This year has seen a lot of significant technical movement. Over the last quarter of last year and in 2013 so far we have seen the destruction of the huge bearish patterns on equities and elsewhere that loomed over the technical landscape in 2012, and every remaining obvious level for SPX to turn back down for a decline continuing from, and comparable to, the declines after the tech and property bubbles has now been broken. The economy is still weak and current policies look highly suspect longer term, but any really major high on equities could now be several years away, and the current cyclical bull market from 2011 looks likely to run quite a distance further.

I’m going to be doing a series of weekend posts looking carefully at bonds, USD, and talking about how I see the overall macroeconomic background here, As time permits I’m planning to do those over the next few weeks. Meantime however we are in a cyclical bull market with no end currently in sight and every retracement is to that extent a buying opportunity. I don’t see any current reason to believe that a cyclical bull market top is likely in 2013.

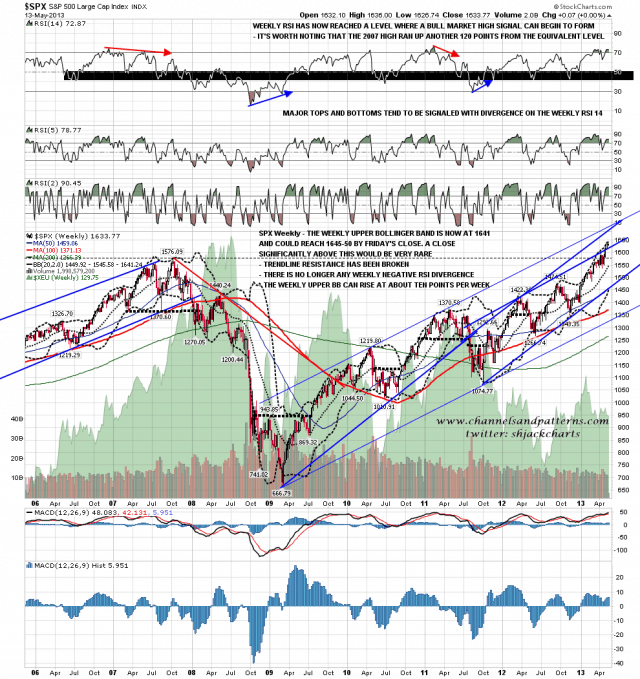

In the short term I posted the weekly SPX chart yesterday with the note that SPX was most unlikely to close significantly above the weekly upper bollinger band, which is likely to be in the 1645-50 area by the close on Friday unless we see a strong decline in the interim:

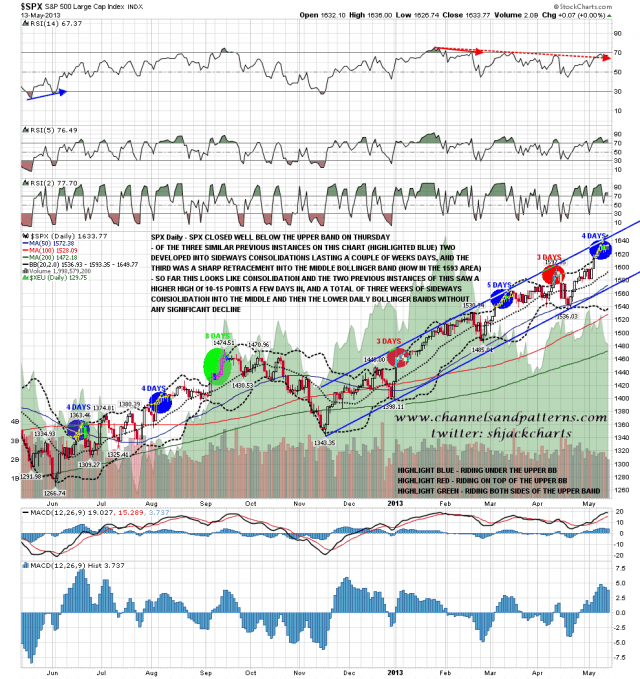

On the SPX daily chart we are clearly seeing sideways consolidation after the pullback from the upper bollinger band last Thursday. There are two previous instances of this on the chart below, and they are remarkably similar in how that sideways consolidation played out, though we won’t necessarily follow the same script here of course. In both instances there was a higher high 10 to 15 points higher a few days after the consolidation started, and the consolidations took three weeks or so overall without any meaningful retracement in that time. Both consolidations finished with a hit of first the daily middle BB and then the daily lower BB, which had moved up into the consolidation range over the consolidation period:

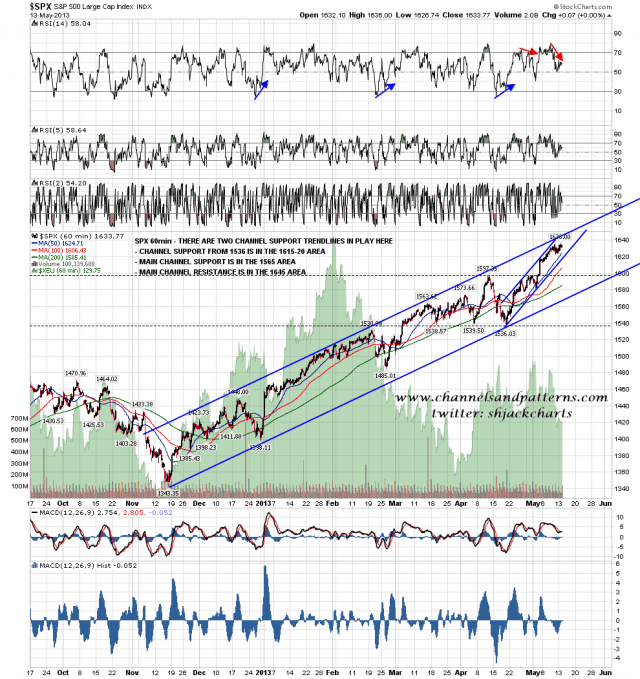

If we are going to see a higher high 10-15 points higher then there is of course an obvious target, and that is at main rising channel resistance from the November low on the SPX 60min chart. That is in the 1645 area and obviously fits well with strong weekly upper bollinger band resistance in the same area. If we see the 1645 SPX level made this week that would therefore be an extremely attractive short entry that should deliver 10 to 20 points on a reversal from there as the sideways consolidation continues:

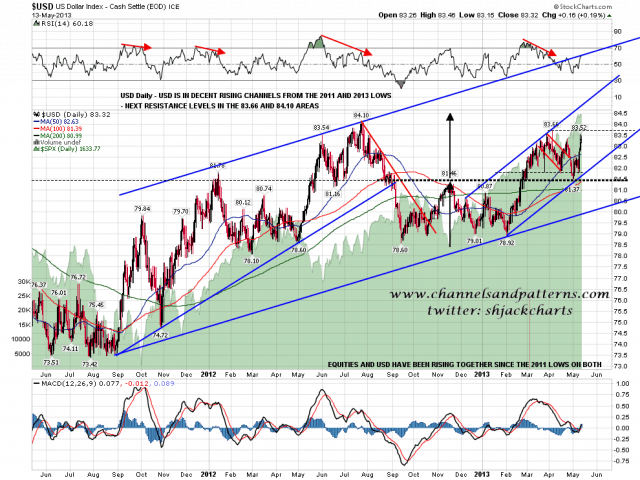

Today however I mainly want to talk about playing the USD uptrend by shorting the British Pound (GBP). I showed the rising channels on the USD chart yesterday and would like to make two additional points about that chart this morning before talking about the setup on GBP. The first is that USD has obviously been strongly positively correlated with equities since the 2011 lows on both. This has happened before every so often, notably in the 1990s, and can last for several years. As I was noting above there is no reason to think that equities are close to a bull market high here, and there’s also not much reason to think that USD is close to a major high either. While this remains the case, US equities are in a position similar to EU equities in the 2009-11 cyclical bull market, in that both the equities and the currency in which those equities are priced are in bull markets, and are therefore relatively very attractive. The second point I would make is that the primary bull/bear line for USD in the 81.5 area, the key support level that held on the last retracement, and as long as USD can stay over that the overall trend for USD will remain bullish:

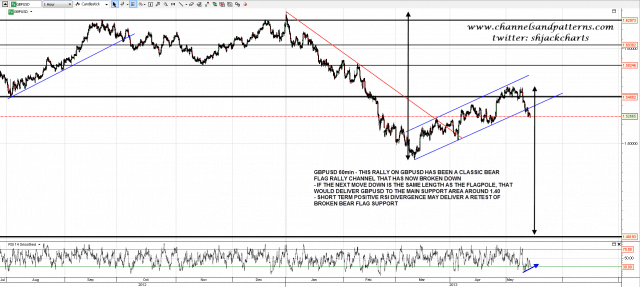

I was posting the charts for the short setup on GBPUSD on twitter last Friday but I’ll follow that up in a bit more detail here today. Last Friday the rising channel / bear flag I was watching on GBPUSD broke down, and I was noting if the decline from that bear flag matches the decline into it, then that would deliver GBPUSD to strong long term support in the 1.40 area. Positive 60min RSI divergence on this chart is worth noting as that may deliver a retest of broken flag/channel support and with it a better short entry:

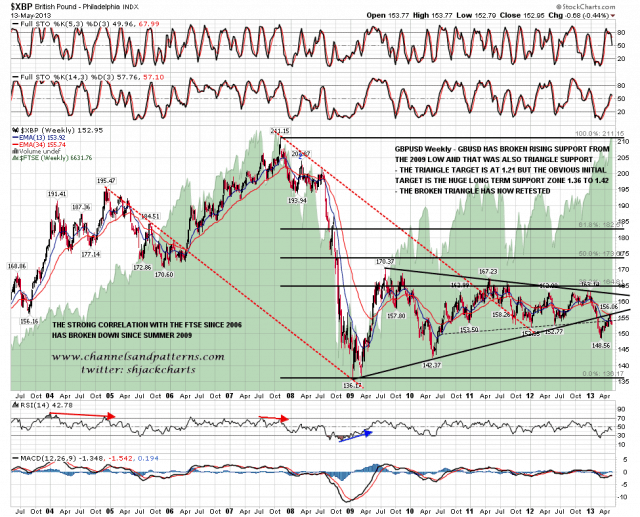

On the GBPUSD weekly 10 year chart we can see that on the last decline GBPUSD broke rising support from the 2009 low, and that support was also the support trendline on a four year triangle. As the bear flag formed from the last low the flag high was a perfect retest of that broken rising support trendline and the next obvious big move is most definitely downwards. The technical downside target for this broken triangle is the 1.21 area, and that could be made, but there is big long term support in the 1.36-1.42 range, and that is therefore my initial target:

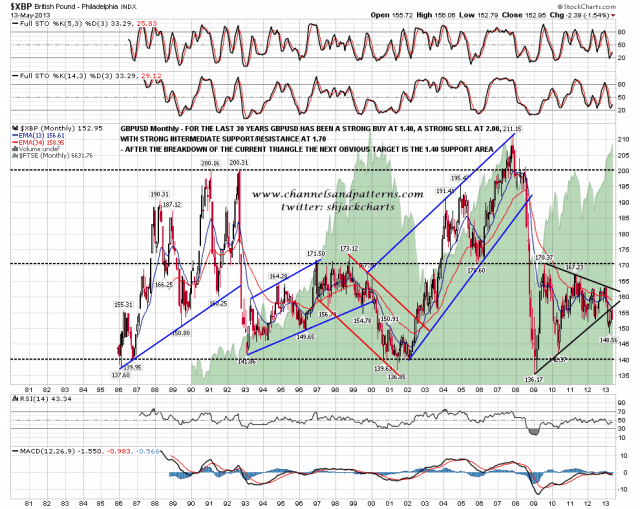

My long term chart on GBPUSD only goes back to 1985, but you can see the huge long term support around the 1.40 area on this chart below. I count seven distinct tests on the 1.40 level in that time and though intra-month GBPUSD went significantly below several times, no month has closed below 1.40 during this 27 year period:

For today on ES and SPX I have 50 hour MA support on ES at 1627.65 at the moment, and have strong resistance on SPX in the 1645-50 area. If the 1645-50 area is reached that will be a very attractive short entry area for the rest of the week.