A month of closes over 30 for the VIX

The VIX rose 2.82% on Thursday, closing at 34.32. Since the market meltdown of August 5th, it hasn't closed below 30 on any day. Something I've mentioned in previous posts, when the VIX was below 20 (e.g., this one) is that long investors ought to consider hedging when volatility is low, and hedging costs are relatively low as well. Since August 5th, that hasn't been the case.

Hedging Update

The table below shows the costs, as of Thursday's close, of hedging a basket of stocks and ETFs against greater-than-20% declines over the next several months, using optimal puts (if there are any optional stocks or ETFs you'd like to see added for future updates, feel free to mention them). First, a reminder about what optimal puts mean in this context, and a step by step example of finding optimal puts for one of the ETFs listed below (GLD).

About Optimal Puts

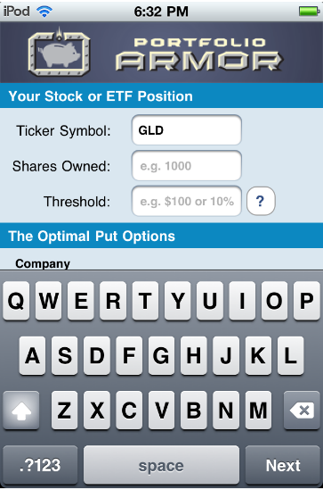

Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. As University of Maine finance professor Dr. Robert Strong, CFA, has noted, picking the most economical puts can be a complicated task. With Portfolio Armor (available on the web and as an Apple iOS app), you just enter the symbol of the stock or ETF you're looking to hedge, the number of shares you own, and the maximum decline you're willing to risk (your threshold). Then the app uses an algorithm developed by a finance Ph.D to sort through and analyze all of the available puts for your position, scanning for the optimal ones.

A Step By Step Example

Here is a step by step example of finding the optimal puts for the comparison ETF listed below, SPDR Gold Shares (GLD).

Step 1: Enter a ticker symbol. In this case, we're using GLD, so we've entered it in the "Ticker Symbol" field below:

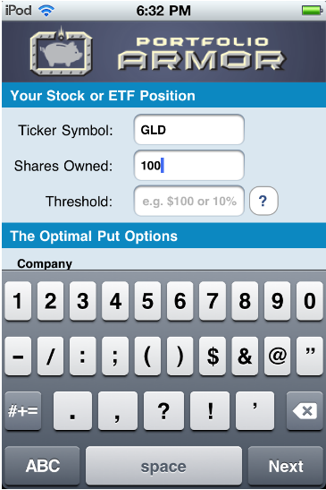

Step 2: Enter a number of shares. For simplicity's sake, we've entered 100 in the "shares owned" field below, but you could also enter an odd number, e.g., 731. In that case, Portfolio Armor would round down the number of shares of GLD you entered to the nearest hundred (since one put option contract represents the right to sell one hundred shares of the underlying security), and then present you with seven of the put option contracts that would slightly over-hedge the 700 shares of GLD they cover, so that the total value of the 731 shares of GLD would be protected against a greater-than-20% decline.

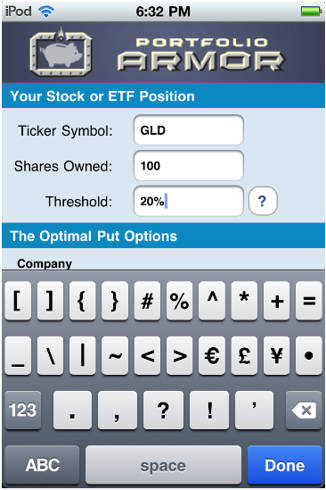

Step 3: Enter a decline threshold. You can enter any percentage you like for a threshold when using Portfolio Armor (the higher the percentage though, the greater the chance you will find optimal puts for your position). The idea for a 20% threshold comes, as I've mentioned before, from a comment fund manager John Hussman made in a market commentary in October 2008:

An intolerable loss, in my view, is one that requires a heroic recovery simply to break even … a short-term loss of 20%, particularly after the market has become severely depressed, should not be at all intolerable to long-term investors because such losses are generally reversed in the first few months of an advance (or even a powerful bear market rally).

Essentially, 20% is a large enough threshold that it reduces the cost of hedging but not so large that it precludes a recovery, so we've entered 20% in the Threshold field in the screen cap below.

Step 4: Tap the "Done" button. A moment after tapping the blue button, you'd see the screen cap below, which shows the optimal put option contracts to buy to hedge 100 shares of GLD against a >20% drop between now and March 16, 2012. Two notes about these optimal put options and their cost:

- To be conservative, Portfolio Armor calculated the cost based on the ask price of the optimal puts. In practice an investor can often purchase puts for a lower price, i.e., some price between the bid and the ask.

- As volatility has climbed, so have hedging costs. Three months ago, the cost of hedging GLD against a >20% drop over the same length of time was 0.49%, as we noted in this hedging update back on June 2nd. As the screen shot below shows, as of Thursday, the hedging cost as a percentage of position was 1.71%.

Why There Were No Optimal Puts for BAC

In some cases, the cost of protection may be greater than the loss you are looking to hedge against. That was the case with Bank of America (BAC). On Thursday, the cost of protecting against a greater-than-20% decline in BAC shares over the next several months was itself greater than 20%. Because of that, Portfolio Armor indicated that no optimal put option contracts were found for it.

Hedging costs as of Thursday's close

|

Symbol |

Name |

Cost of Protection (as % of Position value) |

|

Widely-Traded Stocks |

||

|

INTC |

Intel |

5.13%*** |

|

CSCO |

Cisco Systems |

5.71%*** |

|

MSFT |

Microsoft |

5.19%*** |

|

ORCL |

Oracle |

7.30%** |

|

BAC |

Bank of America |

No Optimal Contracts |

|

F |

Ford |

11.9%** |

|

GE |

GE |

7.38%** |

|

PFE |

Pfizer |

4.14%** |

|

WFC |

Wells Fargo |

10.0%*** |

|

T |

AT&T |

4.29%*** |

|

AA |

Alcoa |

10.2%*** |

|

Major Index ETFs |

||

|

QQQ |

PowerShares QQQ Trust |

3.73%** |

|

SPY |

SPDR S&P 500 |

3.60%** |

|

DIA |

SPDR Dow Jones Industrial Average |

3.19%** |

|

Precious Metals ETFs |

||

|

GLD |

SPDR Gold Trust |

1.71%** |

|

SLV |

iShares Silver Trust |

8.85%*** |

|

DBP |

PowerShares DB Precious Metals |

13.7%*** |

|

SGOL |

ETFS Physical Swiss Gold Shares |

2.00%** |

|

SIVR |

ETFS Physical Silver Shares |

7.38%** |

*Based on optimal puts expiring in February, 2012

**Based on optimal puts expiring in March, 2012

***Based on optimal puts expiring in April, 2012

Disclosure: I'm holding puts on GLD and DIA