Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Steady Ship

For all of its insanity in the late 1990s, Amazon has turned into a placid, stable, and frankly boring stock. That’s no problem for the bulk of people who are content to hold on to it for growth, because there’s no doubt, they’ve metamorphized from a crazy startup to something more closely resembling Walmart

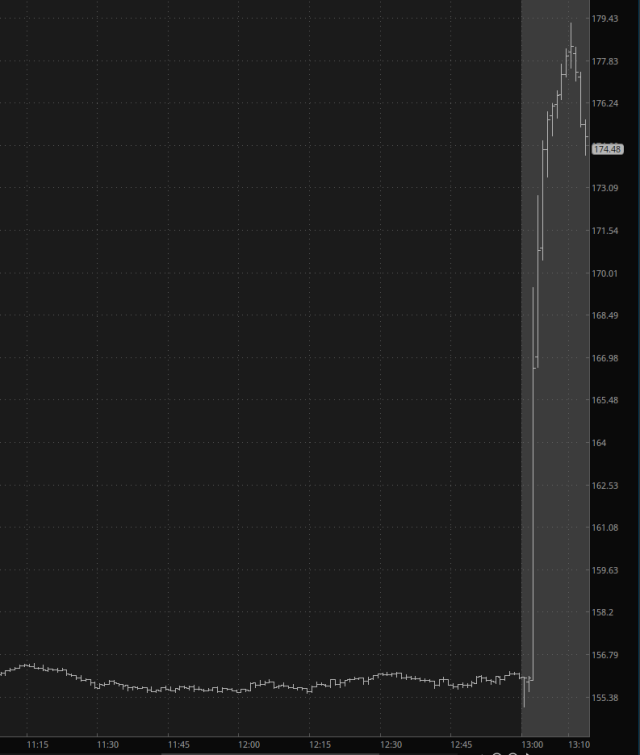

Reverse Reverse

In sharp contrast to yesterday’s META wipeout, the tech stocks are exploding higher tonight, driven by the typical nonsense of (a) massive buybacks (b) massive dividends. Google in particularly is blasting to never-before-seen highs.

Oscar Winner

Oscar Health (OSCR) continues to do nicely………….

Cashing In On Tesla’s Bounce

The Trader Versus The Intelligent Investor

One of the more amusing posts on X after shares of Elon Musk’s other business Tesla (TSLA) spiked after hours yesterday was this one, picturing someone throwing Benjamin Graham’s classic book, The Intelligent Investor, in the trash.

$TSLA +7% https://t.co/KyDGq8C4wU pic.twitter.com/m0VVSqKdFU

— Mads Capital (@MadsCapital) April 23, 2024

(more…)