I’ve been waiting patiently for the rising wedges on SPX and ES to confirm this week with tests of the wedge support trendlines and both have been tested and held so far this morning. It may be that these will hold today and if so, then we might well see a retest of yesterday’s highs.

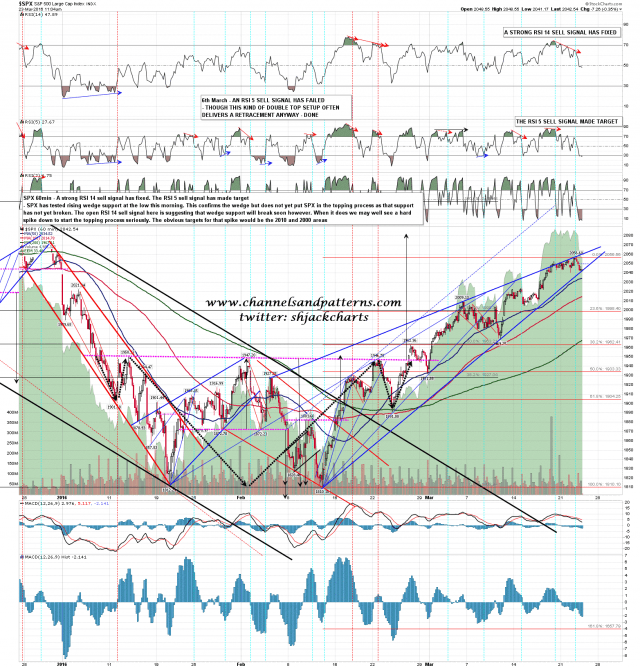

If wedge support breaks then there is quite a bit to suggest a trend down day today, though nothing fixed as yet. A support break like this would often go directly into a hard spike down, there is an open SPX 60min RSI 14 sell signal that is nowhere near target, the up volume so far at 16% is very low and at a level often seen on trend down days, and the short term buy signals that fixed at the first lows this morning are showing no sign of making target so far. On trend days most or all short term counter-trend buy or sell signals tend to fail. We’ll see.

My bull/bear level for today is conversion of the ES weekly pivot at 2026.40, so about 2035 SPX. If bears can convert that to resistance then we likely trend down towards obvious targets in the 2010 and 2000 areas. That kind of move would start off a topping process here very nicely. SPX 60min chart:

ES Jun 60min chart:

I’m leaning towards the bears today but only if they can break below that wedge support, which they haven’t managed so far. If they can’t break it then a retest of yesterday’s highs will very much be on the table.