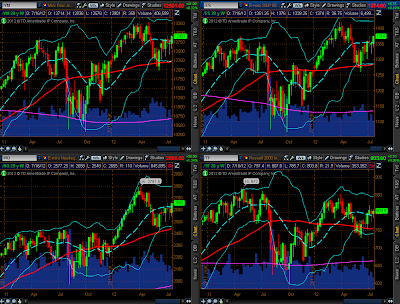

I've drawn a Fibonacci retracement on the Daily chart below of the SPX:VIX ratio pair and have identified a potential Inverse Head & Shoulders pattern.

The first external Fib level of 127.2% at a price level of 92.30ish happens to lie at a confluence/apex of trendline resistance…just above current price.

If the SPX is to move higher, it will have to capture this level and remain above…in this regard, it will be important that the neckline hold at 82.50ish.

However, as can be seen from the Quarterly chart below, that won't be an easy task, as efforts to move much higher since 2004 have been met with profit-taking and choppiness.

Unless some kind of major liquidity injection is forthcoming into the markets soon (e.g. cash on the sidelines), I expect more of the same (profit-taking and choppiness) at current levels on the SPX. However, that will depend on market participant confidence, which seems to have eroded.