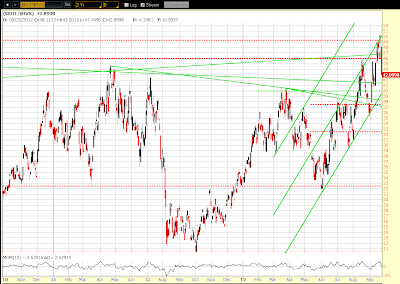

Further to my post of September 15th, and further to Caterpillar Inc's

projections today (Tuesday) for economic growth to be anemic through 2015, if

the Russell 2000 (as represented by its E-mini Futures Index, the

TF) grew at an anemic rate from here through 2015, we may see price hit

950ish by October 2015 if price remained above the 60%

Fibonacci fanline (broken green line) and closed where it meets the first set of

External Fibonacci and Fibonacci Extension confluence levels, as shown on the

Monthly chart below.

Price could, of course, trade

anywhere within the grey shaded zone in a very large 300 point

range if volatility were to increase dramatically during that time

period (the bottom of this range just happens to be around 666)…something that

could happen if a recession were to hit in 2013 to tie in with the enactment of

the Fiscal Cliff policies on January 1st. The pressure may be on for fund

managers to push price higher until the end of this year to, potentially,

provide a cushion against such a scenario.

As usual, I'll be

watching to see if volatility builds on the Russell

2000 Index, as represented by the Daily ratio

chart below of the RUT:RVX. A break and hold

below its lower channel and, subsequently, 37.00 would indicate that

further weakness is to come in Small Caps. Price has, so far, failed to hold at

its all-time high hit last Friday, but closed today above the lower channel, as

well a series of downtrend lines and horizontal price support levels. Volatility

is increasing, along with today's volumes, and the chances of a further pullback

are growing…I'm watching to see if the Momentum indicator crosses the zero

line and accelerates to the downside.