A Vix Buy Signal (for equities) is technically issued when the Vix drops back within the bollinger bands after closing above the upper bollinger band for at least one day. The buy signal has to be confirmed however by a lower close the following day as well. The last signal at the end of July wasn't confirmed and another has now been generated and is awaiting confirmation today. I'm doubtful about this one being confirmed as well but we'll see how that goes today:

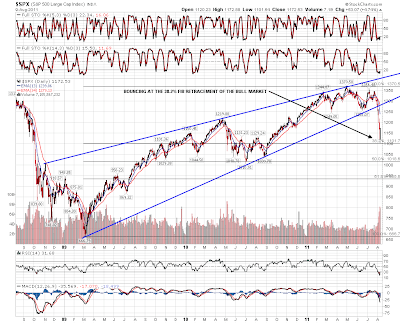

SPX bounced very nicely yesterday at 1100 and the 38.2% fib retracement of the bull market support there. I'm expecting this to mark a short term low but not to be a major low. For that I'm looking at the 50% retracement in the 1018 area, and the two important support levels bracketing that at 1000 and 1040:

If what we have been watching in the last few days was an EW (iii) of 3 move, and it really did look like one, then there is a clear cap on any wave (iv) retracement at the obvious wave 1 low at 1258.07. I'm only an occasional EWaver so forgive my non-standard annotations:

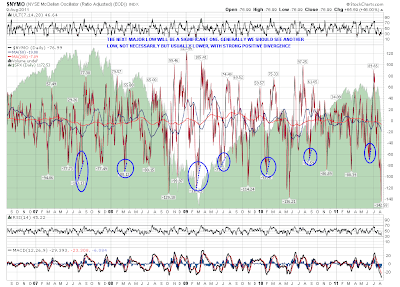

At the major low I would expect to see some definite positive divergence on NYMO, which generally delivers this at major lows and quite a few less major lows. This positive divergence is generally delivered on a lower low, though not always:

I'm leaning short on equities today for a number of reasons. One of those is that EURUSD looks ready to retrace today after hitting declining resistance from the July high. That is within a triangle that is forming:

AUDUSD has returned to retest broken support at 1.04 as I was suggesting yesterday morning. I'm expecting a rejection there today, though I'm noting that an IHS has formed at 1.04 as a neckline. AUDUSD might go the other way and break back up:

Silver looked likely to break up when I capped the silver chart below, and has now done so. I'm expecting to see a decent bounce on silver and would regard that as bearish for equities:

On the ES 15min I'll be looking for support in the 1120 if we see retracement today and a bounce from there:

My WAG on ES for the next few days is that we will see a wave B reversal into the 1120 area today, and then a Wave C of about the same size as wave A taking ES into the strong resistance area around 1220. That's looking promising so far today.