The Downside Of Leveraged ETFs

Leveraged ETFs can add some excitement to a

portfolio: bet right on underlying index, and you can earn double or

triple the returns of that index. The downside of leveraged ETFs,

though, is their potential downside. Consider one of the most

widely-traded leveraged ETFs, the Direxion Daily Gold Miners Bull 3X

Shares (NUGT): we're just about six weeks into 2013, and unhedged NUGT

longs who bought the ETF at the beginning of the year are already down

more than 29%, as of Tuesday's close (unhedged longs, that is, who didn't use stops. A quick search of Social Trade shows that the last Sloper who wrote about buying NUGT prudently used a stop order).

Too Expensive To Hedge Against A >20% Drop With Optimal Puts

As

we noted in a recent post, hedging a security against a

greater-than-20%

drop can offer a reasonable compromise between limiting downside risk

and lowering the cost of hedging. Unsurprisingly for such a volatile ETF

(as of Tuesday, the 52-week high

and low prices on NUGT were $26.69 and $7.62, respectively), its

puts are expensive. On Tuesday, NUGT was too expensive to hedge against

a greater-than-20% drop using optimal puts*. That's because the cost of

hedging it against a greater-than-20% drop over the next several months

was itself greater than 20% of position value.

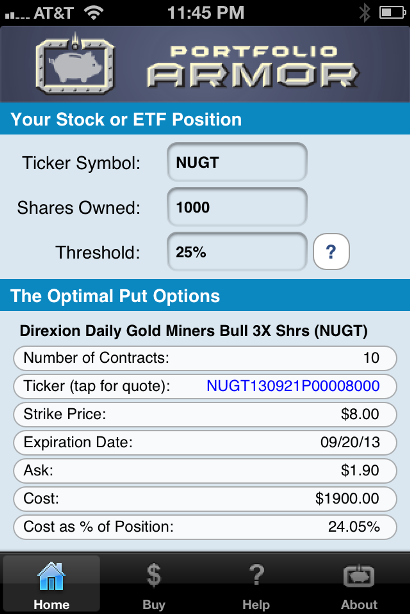

The smallest decline threshold against which it was possible to hedge

NUGT on Tuesday over that time frame was 25%. These were the optimal

puts to hedge 1000 shares of NUGT against a greater-than-25% drop by September 20th, as

of Tuesday's close:

As

you can see in the screen capture above, the cost of those optimal

puts, as a percentage of position, was almost as high as that decline

threshold: 24.05%. It's hard to imagine any investor would want to take a

24% hit to hedge against a >25% drop.

Just as NUGT's puts

were expensive on Tuesday, though, so were its calls. By combining the

right long puts and short calls on NUGT into a collar, an investor could

have dramatically lowered his hedging costs.

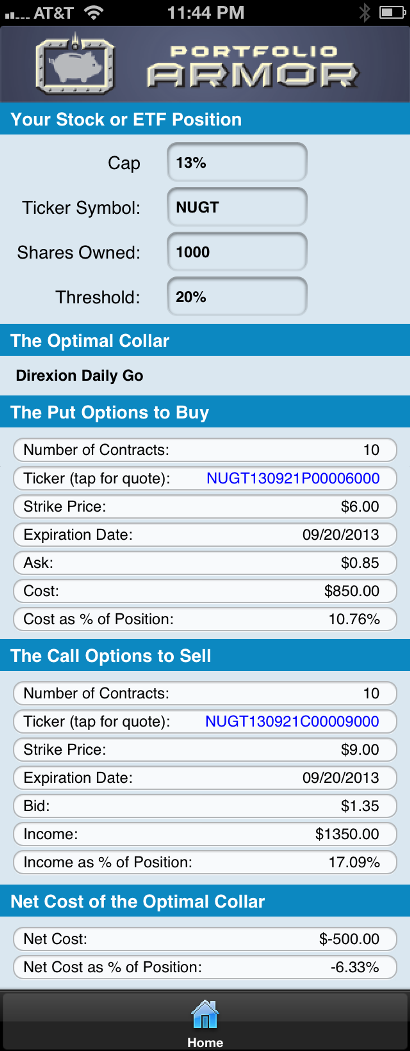

Not Too Expensive To Hedge With Optimal Collars

A NUGT investor interested in hedging against a greater-than-20%

decline between now and September 20th, but also willing to cap his potential

upside at 13% over that time frame, could have used the optimal collar**

below to hedge 1000 shares on Tuesday instead.

As

you can see at the bottom of the screen capture above, the net cost of

this optimal collar is negative — meaning the NUGT investor would be

getting paid to hedge in this case, an amount equal to 6.33% of his position value.

Calculating Net Cost Conservatively

It's worth noting, that, to be conservative, the cost of the puts

above was calculated using their ask price, and, also to be

conservative, the income from the calls was calculated using their bid

price. Since, in practice, an investor can often buy puts for less than

their ask price (i.e., some price between the bid and ask), and an

investor can often sell calls for more than their bid price (again, for

some price between the bid and ask), a NUGT investor opening this

optimal collar on Tuesday would likely have been paid more than 6.33% of

his position to do so.

Worst Case Scenario

For the purposes of this example, we'll assume our hypothetical

investor just got paid 6.33% of his position to open that collar. What's

his worst case scenario? That would be his NUGT shares dropping by more

than 20%. If that happened, the investor's losses on the ETF would be

limited to 20%, but remember, he made 6.33% when he opened that collar.

So, taking that into account, his worst case downside here would be a

net loss of 13.67%.

Best Case Scenario

The best case scenario for an investor who opened this collar would

be for NUGT to rise 13% or more. If that happened, the investor's NUGT

shares would get called away, so his upside there would be capped at

13%. But add in the 6.33% the investor made when he opened the collar,

and he would have a total gain of 19.33%

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor

uses an algorithm developed by a finance Ph.D to sort through and

analyze all of the available puts for your stocks and ETFs, scanning for

the optimal ones.

**Optimal collars are the ones that

will give you the level of protection you want at the lowest net cost,

while not limiting your potential upside by more than you specify. The

algorithm to scan for optimal collars was developed in conjunction with a

post-doctoral fellow in the financial engineering department at

Princeton University.

The screen captures above come from the latest build of the soon-to-come 2.0 version of the Portfolio Armor iOS app. Optimal collar capability will be available as an in-app subscription in the 2.0 version of the app.