I overslept this morning and am doing a quick post to get it out as close as possible to the open. For a more detailed view I’d suggest watching the recording of last night’s public Chart Chat at theartofchart.net, and you can see that on this page here.

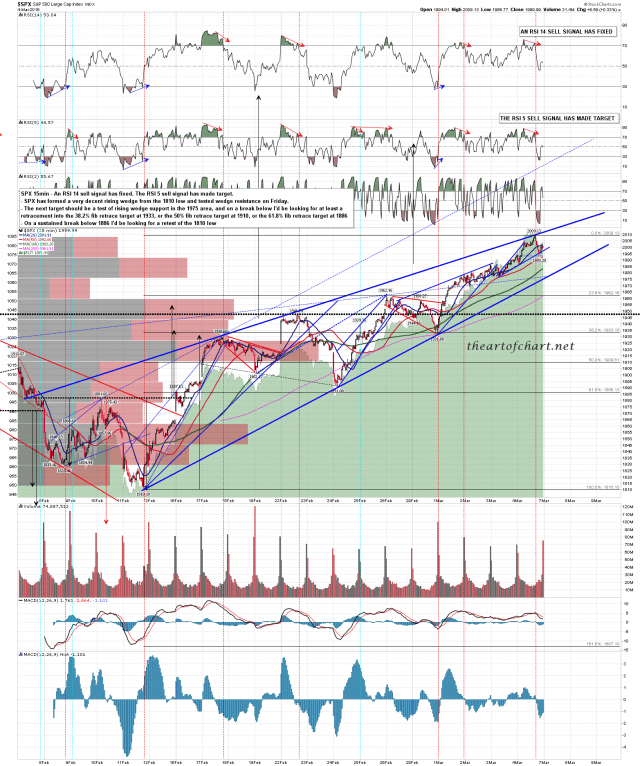

There is now a very nicely formed rising wedge on the SPX chart, and the next obvious target within the wedge is wedge support, which closed the week in the 1975 area. For me that’s the obvious target today though there is some decent support above that may hold. I’d note that I do have a less well formed variant of this wedge where the wedge has already overthrown bearishly. SPX 15min chart:

For speed I’m using the ES chart I was showing in Chart Chat last night. In the event that it is reached I have ES wedge support in the 1962 area, and if reached, that will likely break. ES Mar 60min:

Stan and I are both thinking that this is just a retracement before a likely test of the 200dma on SPX. That’s now in the 2022 area. If wedge support at 1962 ES breaks that becomes less likely. Stan has a support level in the 1986 ES area that has held overnight and could be the low for this retracement if it continues to hold today.