The Dow Hits An All-Time High

With the Dow Jones Industrial Average hitting all-time highs recently (albeit, not in inflation-adjusted dollars), in this post, we'll look at the current costs of hedging the Dow component stocks against greater-than-20% drops. We'll also look at the optimal puts1 to hedge a position in the Dow-tracking ETF DIA against the same decline threshold.

Two Reasons To Track Hedging Costs

The first reason to pay attention to hedging costs is if you're considering hedging. But another reason is that we've seen some examples of stocks with high optimal hedging costs underperform those with lower optimal hedging costs. It will be interesting to revisit these Dow component stocks later this year and see if that pattern holds up.

Hedging Costs Of The Dow Components And DIA

The table below shows the costs, as of Tuesday's close, of hedging

each Dow component, and the Dow-tracking ETF (DIA), against

greater-than-20% declines over the next several months, using optimal puts.

|

Symbol |

Name |

Cost of Protection (as % of Position value) |

|

AA |

Alcoa Inc. Common Stock |

3.11%*** |

|

AXP |

American Express |

1.72%*** |

|

BA |

Boeing |

1.30%* |

|

BAC |

Bank of America |

3.20%* |

|

CAT |

Caterpillar |

1.75%* |

|

CSCO |

Cisco Systems |

2.50%* |

|

CVX |

Chevron |

1.37%** |

|

DD |

E.I. du Pont de Nemours |

1.71%*** |

|

DIS |

Walt Disney |

2.55%*** |

|

GE |

General Electric |

1.61%** |

|

HD |

Home Depot |

1.04%* |

|

HPQ |

Hewlett-Packard |

3.19%* |

|

International Business Machines |

1.12%*** |

|

|

INTC |

Intel |

2.14%*** |

|

JNJ |

Johnson & Johnson |

0.68%*** |

|

JPM |

JP Morgan Chase |

1.92%** |

|

KO |

Coca-Cola |

0.65%* |

|

MCD |

McDonald's |

0.65%** |

|

MMM |

3M |

1.14%*** |

|

MRK |

Merck |

1.64%*** |

|

MSFT |

Microsoft |

1.83%*** |

|

PFE |

Pfizer |

1.03%** |

|

PG |

Procter & Gamble |

1.17%*** |

|

T |

AT&T |

1.21%*** |

|

TRV |

Travelers |

1.80%*** |

| UNH | United HealthGroup, Inc. | 2.10%** |

|

UTX |

United Technologies |

1.17%* |

|

VZ |

Verizon Communications |

1.11%*** |

|

WMT |

Wal-Mart Stores |

0.66%** |

|

XOM |

Exxon Mobil |

1.25%*** |

|

DIA |

SPDR Dow Jones Industrial Average ETF |

0.64%** |

*Based on optimal puts expiring in August

**Based on optimal puts expiring in September

***Based on optimal puts expiring in October.

The Optimal Puts To Hedge DIA

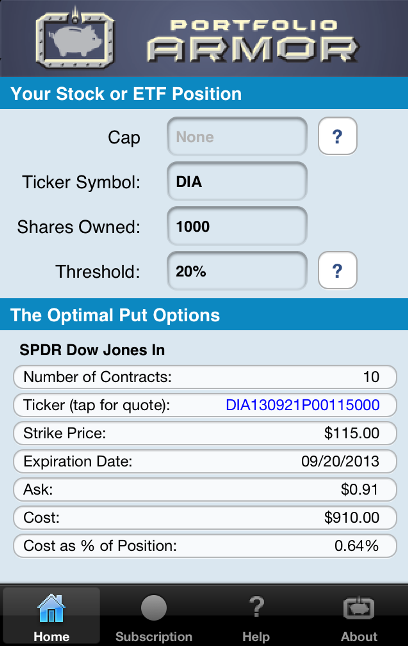

These were the optimal puts to hedge 1000 shares of DIA against a greater-than-20% drop as of Tuesday's close.

1Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor

uses an algorithm developed by a finance Ph.D to sort through and

analyze all of the available puts for your stocks and ETFs, scanning for

the optimal ones. The screen capture below from the latest build of the soon-to-come 2.0 version of the Portfolio Armor iOS app.