It’s probably just my martyr complex showing, but I found some Broadway lyrics dancing in my head this morning. They are from Man of La Mancha, which I listened to many times as a child…….

Why do you do the things you do?

Why do you do these things?

Why do you march through that dream that you’re in —

Covered in glory and rusty old tin —

Why try to be what nobody can be

And what do you want of me?

What do you want of me?

Why do you do the things you do?

Why do you do these things?

Why do you rush at the world all alone —

Fighting mad battles that aren’t your own —

Why do you live in a world that can’t be

And what do you want of me?

What do you want of me?

Why don’t you know that you’re laughed, at wherever you go?

But I … cannot laugh with the rest … and why, I don’t know …

Why do you do the things you do?

Why do you do these things?

Why do you batter at wall that won’t break?

And why do you give when it’s natural to take —

Where do you see all the good that you see —

And what do you want of me?

What do you want of me?

Over the past four years, I’ve certainly lived within the Don Quixote role (with various and sundry Panchos at my side………..). I don’t get any intrinsic jollies out of tiling at windmills. I simply perceive the world in a certain way, and whatever makes “sense” to me, I execute upon. It’s been an uphill fight.

As ga-ga bullish as the world is…………..to the point where laughing and pointing at the handful of surviving bears has become a blood-sport…………I refuse to buy into a market at these levels based on the notion that Things Are Different this time (honest! for real!) thanks to Bernanke – – I man I despise with every fiber of my being – – and his printing press.

I have a blog to run, though, and I don’t want to issue the same post, every day, Gainesville-style, stating that things are going to fall Real Soon Now. That gets old, and I’ve honestly tried my best to balance my tsunami of short ideas with long ones as well.

But I took a long-term view at charts this weekend, and honestly, I will be the first to admit that there is every reason to believe the market could keep pushing higher, but the relative position of prices now vis a vis any sort of mean reversion reeks of madness. Sentiment is positively manic, and the world seems convinced again – just like in 1999 and 2006 – that everyone deserves to be rich and can easily make themselves so.

So let’s walk through the big picture of some important indexes and see what I’m thinking…….

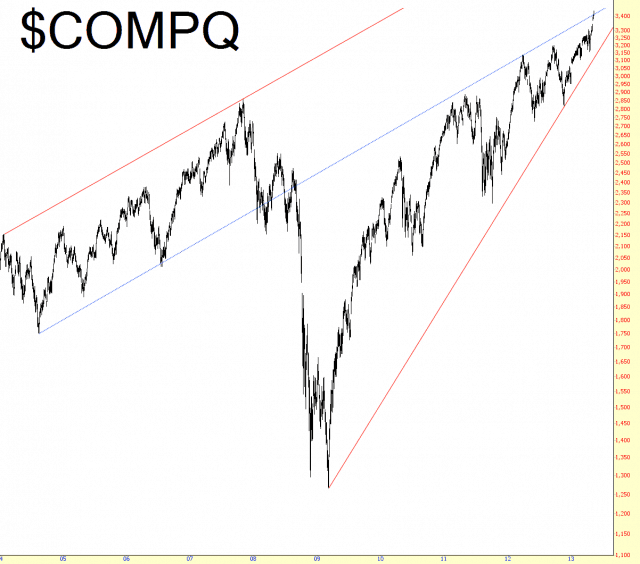

First up is the NASDAQ Composite, whose trendlines I’ve cleaned up and reworked. There is a quite interesting trendline shown in blue below, nearly a decade long, from which we’ve made many retreats in recent years. We are squeaking just above this trendline now, but I don’t think we’re going to break on through to the other side (Jim Morrison style) but will instead be repelled back to the red supporting line. Who knows when the happy day will come that we actually break the red line, but we’ll cross that bridge when we get to it.

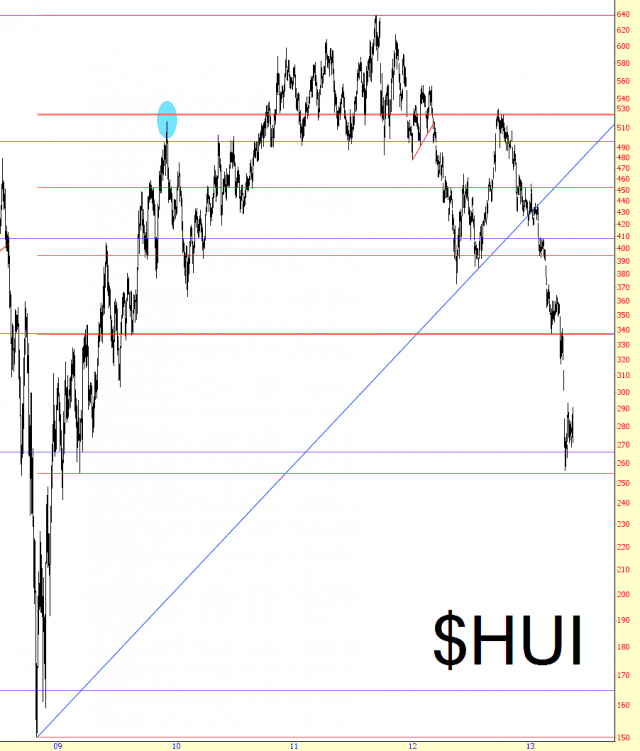

I’m kind of torn with miners; part of me thinks they could actually be a really good long position. This feeling is strengthened by the fact that I laid down some much longer retracement levels only to discover that present prices are also just above one of those levels. In other words, I think – in spite of my bearishness on gold – that miners are more likely to move higher than lower from here, although their long-term bear market remains fully intact.

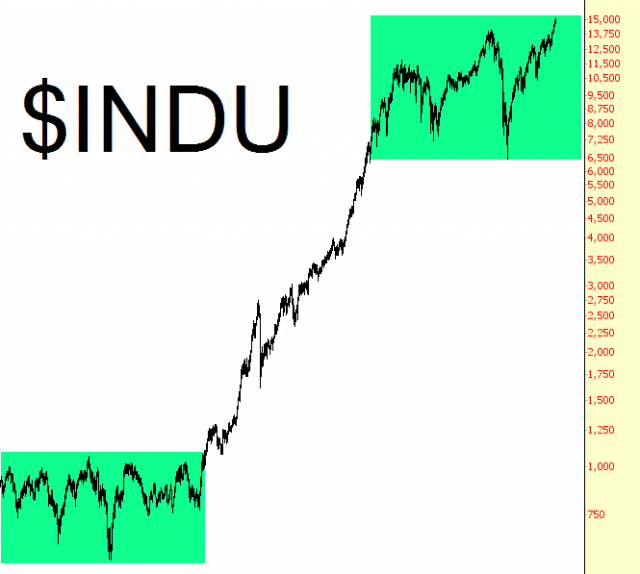

The Dow is a puzzlement. Even though I’ve got 113 years of data on this, I’ve deleted all the drawn objects. I just can’t seem to get a take on this index. The only notion I’d like to offer is how we seem to be in the same sort of multi-decade Make Up Your Damned Mind market that we had in the late 60s, all the 1970s, and early 1980s.

At the risk of seeming like I’m incapable of any insights today, here’s another chart which, while fascinating, I really have no broad conclusions about: interest rates. This shows the phenomenal descent of rates from 1980 to present. The big question, of course, is whether or not there’s been a major bottom (think Oprah Winfrey) or whether this is just another in an whole series of meaningless bottoms (think Richard Simmons).

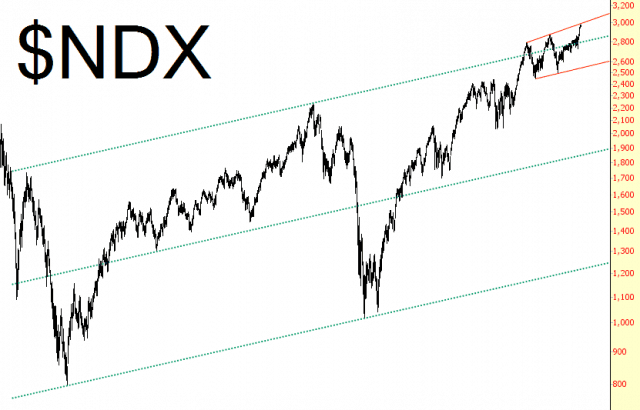

The chart of the NASDAQ 100 is cleaner, but it is still a puzzlement. For years and years, NDX was inside a well-formed channel. I had thought – quite incorrectly, it turns out – that prices would turn away from resistance, but as you can see, they didn’t. What had been resistance has transformed into a midline above and below which prices bobble. I have defined this new, miniature channel by way of the red trendlines and we are, once again, at resistance (this time of a less meaningful pattern).

The S&P 100 has matched its 2007 high. I mistakenly thought we were at lifetime highs here, but only when I took a fresh look at its entire history did I recognize that we are nowhere near a lifetime high. Whether or not prices “respect” both the 2007 level and the blue trendlines remains to be seen. I know we are all anxiously awaiting the market’s reaction to the WSJ “tapering” article (released – – cruelly – – on a Friday evening!), but God knows that the bears are existing on a diet of disappointment lately, so I’m not counting on anything.

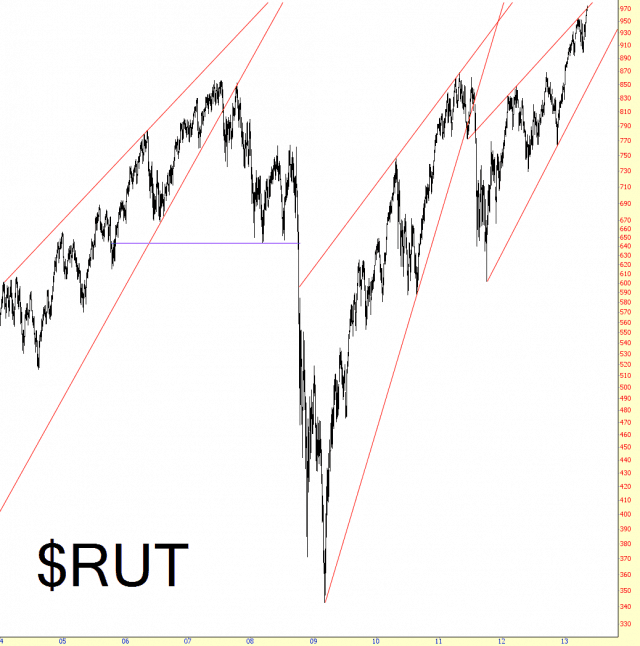

Russell, like the S&P 100, is an easier index to read right now than some of the others I’ve mentioned. Need I say it again? Yeah, I’d better: we are mashed up against resistance. Look what has happened before and make your best guess what’s going to happen next. That’s our job.

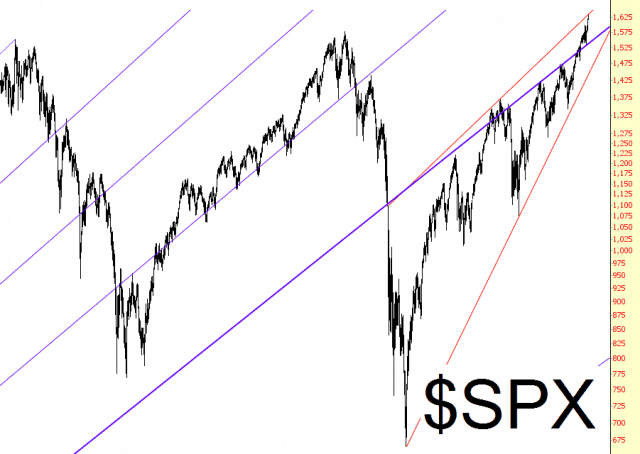

Lastly, the S&P 500 is a bit of a puzzler too. The red trendlines I’ve drawn provide some clarity as to price action over the past couple of years. The more important blue lines, representing Fibonacci fan lines, had done a yeoman’s job for decades now, but prices have cut above the most recent fan line, which has been a particular source of frustration and agony for 2013.

We haven’t gotten a decent selloff in the market for this entire stinking year, and the last meaty selloff we had was back in late summer of 2011, which feels like about three hundred years ago.

One of my biggest regrets of the past several years was not taking full advantage of that big selloff. I made money, but it was very modest compared to the drops we had, particularly on the Russell. There is no way I’m going to let such an opportunity pass me by again. I remain positioned for the drop – – whenever it comes – – and will continue to adjust my multitudinous little equity positions and their stops on a daily basis.

I am presently 70% committed to the market (30% in cash) across a glittering variety of small short positions. I’m interested to see how Sunday opens, of course, but I’m way too cynical to get excited about any drop (should there be any), since the bastards are still consistently in the winner’s circle.

I am definitely “charted out” until Monday, so unless some killer guest post comes along to provide fresh content, I’ll see you here on Monday morning. Have a good rest of the weekend.