I'll begin this post by saying that this was a weird

week…

- + There was very little movement, overall, but there was a "Whole Lotta Shakin' Goin' On".

- + We saw this example of how the Fed's "easy-money-to-create-jobs"

policy was turned upside down by the Bank of America. - + While consumers claim that they are becoming increasingly

uncomfortable, AAPL made new all-time highs, and its market cap has overtaken

that of GE's. - + China's Shanghai Index is about to fall off a cliff, yet its

Financial ETF is telling another story. - + Dow Transports is threatening to become unglued, yet the Dow

30 is hovering over trendline support at new highs from the 2009 lows. - + Emerging Markets and the U.S. Financials appear to be gaining

traction.

Further to my last weekly market update, this week's update will look at

Weekly and Monthly charts and graphs for the 6 Major U.S. Indices and 9 Major

Sectors.

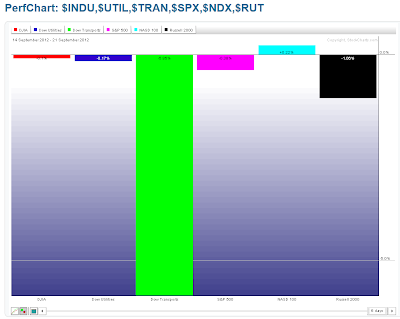

As can be seen from the following Weekly charts and

1-Week gains/losses graph of the 6 Major U.S. Indices, all of them,

except the Nasdaq 100, saw profit-taking. The Dow Transports was especially hit

hard…one to watch for further evidence of weakness, possibly dragging the

others down, as well…although it's sitting at the bottom of a tight range and

could bounce from here.

The Monthly

charts and September's graph below show that the Russell 2000 Index is

leading in terms of percentage gained, so far, for the month. It's the other

Index to keep an eye on to see if weakness enters next week, or if it maintains

its bullish leadership.

The Weekly

charts and 1-Week graph below of the 9 Major Sectors

show that profits were taken in the riskier, Offensive Sectors, while some gains

were made in Health care and Consumer Staples. The largest losses were made in

the Financials…one to watch to see if this continues.

The Monthly

charts and September's graph below show that Materials and Energy still

lead in percentage gained, so far, for this month…ones to watch to see if this

week's downdraft continues, or if they resume their trek to finish the month

even higher next week.

Lastly, the

two Year-to-date volatility ratio charts of the SPX:VIX and

RUT:RVX show that the SPX closed the week at short-term resistance,

while the RUT closed above. In fact, the RUT:RVX closed at an all-time high, as

shown on the third (Monthly) chart, confirming that Small Caps

lead this current market rally in the least volatile environment, for now. This

rally may not end until we see volumes become extremely frothy on the

corresponding Russell 2000 E-mini Futures Index, the

TF.

What do I

take away from all of this? It appears that we have some Sector

rotation going on as some markets (mainly the Defensives) pushed higher at lofty

levels, and others have had some profit-taking. For the time-being, all I can

say is that, generally, overall sentiment/momentum is still favouring the upside

while volatility remains low, in spite of the conflicting data/events that I

mentioned in my opening paragraph. However, most markets remain near their highs

of this year and some people may consider them as being overbought. They are

likely, technically, correct…however, in this Fed-controlled monetary

environment, markets may not always pay attention to pure technicals, as the

Fed's actions seem to remove some of the risk in going long at these levels.

But, since markets may react to unexpected negative news events and are, no

doubt, pricing in this risk, and we may see a market that produces small daily

gains in the days/weeks ahead…it becomes a slow, griding, melt-up. Time will

tell. The challenge for me, as a daytrader, is in determining where support and,

to a lesser extent, resistance lie for the day in this kind of

environment.

Enjoy your weekend and good luck next week!