I was out for the first half of the session and was very pleased to see (buffs fingernails modestly) that DX and ZB both bounced at the support levels I had said must hold for the bear scenario. Overnight ES has fallen hard into a potential short term double bottom in the 1192 area and is now close to the 1185 level that I've been talking about as main support on ES. Here's how that looks on the ES 60min chart and I would draw your attention to the short term falling wedges confining the current downtrend. Those are suggesting that we may see a strong bounce in the 1185 area later on, and I have noted the wedge resistance levels on the chart:

There is another falling wedge on the NQ chart that's also well worth a look. Longer term I'm seeing the next big support for NQ at rising support in the 2110-20 area:

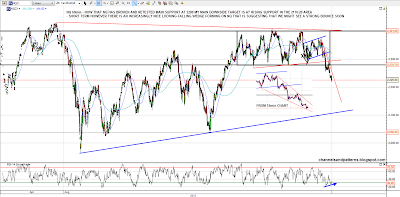

There is yet another falling wedge forming on the TF chart, so I'll be watching those carefully today. TF has now broken the triangle that formed there and I'm seeing longer term downside targets there in the 675 area and possible declining channel support in the 665 area:

Going back to the DX and ZB charts we obviously saw a strong bounce on USD futures (DX) on Friday and I'm watching to see how that develops today. DX is again testing strong resistance at the 78.60 level and we'll see whether that breaks today. If it breaks I have marked in two possible rising wedge resistance trendlines, but the main target is obviously the IHS target at 80.85 which would be a new high for 2011. If the support trendline that held on Friday morning should break that would be a strong warning to USD bulls to become very cautious:

30yr Treasury futures (ZB) have broken up to a new short term high overnight and the rectangle target is back to test the 2011 hghs. ZB needs to hold the 142'15 area on any retracement and I have some short term trendline resistance in the 144'12 – 144'14 area:

Oil has broken and retested the rising channel since the October low. My preferred retracement target is strong support and the potential H&S neckline in the 90 area:

Overall the bear case is looking pretty good here but the falling wedges on ES, NQ and TF are suggesting that we might make a short term low today followed by a strong bounce, probably to retest the support levels that broke last week. After that I'd expect more downside, but it's possible of course that these falling wedges will resolve downwards. If so the DX and ZB charts particularly suggest that equities may fall very hard.

I've been out much of the morning so the post is shorter than usual. I've also done some other charts that I haven't had time to post on EURUSD, copper, gold and silver and you can see those by clicking on their names in this sentence. My personal WAG for today on ES is that we see a bounce to the 1200 area now, then a test of the 1185 level, and then a stronger bounce to test the larger falling wedge upper trendline in the 1210 area. At that stage we would see whether the falling wedges will break up into a stronger bounce.