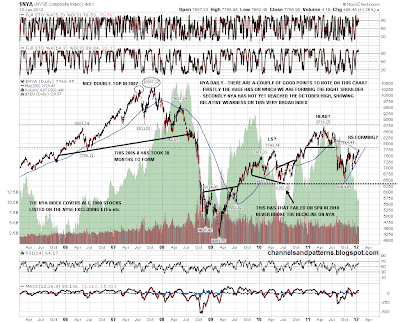

I'm going to be posting a lot of bullish charts today, so I'll balance that by leading with a bearish big picture chart. That chart is of the NYA Composite, which is a very broad based index including all stocks listed on NYSE, with the exception of some ETFs etc. On this chart you can see the huge H&S building that I have posted before, and it's also worth noting that NYA has not yet reached the October high, which is very strong resistance as it was also the H&S neckline for the topping H&S last year. A lot of analysts are changing to a bias that a new bull market is in progress but I'm not one of them yet, though I am most definitely weighing the evidence that it might be:

On NDX we saw a touch of the upper channel trendline yesterday and this is an obvious place to look for reversal, particularly as on the bigger picture NDX is in the middle of a strong resistance zone that includes the all time NDX high, and was hit four times last year, followed in each case by a correction of at least 9%. This rising channel on NDX is rough, so I wouldn't be surprised to see some overshoot before reversal:

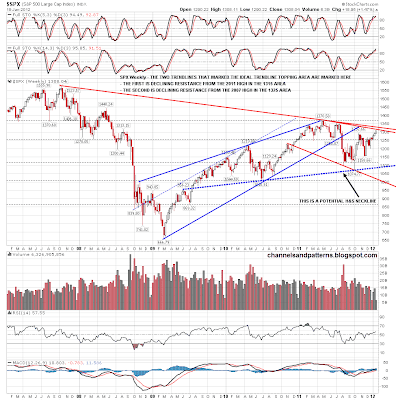

On SPX the high yesterday was very close to declining resistance from the 2011 high in the 1315 area, and if that breaks obviously there is also declining resistance from the 2007 high to consider, and that should be in the 1320-5 area:

The rest of the charts today are supporting the bull case here and I'll lead with a thought-provoking SPY chart. I've mentioned a few times that I am not happy with the support trendline situation on equities from the last low, but I know from experience that sometimes in a strong move you have to wait a while for the situation to clarify. With that in mind I have identified two possible very bullish looking rising channels on SPY, from the November and December lows, and I'm throwing these out as possibilities to consider in the event that my declining resistance trendlines on SPX are broken:

My declining resistance trendline on Vix was hit yesterday, and that's excellent news from a trendline perspective as it now gives us a strong resistance trendline there. A break up through it would be a correspondingly strong bearish signal. Short term however it means that the next obvious move on Vix is down, possibly to confirm the lower trendline of a falling wedge in the 18 area. That is potentially very bullish for equities, at least in the short term, though longer term a falling wedge on Vix would be bearish:

Next up is the 30yr treasury futures chart (ZB). I mentioned yesterday that ZB was finding strong resistance at the 145'08 level and a double-top has now developed with a target just above a support level at 142'25. Short term rising support has been broken and retested from underneath, so I'm leaning short on bonds. A drop like that on ZB would be bullish for equities:

Copper has made a higher high and is moving towards very significant resistance in the 390 area on the futures chart. I won't post that chart here today however as I'm running out of time and space. I mentioned yesterday that EURUSD was showing a possible swing low on the daily chart. Since then EURUSD has made a higher high and that has strengthened that setup. I have marked four possible targets for this swing up on the chart and EURUSD is testing the first of those at the moment. If we see a break above 1.293, then resistance in the 1.305 area would become my primary short term target. It's harder than it used to be to say whether a swing low on EURUSD would be bullish for equities, but given the history I would assume that it would be until demonstrated otherwise:

Yesterday was a trend day and statistically the following day tends to be flat or see some retracement. I'm expecting a flat or red close today but not as confidently as I would be usually, because the setups on ZB and EURUSD particularly may boost equities. I'm therefore leaning short today but not with a lot of conviction. My WAG is that we might see an early boost to hit declining resistance on SPX followed by weakness for the rest of the day. I like the odds for a gap fill if we gap up, which seems likely at the time of writing.

Last comment of the day is that bearish sentiment is reaching historic lows, with a Bloomberg article on Tuesday noting that bearish sentiment was at a six year low and that short interest was at a nine month low. The last time short interest was this low was last March, and SPX peaked the following month. This is generally a contrarian indicator and it's worth noting that bullish sentiment hit a big low in September shortly before the early October low on equities. Just sayin'.

You can see that Bloomberg article here. At the very least this means that there cannot be much in the way of short-covering rallies left to propel indices higher, and I dare say that short interest and bearish sentiment are both even lower today. The dumb money is all long here, and historically that has been a big warning signal.