My main charting computer went down yesterday afternoon and all my futures and live forex charts have gone down with it for the time being. I'll be doing computer open-heart surgery today and tomorrow to get back to normal service and for today I'm just using stockcharts, as that is web-based.

I've been expecting the current retracement to resolve bullishly and I'm still expecting that, but I'll spend some time today considering the possibility that this might go the other way. We're close to key support on SPX and key resistance on USD, and it's worth looking at where those levels are and what the implications are if they break.

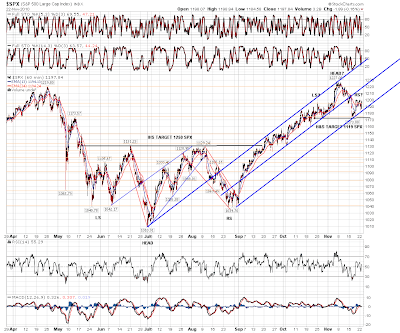

Firstly on SPX where after last week's low it is clear that SPX is in a rising channel that is a model of technical perfection. Here it is on the daily chart, and it really is a beauty:

Note also the parallel lines I have drawn in in red, as a mainly notional declining channel / range between January and October this year, and how last week's low retested the broken upper trendline perfectly.

Now that doesn't mean of course that this must resolve bullishly, but it does underline that as we stand today, the SPX move up from the summer lows is in robust technical shape, albeit also at major resistance levels, and until that changes the trend is still up.

There is some reason to think that this might resolve bearishly though. We are still close to the channel support trendline and a move below 1180 SPX now would break down through it. There is also a possible H&S forming, with a target at 1119 SPX, that you can see here on the 60min chart:

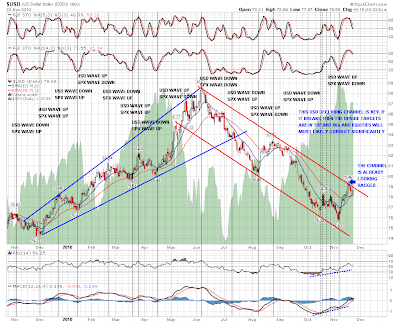

I've posted often before that equities and USD are strongly inversely intertwined, and that a break up on USD here would move likely end this wave up on equities. It's hard to believe that USD can do anything other than fall under the stewardship of the Fed, but some winds of change are blowing in the US, and it may be that the Republicans may be able to restrain the Fed from the reckless money printing that has dominated the last two years, and from the push to devalue USD that has dominated the second half of 2010 after the USD top in early June.

On the weekly USD chart we hit a key support trendline a few weeks ago, and it held on a weekly basis. If the bounce holds and breaks recent highs then there are two patterns in play. First is the triangle, with a target in the 87 area, and a rising channel upper trendline with a target in the 94 area:

First however, USD will need to break the declining channel from the June high. In practical terms a daily close over 79 would deliver that, and yesterday's close was at 78.69. The upper trendline of the channel has already been tested hard and is looking a little ragged now. It could break and this daily chart with SPX as the background illustrates the likely implications for equities if it does:

I've posted before a little right-angled and ascending broadening formation that I have on the Vix 60min chart. Here it is again, and unless the support trendline breaks, with a pattern target of 13 that I'm not taking too seriously, then the next move should be up with a target in the 23.5 area, which would obviously be negative for equities:

I've been reading a lot recently from Carl Futia and others that this retracement will go down further and then reverse to an upwards target in the 1300 area. I disagree, as we're clearly testing major support and resistance levels on SPX and USD respectively at the moment. If these break then this current equities uptrend will be broken, and the recent high was a major interim top. I'd be expecting a move then to retest support at 1130 SPX and that might well also be broken.

Until we see those breaks though, there's only one good risk / reward trade at an unbroken major support level, and that's obviously to go long. Only when that support breaks does the short trade become more attractive. I'll be watching for that support break on SPX, and the resistance break on USD, and if they happen the picture will entirely reverse, and the best risk / reward trades will be short equities / long USD.