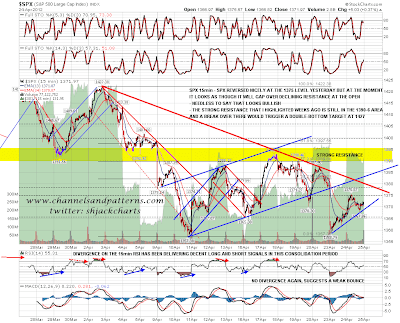

SPX respected resistance at 1375 yesterday, and the bear case was looking ok until the AAPL earnings after hours, which has triggered a potentially very bullish setup. On the SPX 15min it looks as though SPX may gap over declining resistance in the 1380 area at the open, and may then retest the strong resistance area in the 1390-6 area that highlighted after the first decline. If it should break over that, a double-bottom target at 1427 would be triggered:

The same double-bottom is in play on ES as well, with a target there at 1427.50 on a break over 1390:

Looking at the NQ chart this morning a test of strong resistance looks likely on SPX, though whether it breaks above is another matter. The reason I say that is because there is another smaller double-bottom on NQ that triggered on the AAPL earnings after hours. That double-bottom there targets 2708, slightly below declining resistance from the high, which is now in the 2715 area:

Just a short post today as I got back late yesterday and the setup on equities looks clear. The last chart is GBPUSD where the rising wedge I posted on Monday is still in play, and GBPUSD looks distinctly short term toppy. It's worth noting though that GBPUSD broke slightly over the October high overnight, and that looks bullish after some likely retracement:

Leaning bullish on equities here and watching that resistance zone on SPX and declining resistance on NQ. Fed day today and Bernanke is giving a speech this afternoon so it could be a wild day.