Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

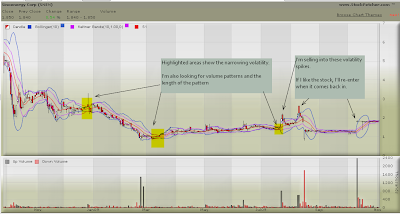

Hunting for Volatility Squeezes (by Leisa)

Here's a re-tread post of mine from 11/05/09 that might serve as a useful follow on to my post on how to ride (not shoot) your winners. Paying to volatility has helped my trading tremendously. I'll dig out some other posts on this matter to if there is sufficient interest.

While I consider myself a serious student of the market, I don’t

call myself a trader. But I do trade and have done so with reasonable

success. This year, I incorporated a new dimension into my trading:

volatility. Simply put, I’m buying when volatility is low, and I’m

selling when volatility is high—and I’m doing so on charts that appear

to be good candidates for long entries. I’ve not used it for short

positions.

The point of this post is not to go into an in-depth

analysis regarding volatility, but rather to introduce to you this

concept and provide some actual examples. I think that you will have

fun experimenting with it. I'll mention, too, that John Carter uses

this in Mastering the Trade

. But I cobbled it together for myself (after first experimenting with

Donchian Channels) before reading his book. I believe it to be a book

that belongs on most traders bookshelves.

Method: There are two technical indicators deployed: The Keltner Channel and Bollinger Bands.

Like most indicators, both of these are measurements that are

incorporating time and range of price movement that the user defines.

For this method, I am specifically hunting for stocks that have the

Bollinger Band nested INSIDE the Keltner Channel. Carter notes this as

quiet periods…"period of reduced volatility and signals that the

market is taking a significant breather, building up steam for its next

move." For the Bollinger Bands, he uses 20 and 2, and for the Keltner

Channels, 20 and 1.5. I started out using 10, as a parameter for both,

and I've not changed it. But I wanted to share the parameters a

vocational (Carter) rather than an avocational (me) trader utilized.

Now

for four charts. (Click to make larger!) I want to give a brief preamble. While many of you are

technical traders, I mix macro fundamentals and sector fundamentals

into my work. It's my quirk, and it works for me because of my learning

style and my background. It points me in the direction I want to look

and helps me assess risk.

The first three stocks were actual

positions. I've been trading Chinese stocks long before it was

fashionable to do so. The floats and price range may not suit many

here, but the concept can be applied to any stock. It's worth noting

that because this market fell hard, there were lots of attractive

candidates in these long bases. The last is a contemporary example.

Here's

SNEN. I liked them because they were in the compressed natural gas

space in China (engine conversion units and stations). I also knew that

they had a small balance sheet problem–so I took my money and ran.

This stock is an example where I entered, sold on the volatility spike.

Re-entered and re-sold on the volatility spike. No third time charm on

this one because of the risk on the balance sheet. They are being

bought by a shareholder.

Second

is AZC. This stock is again a combination of fundamental (copper–they

will supply 10% of the copper when one of their Rosemont site comes on

board) and TA.

HPJ is another one. This one broke out along with the other lithium-ion battery producers.

HPJ is another one. This one broke out along with the other lithium-ion battery producers.

Here's the stock screen that I use on StockFetcher (XX's signify variables that suit your trading style–you see I'm no stranger to the boneyards):

Close is above (XX)

AND Volume is greater than (XXXX)

AND Upper Bollinger(10) is less than Upper Keltner Band(10)

AND lower Bollinger(10) is greater than Lower Keltner Band(10)

and add column Bollinger %B(10,2) (I use this to order candidates from lowest band width to highest)

To

put this post together, I didn't have to cherry pick through my stock

entries to provide examples for you. It has proved to be a high

probably trade and a richly rewarded trade. I will tell you that the

hardest thing to do is to sell into the volatility explosion. And we

know that doing the hard thing is often the right thing! Naturally, any method you deploy must fit with your time, money and

risk/reward parameters.

DBA Trader

Our Old Friend UNG

I have not mentioned the natural gas ETF UNG for a long, long time, but I bought a bunch of it today. I've got a stop at 8.78. As a side note, I've gone from about 95% loaded on my portfolio to only 50%, having taken a bunch of short profits today. I've been remarking on this disposition non-stop in the comments section today.