A good question was asked yesterday, and the question was why I and others were regarding this as a pullback rather than a move down from a major top. There are several reasons why that is. Firstly equities are clearly in a strong cyclical bull market, and the bull trend has to be given the benefit until demonstrated otherwise. Secondly this bull market has been fuelled and boosted to a very significant extent by negative real interest rates and, much more importantly, quantitative easing on an vast scale. QE2 doesn't finish until the end of June, and equities didn't top for a month after the end of QE1 in March last year.

I'm expecting equities to struggle after the end of QE2, but I'd be surprised to see a major top much earlier. Thirdly the pullback we've seen so far is still within the normal limits that we would expect to see for a pullback within a bull wave up. There are some worrying signs that this may go further, but no serious lines have yet been crossed as yet, and there's no great reason to think that they will be.

In terms of bull/bear indicators copper broke up from a declining channel a few days ago, and that was very bullish. Copper's retracing now, but hasn't done more than retest the upper trendline of the broken declining channel. The current retracement is also within two bullish (albeit weakly bullish) patterns, suggesting that it is just a retracement. That may change, but that's where copper is now. Here it is on the 60min chart:

Looking more closely at copper on the 15min chart you can see the two bullish patterns for the retracement. I'm expecting a fairly big move on a break up though the targets are only 453 for the wedge and 450 for the broadening bottom. :

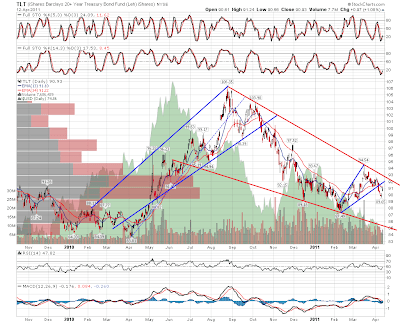

Looking at other indicators I've been watching bond prices, and there was a serious chance that a major low had been made in February. As you can see from the TLT daily chart though, the rally failed at declining resistance from the high last August, and while that trendline holds the presumption has to be that the move up was a rally within the greater downtrend. As bond prices are fairly strongly inversely correlated with equities, that still supports an ongoing equities uptrend:

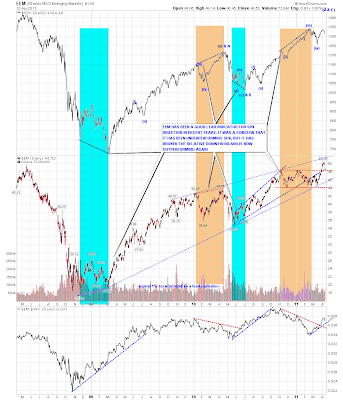

I also watch EEM as a lead indicator for equities, and there as well we saw a bullish break up in the couple of weeks. The current retracement has only retested the broken trading range ceiling so far:

On SPX I've mentioned a few times that the obvious target for a pullback was the daily 20 SMA, and we hit that yesterday and closed back above it. There's nothing remarkable about that so far and in any case there is strong support just below in the 1300 – 1305 SPX area. If we see a close below there that would look considerably more bearish:

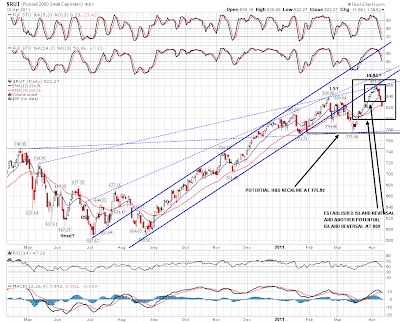

Now that's not to say that there aren't some worryingly bearish charts here. The Russell 2000 daily chart is a concern, as there is a clear island top there, and an obvious target in the 800 area where a larger island top could also be established. There's also a potential HS pattern forming if RUT makes it back to 775.90. As yet there's no reason for real concern though and looking at the premarket, RUT could well negate the current island top today by moving back above it:

Overall there's not a lot to see on the bear side on the bigger picture so far, and I'll only be looking harder at that if we see SPX move back below 1300. Until then this just looks like another dip to be bought.

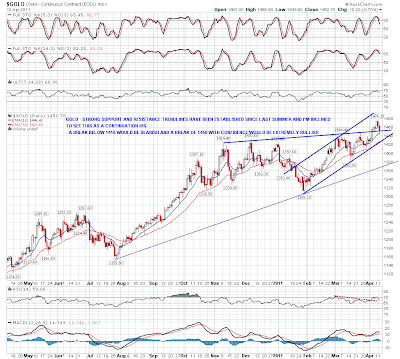

The last chart for today is the gold chart. I posted the strong resistance trendline, and possible continuation IHS neckline a couple of weeks ago, and here's the updated chart. Gold had a significant pullback this week, but so far the broken resistance trendline has acted as support. We'll need to see a close below that trendline to raise a potential warning flag for a significant pullback there: