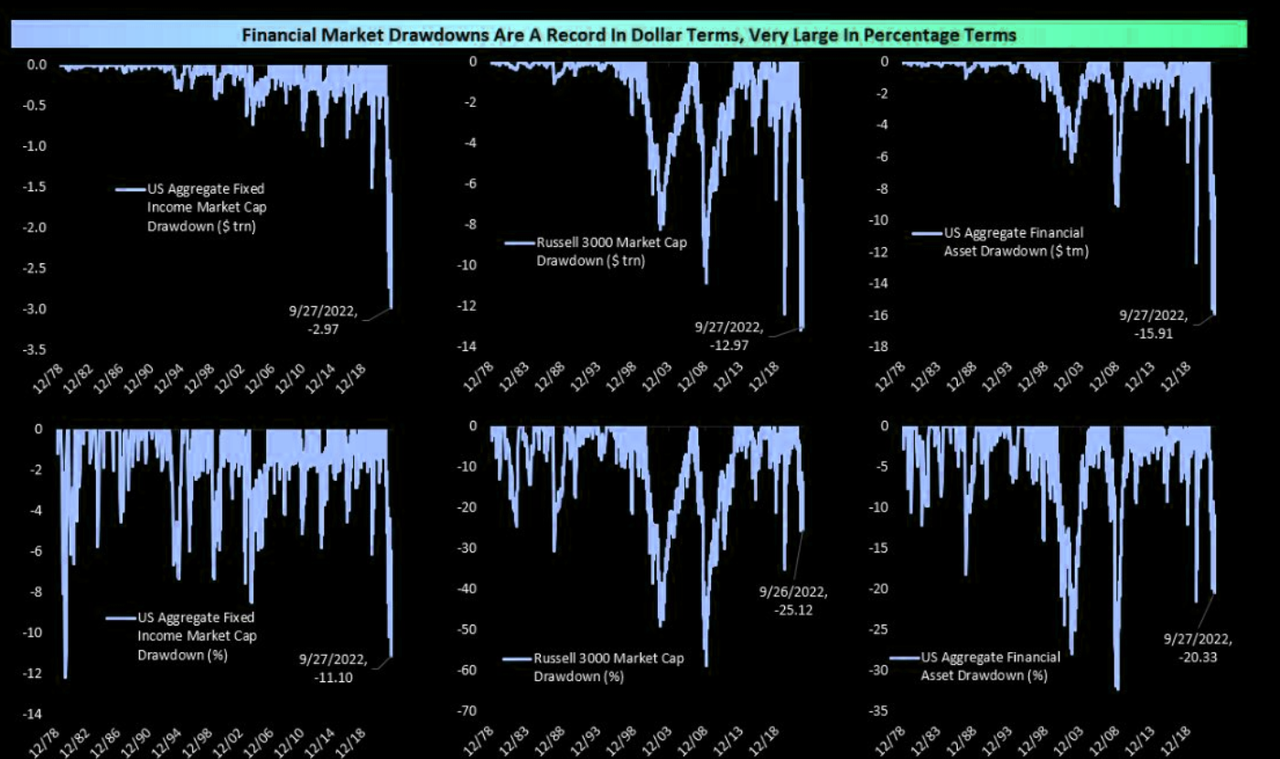

The fakery has finally been exposed. The lies, the deceit, the arrogant disregard for decency, and all the other sociopathic madness the bulls have brought upon this world is finally being seen for what it truly is, and for what I have been preaching for lo these many years. $30 trillion of asset destruction later, it is pleasing to witness this gargantuan canard unravel, with the knowledge that countless more tens of trillions of destruction are forthcoming. It makes my heart sing.

There is one element left which requires demolition, and that is cryptocurrencies. Of all the nonsense promulgated over the past dozen years, surely this must stand up as the apotheosis of this age (if you can set aside the utterly grotesque Rebekkkkah Neumannnnnn and her WeWork scheme, in alliance with her bizarre spouse). Simply stated, Bitcoin and Ethereum MUST be destroyed in order for the full fury of the bear market to be utterly unleashed. If at any point you see them finally break support, it’s time to kick back, relax, and watch the show.

(more…)Last week I was looking for a new low on SPX for 2022 and we’ve seen that week. I was also wondering about a possible rally after that and SPX has been setting up nicely for that rally, even with news this week that has mainly been grim. Nonetheless it is a decent looking setup for a rally here, so I’ll have a look both at that and the obvious next target below in the event that this rally setup fails.

On the rally prospects side the new low and retest of that low has created a very decent quality potential double bottom setup that using the lows at the time of writing would look for the 3850 area on a sustained break over 3736.74. The retest has also set up positive divergence on the daily RSI 14 and RSI 5. Given that there is similar divergence on NDX and still an open hourly RSI 14 buy signal fixed, that is a lot of potential and actual support for a rally here.

(more…)

THIRD RED QUARTER IN A ROW. Let’s do the same for Q4, shall we?

I’m a preternaturally good worrier, and as we bring to a close to this sensational quarter (at least the part that started on August 17th, so let’s call the most recent eighth of a year sensational), I am wringing my hands, as I always do, about what could go wrong. After all, the bears have been dominating in a way unseen since 2008.