Well, wouldn’t you know it? The moment I’m starting to really enjoy trading again, along comes the biggest up day of the year. A major reversal in the ES and the NQ, apparently prompted by little more than the fact that the Japanese Yen stopped gaining value. Incredible.

Well, wouldn’t you know it? The moment I’m starting to really enjoy trading again, along comes the biggest up day of the year. A major reversal in the ES and the NQ, apparently prompted by little more than the fact that the Japanese Yen stopped gaining value. Incredible.

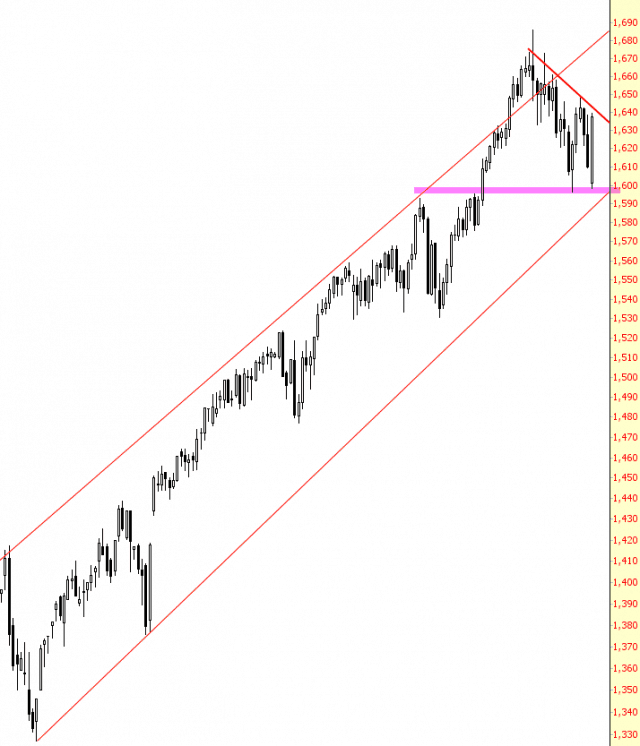

The area around 1600 is representing very firm support for the market right now. That was our “breakout” area weeks ago, and twice now we’ve challenged the same zone, confirming it as support both times. What’s especially interesting about this level is that it also coincides with the ascending supporting trendline of the channel I’ve drawn. If, God willing, the ES breaks 1600 and can actually stay beneath it, that suggests a pretty important violation of support. But it hasn’t happened yet, so the support stands.

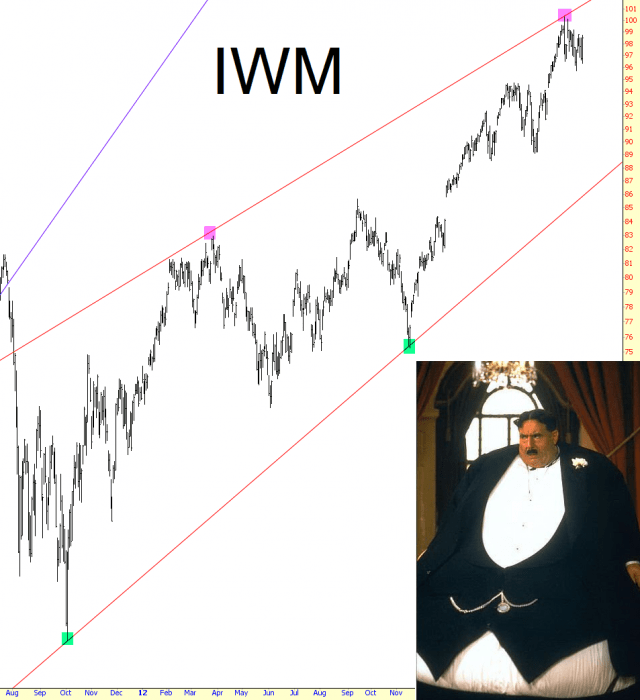

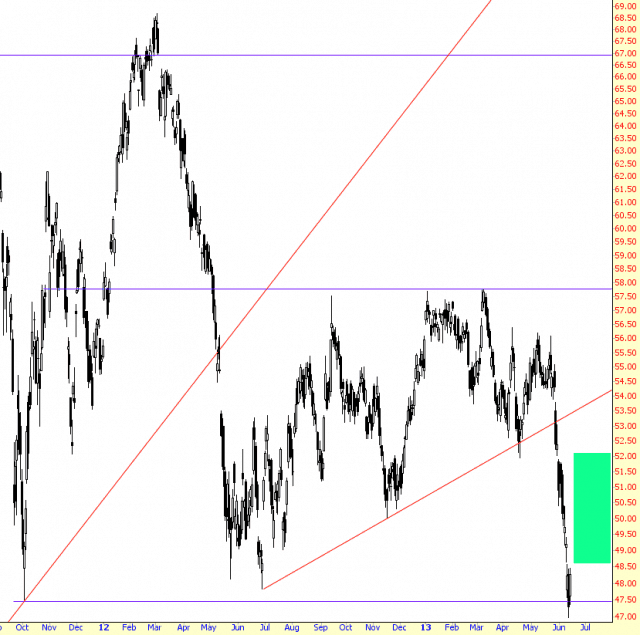

I beat a fairly hasty retreat this morning, reducing my portfolio’s commitment from 80% to 55%. One thing that concerns me is that many of the non-U.S. markets, particularly Mexico, the emerging markets, and Brazil, could easily bounce 7% or so without violating their downtrends. They have fallen mightily of late, and, as indicated with the green tint below, there have plenty of room to roam higher with relatively little effort.

My one point of solace is that most U.S. equity charts state the same story: we are much closer to resistance than support. This entire month will probably hinge on next Wednesday, which is the big FOMC announcement. There’s already plenty of back-pedaling in the press about how the Fed isn’t even thinking about taking away the punch bowl. Until someone’s back is genuinely against the wall, I guess we can expect the same old smoke and mirrors in perpetuity.