Preface from Tim: I received what surely most be Earth’s Longest Post from a reader, who was kind enough to share it here. I’ve broken it up into three parts, each of which is big enough to be seen from space, and I’ll spread these out over three days.

New stock market crash inevitable

Every production phase or society or other human invention goes through a so-called transformation process. Transitions are social transformation processes that cover at least one generation. In this article I will use one such transition to demonstrate the position of our present civilization and and that a new stock market crash is inevitable.

When we consider the characteristics of the phases of a social transformation we may find ourselves at the end of what might be called the third industrial revolution. Transitions are social transformation processes that cover at least one generation (= 25 years). A transition has the following characteristics:

- it involves a structural change of civilization or a complex subsystem of our civilization

- it shows technological, economical, ecological, social, cultural and institutional changes at different levels that influence and enhance each other

- it is the result of slow changes (changes in supplies) and fast dynamics (flows)

A transition process is not fixed from the start because during the transition processes will adapt to the new situation. A transition is not dogmatic.

Four transition phases

When we consider the characteristics of the phases of a social transformation we may find ourselves at the end of what might be called the third industrial revolution.

The S curve of a transition

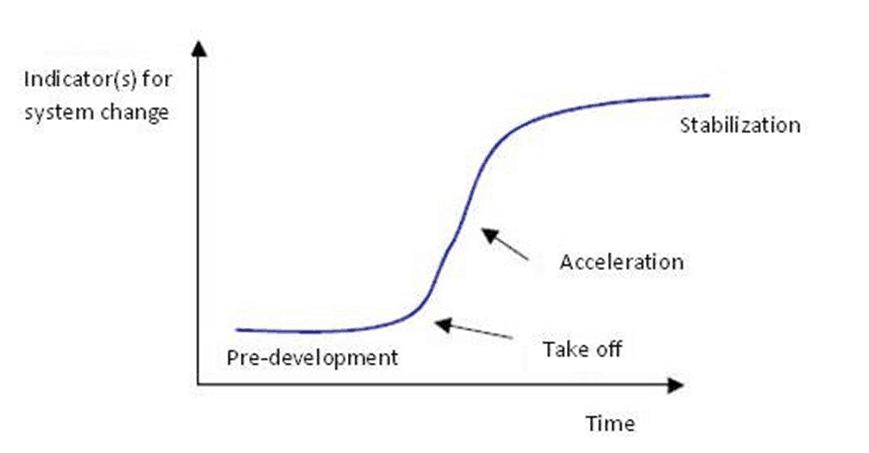

Figure: Four phases in a transition best visualized by means of an S – curve:

Pre-development, Take off, Acceleration, Stabilization.

In general, transitions can be seen to go through the S curve and we can distinguish four phases (see fig. 1):

- a pre-development phase of a dynamic balance in which the status does not visibly change

- a take-off phase in which the process of change starts because of changes in the system

- an acceleration phase in which visible structural changes take place through an accumulation of social cultural, economical, ecological and institutional changes influencing each other; in this phase we see collective learning processes, diffusion and processes of embedding

- a stabilization phase in which the speed of sociological change slows down and a new dynamic balance is achieved through learning

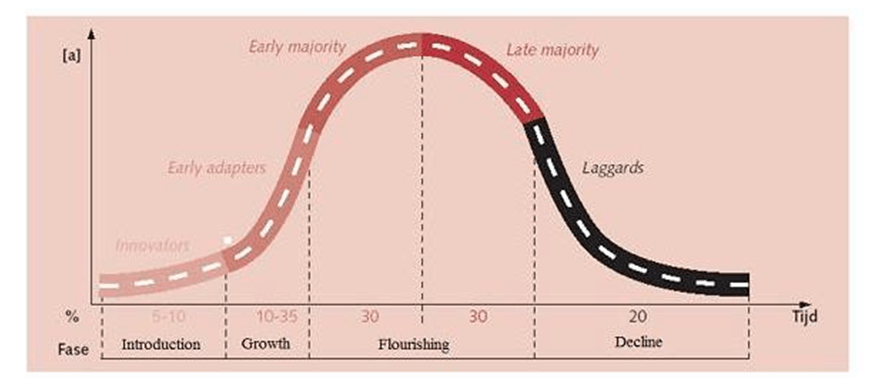

A product life cycle also goes through an S curve. In that case there is a fifth phase:

- the degeneration phase in which cost rises because of over capacity and the producer will finally withdraw from the market.

When we look back into the past we see three transitions, also called industrial revolutions, taking place with far-reaching effect:

- The first industrial revolution (1780 until circa 1850); the steam engine

- The second industrial revolution (1870 until circa 1930); electricity, oil and the

car - The third industrial revolution (1950 until ….); computer and microprocessor

The emergence of a stock market boom

In the development and take-off phases of the industrial revolution many new companies emerged. All these companies went through more or less the same cycle simultaneously. During the second industrial revolution these new companies emerged in the steel, oil, automotive and electrical industries, and during the third industrial revolution the new companies emerged in the hardware, software, consulting and communications industries. During the acceleration phase of a new industrial revolution many of these businesses tend to be in the acceleration phase of their life cycle, more or less in parallel.

Figure: Typical course of market development: Introduction, Growth, Flourishing and Decline

There is an enormous increase in expected value of the shares of companies in the acceleration phase of their existence. This is the reason why shares become very expensive in the acceleration phase of a revolution.

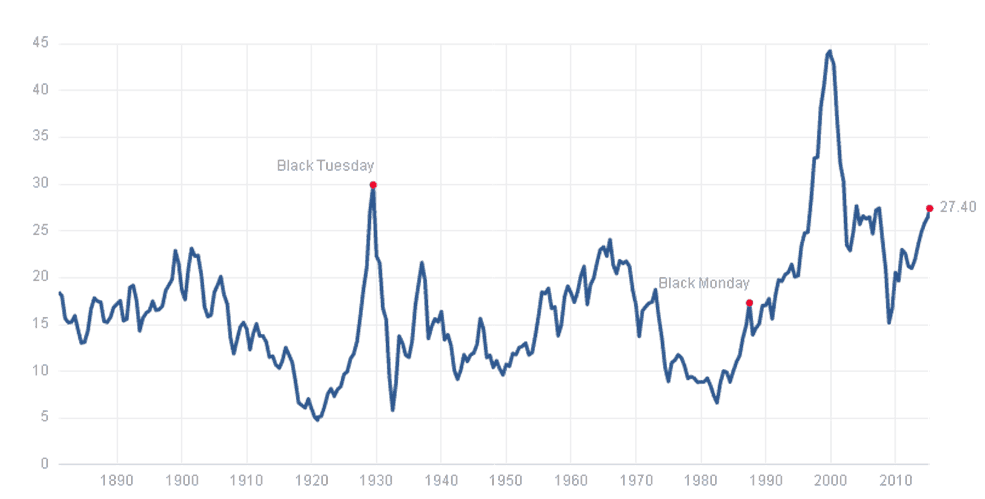

There was also an enormous increase in price-earnings ratio of shares between 1920 – 1930, the acceleration phase of the second revolution, and between 1990 – 2000, the acceleration phase of the third revolution.

Figure: Two industrial revolutions: Shiller PE Ratio (price / income).

……….Part 2 tomorrow!