The last two cycle trend days both delivered. There is a third this week on Friday but the volume will be very low and I’m doubtful about any decent trending move. We may well not see much in the way of any moves on the equity indices before next week now.

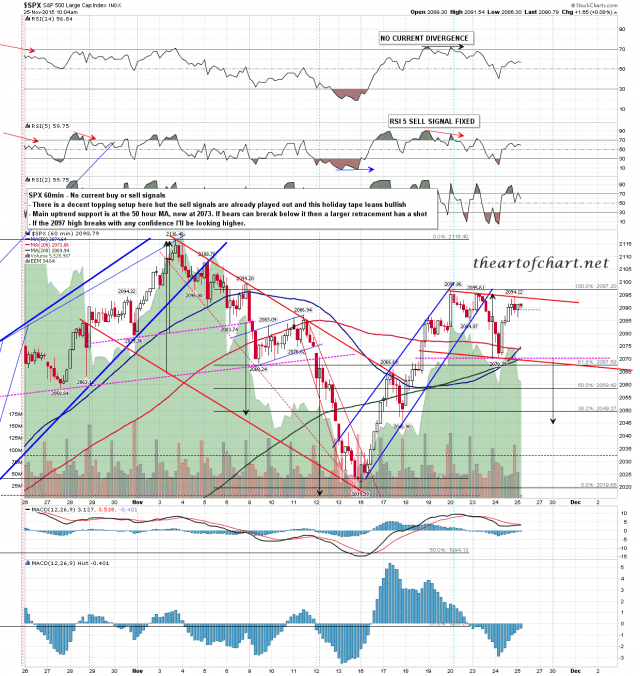

The retracement on SPX stopped just short of a test of the important 50 hour MA. As long as that holds the uptrend is intact. If that breaks then there is a nice looking pattern setup to retest the 2043 area. Resistance is at the current high at 2097. If we see a decent break above we should see a test of 2116 next. SPX 60min chart:

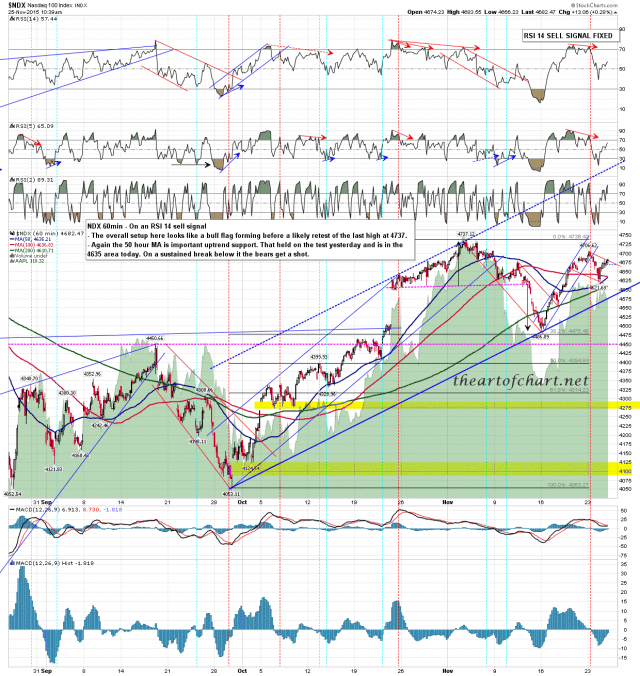

The 50 hour MA is also strong uptrend support on NDX, with a close test yesterday. Again, while that holds the uptrend is intact. NDX 60min chart:

I’m not a fan of trading thin holiday tapes and my experience has been that to the extent that these low volume tapes have a direction, they definitely lean bullish. The key support levels today on SPX are the 5dma at 2087 and the daily middle band at 2080. Both of these are daily closing support. Not far below now is the 50 hour MA at 2076, and if the bears can convert that to resistance then we can see a deeper retracement. I’m keeping an open mind but I won’t be holding my breath waiting.

Thanksgiving isn’t a holiday in the UK for some reason, but I need a break and am going to take the opportunity to take some time off. My next post will be on Monday morning. Everyone have a great Thanksgiving. 🙂