Further to my last weekly market update, this week's update will look at

graphs and charts for:

- + 6 Major U.S. Indices

- + 9 Major U.S. Sectors

- + Germany, France, and the PIIGS Countries

- + Emerging Markets Sector (EEM) and the BRIC Countries

- + Canadian, Japanese, and the World Indices

- + Commodities

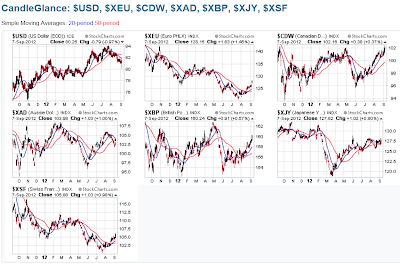

- + 7 Major Currencies

- + 30-Year Bonds

- + SPX:VIX and RUT:RVX Ratio Pairs

Very simply, you

can see from the following series of graphs depicting percentage

gained/lost for the past week, and the corresponding 1-Year

Daily chartgrids, that they all ended the week higher, with the

exception of Japan's Nikkei Index, the Agriculture ETF (DBA), the U.S. $, and

30-Year Bonds.

The global rally in the "Risk-on" trade

was fueled by the ECB's proposed conditional/sterilized (i.e. no new money

printing) bond buying program and China's fixed asset spending/stimulus program,

which were announced this past week.

Price is either:

at/near a prior 1-year high, making new highs for the year, at horizontal

overhead price resistance levels, at uptrending channel levels/resistance, at

downtrend channel resistance, or at moving average resistance.

Any that are in uptrend should look to their 20

sma for near-term support, followed by the 50 sma, on any pullback from

here.

Any further rally would, no doubt, be

fueled by positive news on a variety of events during the upcoming

week, including Germany's Constitutional Court ruling on the legality of the ESM

on September 12 (which will have a bearing on the ECB's ability to implement its

bond buying program), the Dutch election on September 12, and the Fed

meeting/Chairman Bernanke's press conference on September 13. There are also

Eurogroup meetings and European Council Finance Ministers meetings next weekend,

which may affect price action at the beginning of that OPEX week.

The Weekly

chart below shows the profit-taking that's been occurring since the

beginning of June on the 30-Year Bonds as it begins to form a

"diamond" (potentially topping) pattern. For the moment, it's holding at

trendline and near-term support as it closed just above its middle Bollinger

Band. It's one to watch to see which direction is held by the eventual break of

the diamond apex.

Volatility

dropped over the past three days, as the SPX:VIX and

the RUT:RVX ratio pairs bounced back above the

bottom channel after a brief dip below, as shown on the two Year-to-Date

Daily charts below.

Ideally, any further

equity rally should see these two hold above the bottom of the channel,

particularly on any pullback in the SPX and the

RUT to their 20 sma on the Daily timeframe, as mentioned near

the beginning of this post…otherwise, this four-month rally in Global

equities may be finished for the time being as price, potentially, corrects to

the 50 sma, or lower.

Enjoy your weekend

and good luck next week!