As suspected the surge in USD/JPY and Nikkei is causing global

markets to factor in an inflationary boom. World bond markets and

interest rates are showing a change in trend. Banks and housing remain

very strong while most commodities are making all time highs.

While

the S&P 500 has started to stall at resistance levels the past few days (Editor's Note: this was written Thursday), I

am out of the VIX calls because I only suspect it will be a pullback

and nothing more. I am thinking it will be the last pullback before the

market truly takes off.

While I hate to be so sure of

the future, every single market that factors in inflation is looking

very strong while bond markets in my eyes have started topping out. Now

the only thing left in a huge inflationary boom is the fall of the US

dollar and the rise in silver and gold. You can take your bets now if

you want, but I need to see the chart's confirmation before I place my

bets on those.

Brent Crude and Gasoline also look set to pose higher.

3mEuribor

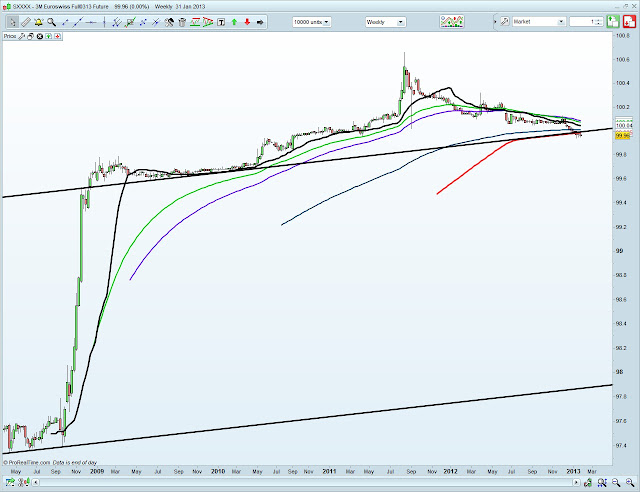

3mEuroswiss

GuiltFutures

Meanwhile China's per capita income continues to rise.

Japan's unemployment is looking like it will fall.

U.S. Debt continues to grow.

Please visit heavenskrowinvestments.blogspot.com if you like my analysis. Happy trading!