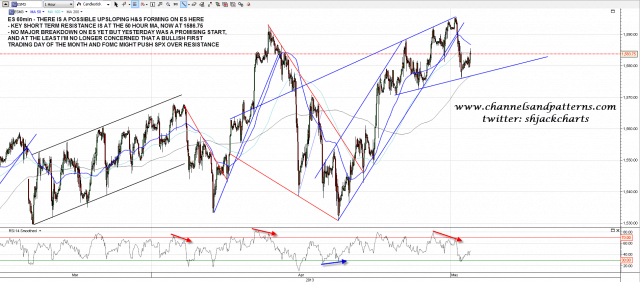

I was concerned yesterday morning that the often very bullish first trading day of the month and the FOMC meeting might push SPX over resistance and seriously damage the spring high setup here, but it seems my concerns were unfounded. Yesterday’s decline was at the least a promising start to the significant retracement that may well be starting here.

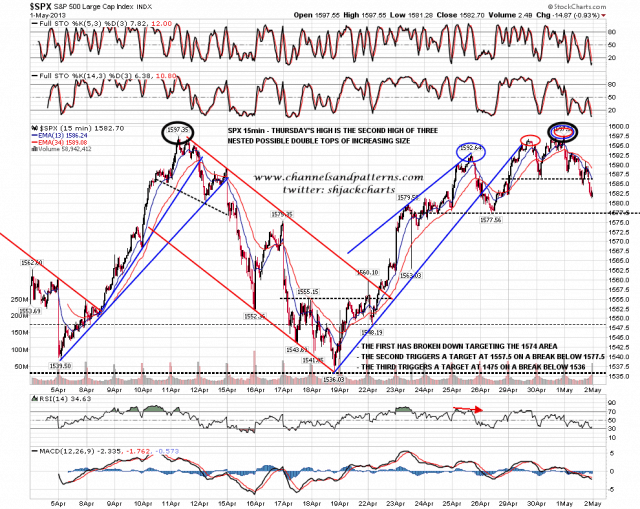

I’ve taken the post title today from the russian nested dolls that I enjoyed playing with as a child, and which are very collectible nowadays. They came to mind as I was looking at the SPX 15min chart, where there is a series of nested double-tops in play here to take SPX back to my ideal target at the 200 DMA. The first of those broke down yesterday with a target in the 1574 area. If we get there that will trigger a second double-top targeting the 1557.5 area. If SPX gets to 1557.5 then main support below will be at the possible main double-top valley low at 1536.03, and if we see a break with confidence below there the target would be the 1475 area. The SPX 200 DMA closed at 1461 yesterday and as it is rising, that might well be in the 1475 area by the time it was reached. That is the ideal retracement scenario here and that test of the SPX 200 DMA would most likely be a good opportunity to go long for the rest of the year, though we would see how the retracement develops on the way there of course. Here’s the setup on the SPX 15min chart:

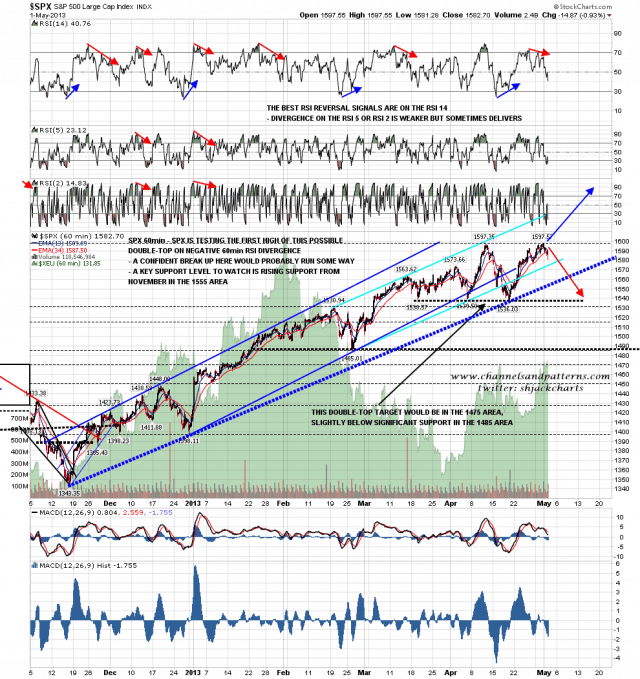

What is the key support level for SPX here? Definitely at 1536 and the reason for that is the current perfection of the possible main double-top in play here, with only 0.22 handles separating the two highs. On a break below 1536 that strengthens the downside target considerably, but it opens the possibility that we may be seeing a bullish rectangle form here, and if we saw a test of 1536 with a strong reversal there then that would be a very significant possibility. On the SPX 60min chart it’s also worth mentioning that rising support from the November low is currently in the 1555 area and has not yet been broken:

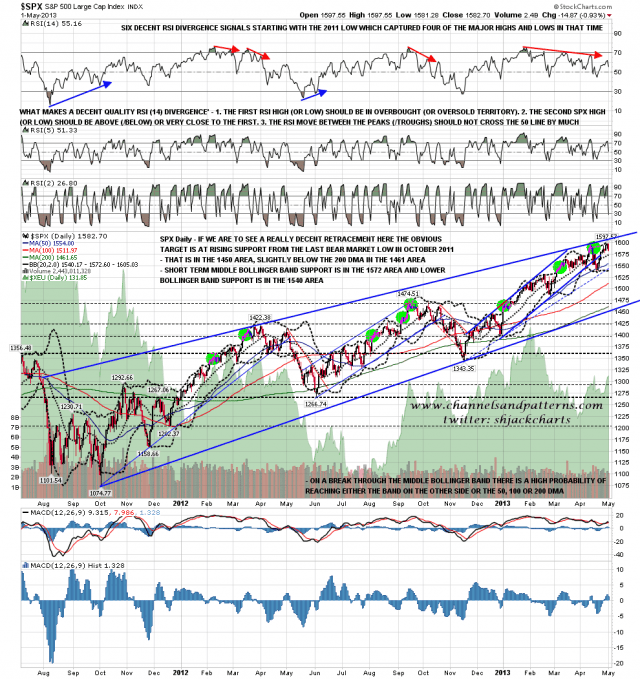

On the SPX daily there was a significant move down from the upper bollinger band yesterday. I would normally expect to see at least a test of the middle bollinger band next, and that’s now at 1572, and lower bollinger band support is now at 1540, just above primary support at 1536.03:

On ES the rising channel was thoroughly trashed yesterday and there is a possible upsloping H&S forming. I have written on the chart below that key short term resistance was at the 50 hour MA at 1586.75 but that has since broken. If ES holds above the 50 HMA, and it’s not holding so far, then we could see yet another test of the highs:

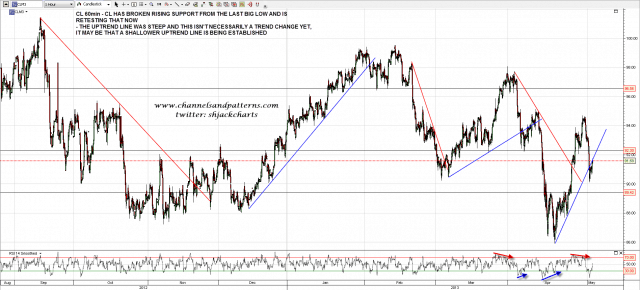

CL broke below rising support yesterday and is retesting broken support this morning. We could be looking at a trend change here but that rising support trendline only had two touches and was rather steep, so CL may just be establishing a shallower uptrend support trendline. The next significant support area below is in the 89.4 area:

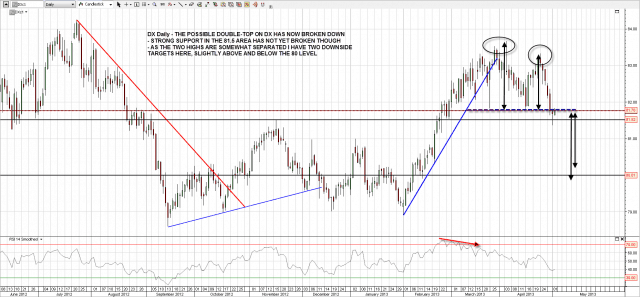

The DX chart has had a bad couple of days since I posted the possible double-top setup there. That double-top has now broken downwards and I have marked in two targets around the 80 area for this pattern. There is still strong unbroken support in the 81.5 area however and that could still hold, though I’m doubtful about that:

Obviously I am still leaning short on equities here unless we see a convincing break up through resistance on SPX. Yesterday was a promising start to a break downwards, but ES needs to break below significant support around 1570 soon to open up the short side more convincingly.

I prepared some charts for Dax, FTSE and EEM this morning but have run out of time to include these in this post. If you want to see those charts click on those names above to see them.