I’m planning a series of weekend posts that will be linked together under the title of Brave New World. There are following up from the series of major resistance breaks on SPX over the last twelve months, and will be putting the case for seeing what could well be a massive bubble on equities over the next few years, now that all those obvious reversal levels have been broken.

These won’t make particularly comfortable reading for bears here, and given my extreme skepticism over the long term wisdom of current policies, won’t make particularly comfortable writing for me either. Nonetheless I am a technician, and the technical case is there. I know a fair amount of economics, and will also make the case both for why corporate profits as a proportion of GDP have pushed to such an outlandish historical high here, and why that process may run quite a bit further from here. At the very least I’m hoping that this will make interesting and thought-provoking reading, and may provoke some informed discussion of my economic thinking that I present in the series:

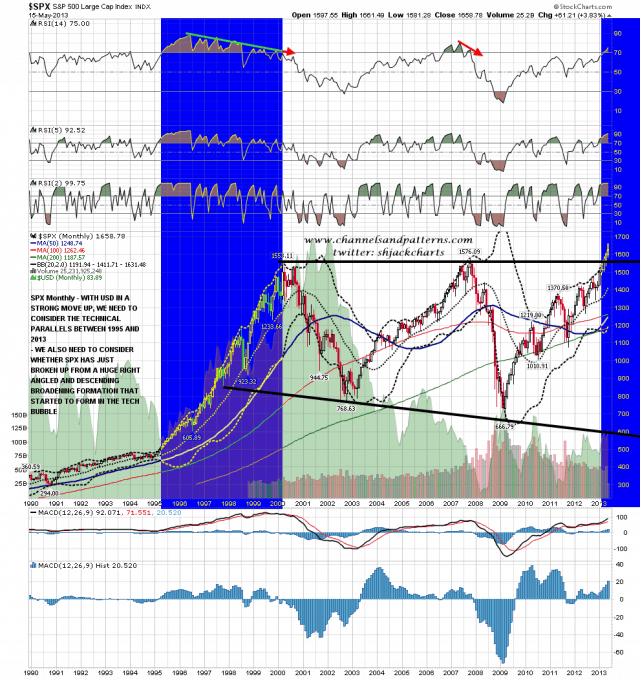

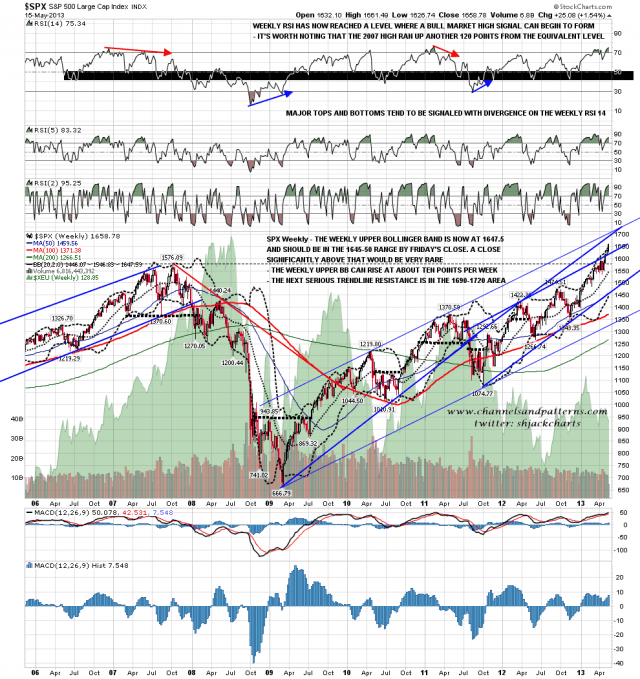

While I’m putting this series together I will post a few charts looking at aspects of the overall picture, and I’ve already been posting some of these. One central theme I’ve been looking at is the parallels between the situation here and the situation in 1995, and considering the possibility that we may be starting a move of comparable size to the move seen then. This is an important possibility, as equities tripled between 1995 and the 2000 high. In terms of the pattern setup here we would be in the early stage of a breakout from a right angled and descending broadening formation that started forming in the tech bubble, bottomed out in 2009, and has broken up this year. These patterns aren’t great performers, as you can see from Bulkowski’s page on these here, but this is a well formed pattern, and I would be seeing this pattern as, in effect, a consolidation/continuation pattern within the overall long term uptrend:

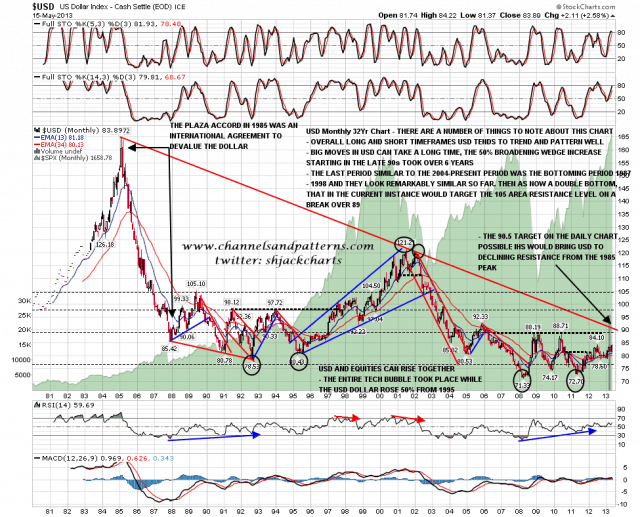

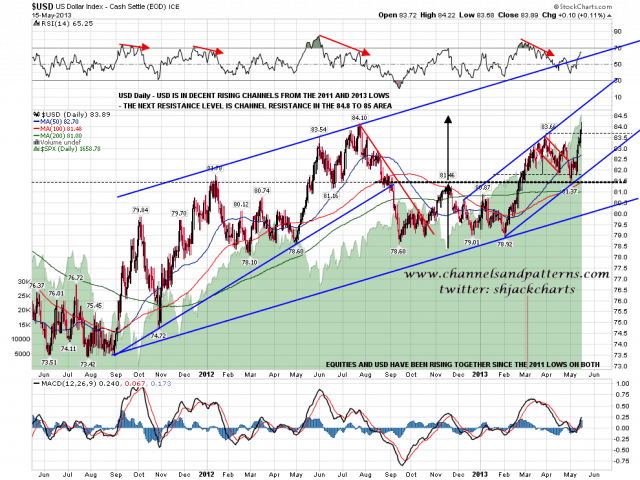

One parallel I’m looking at carefully here is the parallel between the equities/USD setup here and in the tech boom. You can see from my long term USD chart that I’m thinking that we may well see a massive move on USD from here with a target at 105 on a break over strong level and trendline resistance in the 88-90 area. This parallels a move following a double-bottom on USD that formed in the early 1990s as you can see on my main USD monthly chart:

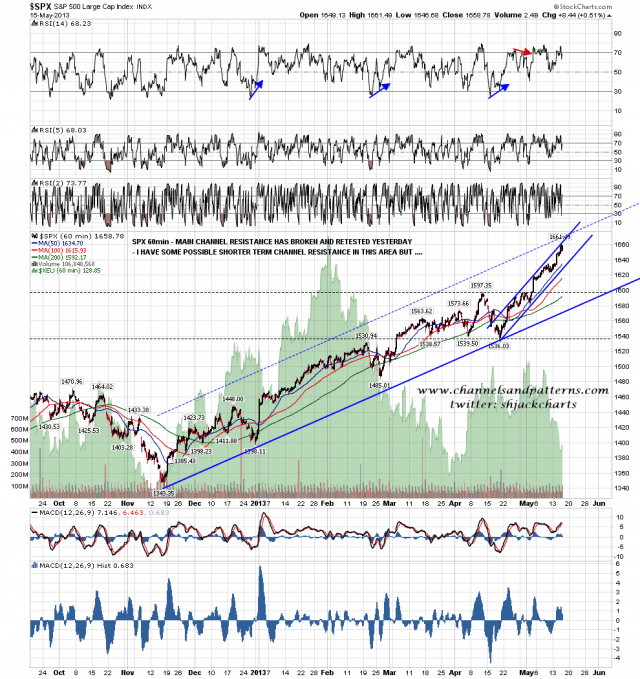

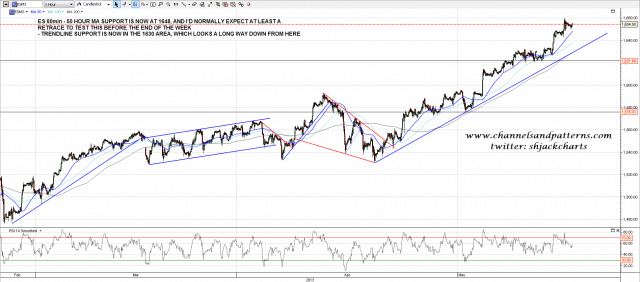

Back in the shorter term I mentioned yesterday that my channel resistance on the SPX 60min was in trouble, and it broke with confidence and retested yesterday. I have some shorter term channel resistance in this area that may or may not hold today:

The setup for a consolidation period here is still intact, just about, and mainly relies on the fact that periods of trading over the weekly upper bollinger band have been very rare in the past. This band can rise at most historically by twelve points or so per week and has tended to be very effective resistance. With the likely closing area for this in the 1650 area this week that would normally limit short term upside here:

On ES I have current rising support in the 1630 area, which looks a long way down from here, and I would normally expect to see at least a test of the 50 hour MA by the end of this week, and that’s now in the 1548 area:

On USD a new trend high has been made and I have next resistance at shorter term channel resistance in the 84.8 to 85 area. I have 84.5 as the double-bottom target marked on the chart below, and USD is very close to making that now:

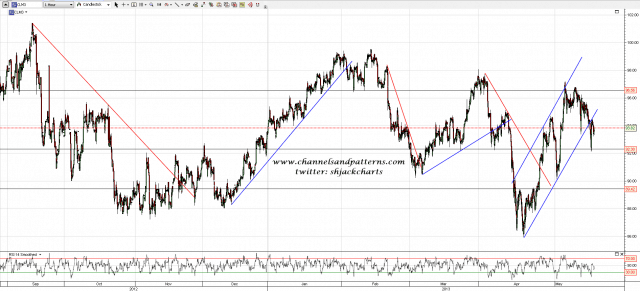

On reason I’ve been looking at the current equity and USD uptrends today is because it’s worth also considering here what happened to commodities in the late 1990s, as they were of course crushed in the face of the bull market on USD even as equities climbed ever higher. That has been happening already and that process could again just be getting started. I’ve been looking at the big inflection point on oil here in recent days and on my daily chart USO appears to be breaking down now. On my CL 60min chart CL retested broken rising support yesterday. I think we may see a major decline on oil over the next couple of years, and that may just be getting started:

Short term I’m still leaning towards seeing consolidation on ES/SPX over the next couple of weeks, but obviously that may not deliver in the teeth of this incredibly powerful upwards trend. If we do see that consolidation I’ll be seeing that as a buying opportunity.