The article below was sent in by a reader (I’m not sure if he wants me to cite his name, so I won’t). I am particularly grateful since I really need to spend the rest of the day horizontal. I should be right as rain in the morning, God willing.

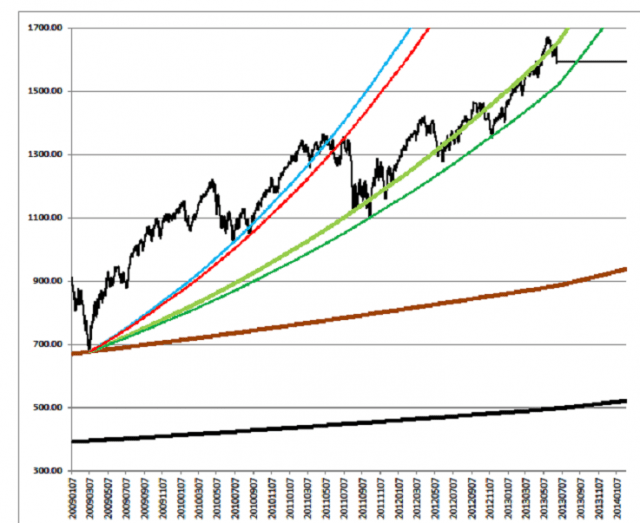

Chart description:

Black line at bottom = Long term base line from January, 1950 through low in October, 1974. 5.32% CAGR. Current value = 496.96.

Brown line = January, 1950 through low in March, 2009. 6.22% CAGR. Current value = 885.27.

Dark Green line = March, 2009 through low in October , 2011. 18.7% CAGR. Current Value = 1518.47.

Light Green line = March, 2009 through low in August, 2011. 20.65% CAGR. Current Value = 1651.62.

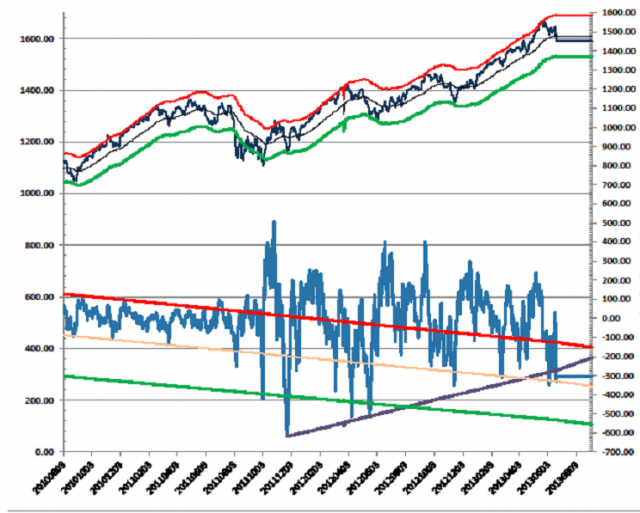

Chart description:

Blue Line at bottom of chart = McClellan Volume Oscillator.

Red, Yellow and green lines at bottom of chart = Not used.

Blue line at top of chart = SPX Typical Price (High + Low + Close)/3.

Black line at top of chart = 55 Day EMA.

Red Line at top of chart = 55 Day EMA + 5%.

Green Line at top of chart = 55 Day EMA – 5%.

In order to be bullish and think that SPX is going to stay above the dark green line, you have to believe that one of the following 2 statements is true.

A.) There is no relationship between the price of SPX and the earnings of the underlying S&P 500 companies.

B.) The earnings of the underlying S&P 500 companies are going to grow at a compound annual rate of 18.7% or more.

Dates and Events:

April 15, 2013 First Hindenburg Omen

May 22, 2013 Large intraday bearish reversal from a new all time on SPX (Also occurred on March 24, 2000 and October 11, 2007.)

May 28, 2013 SPX makes a lower high.

May 31, 2013 SPX makes a lower low, Second Hindenburg Omen, SPX drops below 20 Day SMA.

June3, 2013 Third Hindenburg Omen.

June 4, 2013 Fourth Hindenburg Omen.

June 4, 2013 SPX close below uptrend dating back to 2009 low signifies a failed breakout (Current Value 1635.34.) Next lower uptrend line is currently at 1504.90.

June 5, 2013 McClellan Volume Oscillator drops below rising trend line currently at -280.91.

June 19,2013 Fifth Hindenburg Omen.

June 20, 2013 SPX closes below 55 Day EMA (Currently at 1612.06).

June 20, 2013 SPX falls below uptrend line defined by the March, 2000 and October, 2007 High signifies another failed breakout and also gets SPX back into the large megaphone formation defined by the above trend line and the downtrend line defined by the 2002 and 2009 lows. (Current value 1593.61.)

????? SPX drops 5% – 6% below declining 55 Day EMA.

????? Subsequent RIPs reverse at the 55 Day EMA. (At this point this bull is DEAD.)

????? 50 Day SMA (Currently 1619.06) drops below 200 Day SMA (Currently 1505.33) Death Cross.