We've seen some impressive resistance breaks overnight and I'll start with forex today as I think that is extremely important for whatever we're likely to see next. EURUSD broke declining resistance overnight with confidence and the potential double-bottom that I was talking about on Friday now looks far more likely. The next target would be 1.32 and a break over that would target the 1.355 area:

The break up on EURUSD isn't a done deal yet, for reasons I'll explain below, but if the have seen an interim bottom now, then on the daily chart below I have shown that this low is at the key support / resistance level over the last seven years, to the extent that we may be seeing a very large H&S forming with 1.285 as the neckline. If so then if the right shoulder were to match the left shoulder I'd expect to see a three or four month bounce into the 1.43 area:

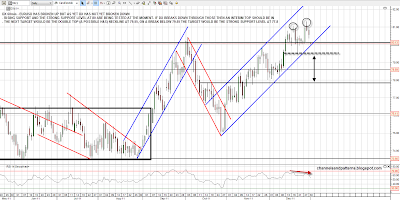

The reason that this break up on EURUSD isn't yet a done deal is that DX also needs to break rising support at the very strong 80 support level. DX is bouncing there overnight so far. If 80 breaks then the next DX target is at the double-top (and possible H&S) neckline at 79.55 and if that breaks the double-top target would be at the strong 77.80 support level:

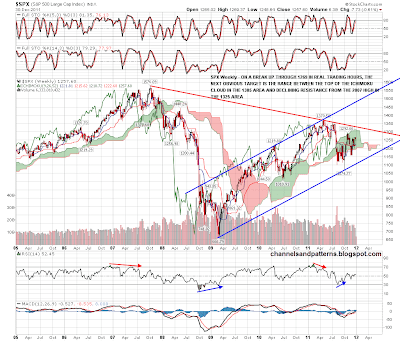

On ES the opening candle overnight peaked at 1280, but has pulled back to 1272 at the time of writing. We might see a test of broken declining resistance today and I have that in the 1265 area. I have a decent rising resistance trendline in the 1283 area:

Unless we see a strong pullback below 1265 into the open that is then sustained, this break up on ES opens up the next major upside targets on SPX. I have a range for that upside target and that is from the top of the weekly Ichimoku Cloud in the 1305 area to declining resistance from the 2007 high in the 1325 area. On a break above declining resistance from 2007, improbable as it might seem, the next upside target would be a test of the 2011 Obama top and most of my indicators would have swung into bull market territory:

The economic outlook for 2012 doesn't look great, and there's a good writeup from Ritholz about that here. I've seen Doug Kass's prediction that SPX trades above 1525 in 2012, and it looks far-fetched to me but this is a strange market we trade, in strange times, and I'd be reluctant to rule anything out altogether. What I do know is that a gap up through strong resistance that is not swiftly reversed targets the next major resistance level up, so right here and now, this is a bullish break targeting at least the October high and probably higher. If DX has made an interim top then that will help the bulls here a LOT. I'll be watching that 80 support level on DX and as I said above, my key levels for ES today are broken resistance turned support at 1265 and rising resistance in the 1283-5 area.

I'll be out a lot of the trading day today as my children aren't back at school yet. Happy New Year everyone!