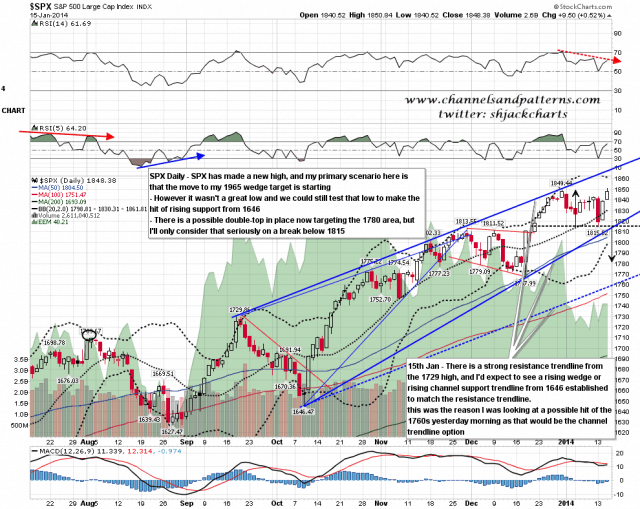

There was a new high on SPX yesterday so, poor quality though Monday’s low was, the final move up to my wedge target at 1965 may now be starting. That was the rising wedge target I gave on 30th June and you can see that post here. The failure to hit rising support from the 1646 low however leaves open the possibility that the 1815 low might be retested over the next few days and that should be borne in mind. There is also a possible double-top in play now targeting the 1780 area on a break below 1815, but I’ll only be considering that seriously on a break below Monday’s low. SPX daily chart:

On Monday I was looking at the AAPL chart with the comment that the overall setup looked bearish but a bounce first seemed likely and we have been seeing that bounce. The overall setup still looks bearish but if AAPL can clear declining resistance in the 569 area and then the last high at 571.88, then I’d be cautiously looking for a move to rising wedge resistance in the 600-10 area. AAPL 60min chart:

On other markets EURUSD has been finding some support at rising support from May. I’m expecting that to break soon and if so I’d then be looking for a move to overall rising wedge support in the 1.325 area. EURUSD daily chart:

On CL my overall lean is bearish but CL is currently bouncing and there’s plenty of room available to bounce further. There is an open target in the 95.5 area, but CL may well be pausing to finish an IHS that would target the 98 area. I have overall declining channel resistance in the 99 area and would only be switching my lean to bullish on a break over that. CL 60min chart:

GC may have made a major low. Short term I have declining resistance and a possible IHS neckline in the 1270 area. Main resistance is at the 150 DMA in the 1300 area and on a clear break over that I would expect the bear market in precious metals to be over. GC daily chart:

I’m expecting to see some retracement today and am looking for a possible fill of yesterday’s opening gap. The 50 hour MA on ES is a support level to watch and that is currently at 1836.50 ES.