Further to my last weekly market update, this week's update will be a

very simple top-down look at the 6 Major Indices and 9 Major

Sectors. To keep my analysis simple, I'll be looking at Friday's

closing price relative to its position within the Bollinger Bands (BB) on three

timeframes. The upper BB represents resistance, the middle BB represents either

support or resistance, and the lower BB represents support. Price in between the

middle BB and the upper BB is said to be in the "Bull Zone"

(still under bullish influences/buying pressure with support at the middle BB)

and price in between the lower BB and the middle BB is said to be in

"Bear Zone" (currently under bearish influences/selling

pressure with resistance at the middle BB).

The first three chartgrids

show a Monthly, Weekly, and Daily timeframe for the 6

Major Indices.

- In the longer term (Monthly), price is sitting in the "Bull Zone" for all 6

Indices.Save - In the medium term (Weekly), price is still in the "Bull Zone" for 5 of the

Major Indices, with only the Dow Utilities Index now in the "Bear Zone." - In the short term (Daily), price closed in the "Bull Zone" for 5 of the

Major Indices, with only the Dow Utilities Index remaining in the "Bear Zone."

The one to watch for either further developing weakness or a strengthening is

the Dow Utilities Index.

The graph below

depicts percentage gained/lost for the past week for the

Major Indices. Profits were taken in all 6 Indices (with the

least taken in the Nasdaq 100 Index), as some of them met with resistance at the

upper BB. The Nadsaq 100 Index is worth keeping an eye on to see if it can

maintain its bullish lead.

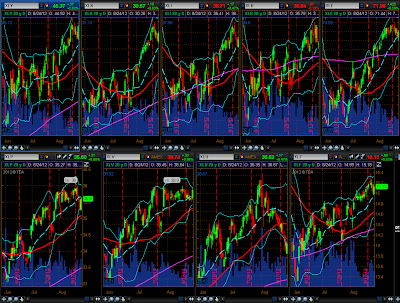

The next three

chartgrids show a Monthly, Weekly, and Daily timeframe for the

9 Major Sectors.

- In the longer term (Monthly), price is sitting in the "Bull Zone" for XLY,

XLK, XLI, XLE (just), XLP, XLV, XLU, and XLF (just). Price on the XLB is just in

the "Bear Zone." - In the medium term (Weekly), price is still in the "Bull Zone" for all 9

Major Sectors (XLU is just inside this zone). - In the short term (Daily), price closed in the "Bull Zone" for XLY, XLK,

XLI, XLB (just), XLE, XLV, and XLF. Price closed in the "Bear Zone" for XLP

(just) and XLU.

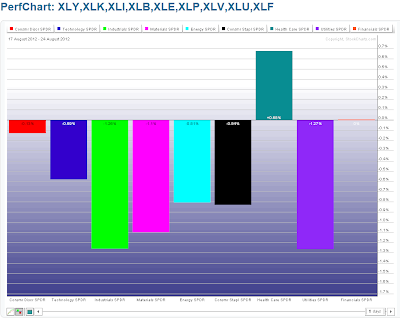

The graph below

depicts percentage gained/lost for the past week for the

Major Sectors. Profits were taken in 7 Sectors, as some of them

met with resistance at the upper BB, while XLF remained flat, and XLV gained on

the week.

In summary,

and in the coming week(s), it will be important to monitor price action

on all 6 Major Indices and 9 Major Sectors on

all 3 timeframes around the middle BB to try to gauge whether buying pressure

continues to surface at this point, or whether more bearish selling begins to

appear. Furthermore, we'll see whether buying overcomes the resistance of the

upper BB on any retests at this level, firstly, on the Daily timeframe (to gauge

the strength of their support levels from where they bounced on Friday).

Otherwise, I'd look for a retest of this near-term support, and possibly lower

support levels (e.g. the lower BB on the Daily timeframe, or the middle or lower

BB on the Weekly and Monthly timeframes).

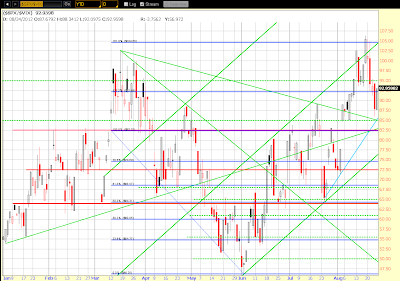

Before I conclude this post,

I'll also take a look at where volatility ended on Friday for

the S&P 500 Index and the Russell 2000

Index. The two Daily ratio charts below of

SPX:VIX and RUT:RVX show that price pulled

back after running into major resistance, but both bounced on Friday at their

respective near-term support levels…two to watch to see if volatility

reappears in coming days/weeks. (Please refer to my last weekly market update and to my post of August 15th to get a longer-term perspective on

these charts.)

Enjoy your weekend

and best of luck next week!