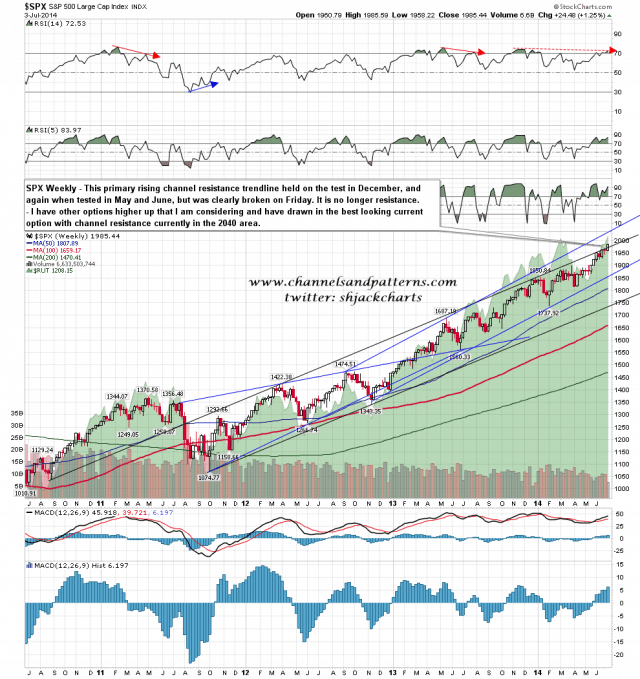

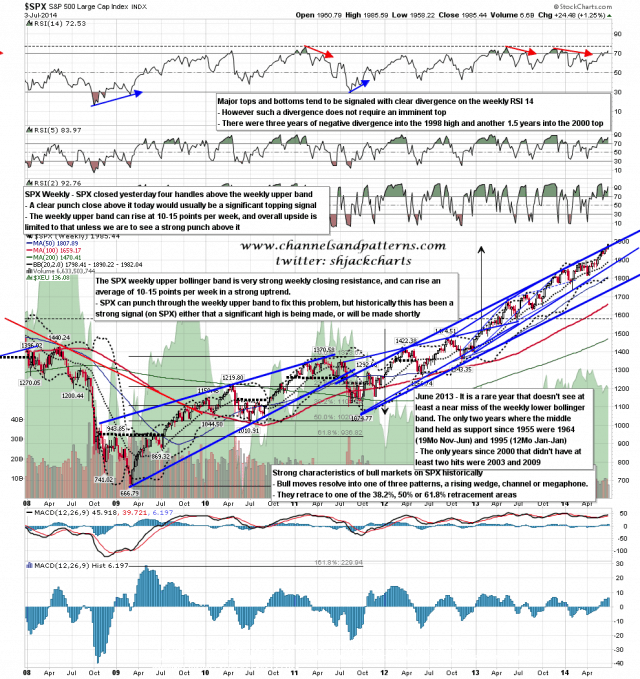

Thursday was a strong day on SPX and NDX, and at the close, all three of the significant resistance trendlines that I was looking at in my Thursday morning post were broken. The most important of those was primary channel resistance from the October 2011, which had been tested and held in all four of the preceding weeks but has now finally been broken. I would expect another pattern to form and am considering the likely options, but at the least I’d be looking for a further move to the 2040 area now. SPX weekly chart:

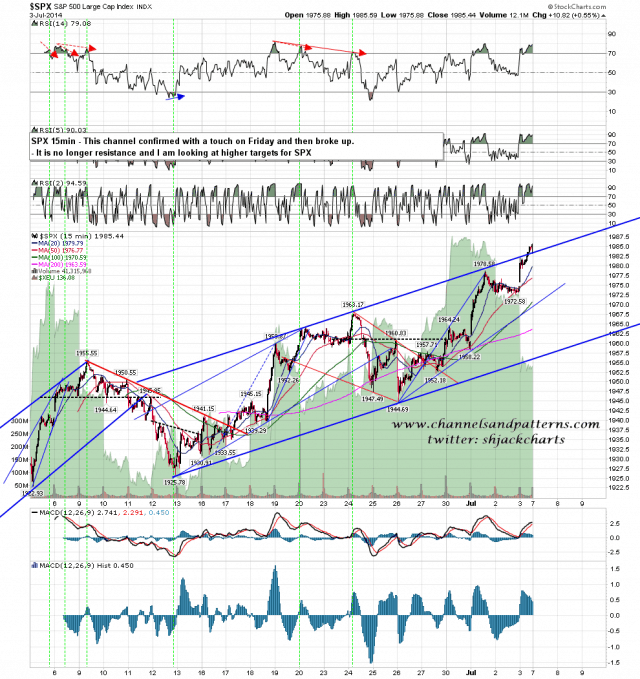

Rising channel resistance from the 1926 SPX low also broke up. There’s not much to suggest reversal on the 15min or 60min RSIs, and I now have my eye on rising megaphone resistance from 1814, currently in the 1995-2000 area. SPX 15min chart:

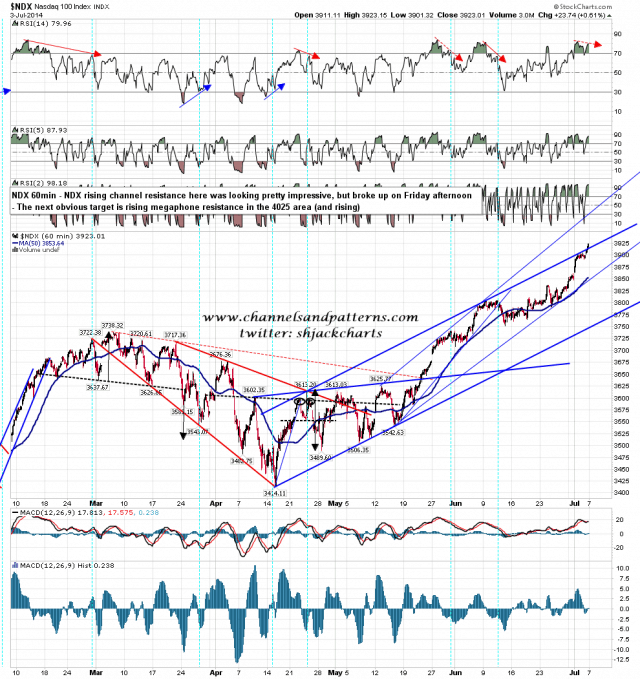

NDX broke up through rising channel resistance, and I’m looking there for a move to rising megaphone resistance in the 4025 area. NDX 60min chart:

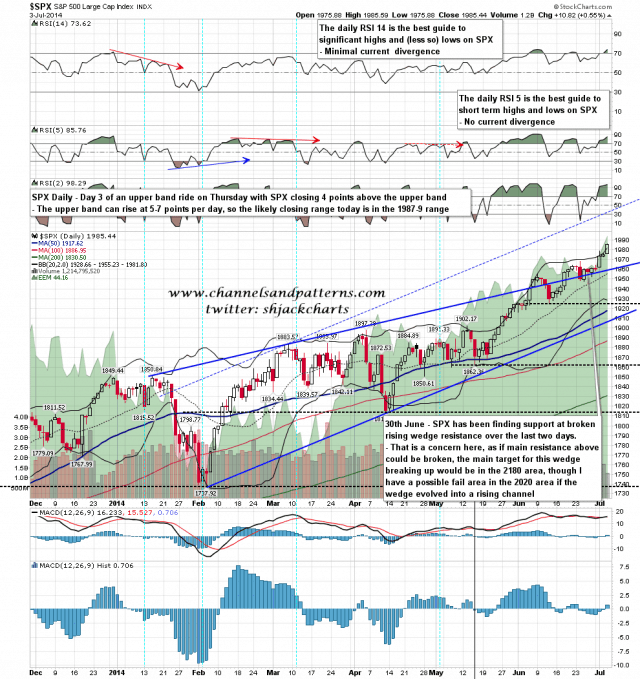

The upper bollinger bands on SPX are a limitation here. On the daily chart less so, but SPX closed 4 points over the daily upper band on Thursday and we may see some weakness or consolidation today. Today is day four of the current ride up the SPX daily upper band. SPX daily chart:

The upper band is a very real limitation here on the SPX weekly chart. SPX also closed four points above the weekly upper band on Thursday, and unless we are to see a strong punch over the weekly upper band, which would generally be a strong topping signal, then SPX can only rise as fast as the weekly upper band can rise, which is about 10-15 points per week. If the band ride up the weekly upper band is to continue (currently starting week 7) then we are likely to see some more two way action. SPX weekly chart:

Leaning towards seeing some consolidation today or tomorrow. The stats for today are 62% bullish according to the Stock Trader’s Almanac.

No room for non-equity charts today, so I’m planning to post TNX, oil and gold charts on twitter later on.