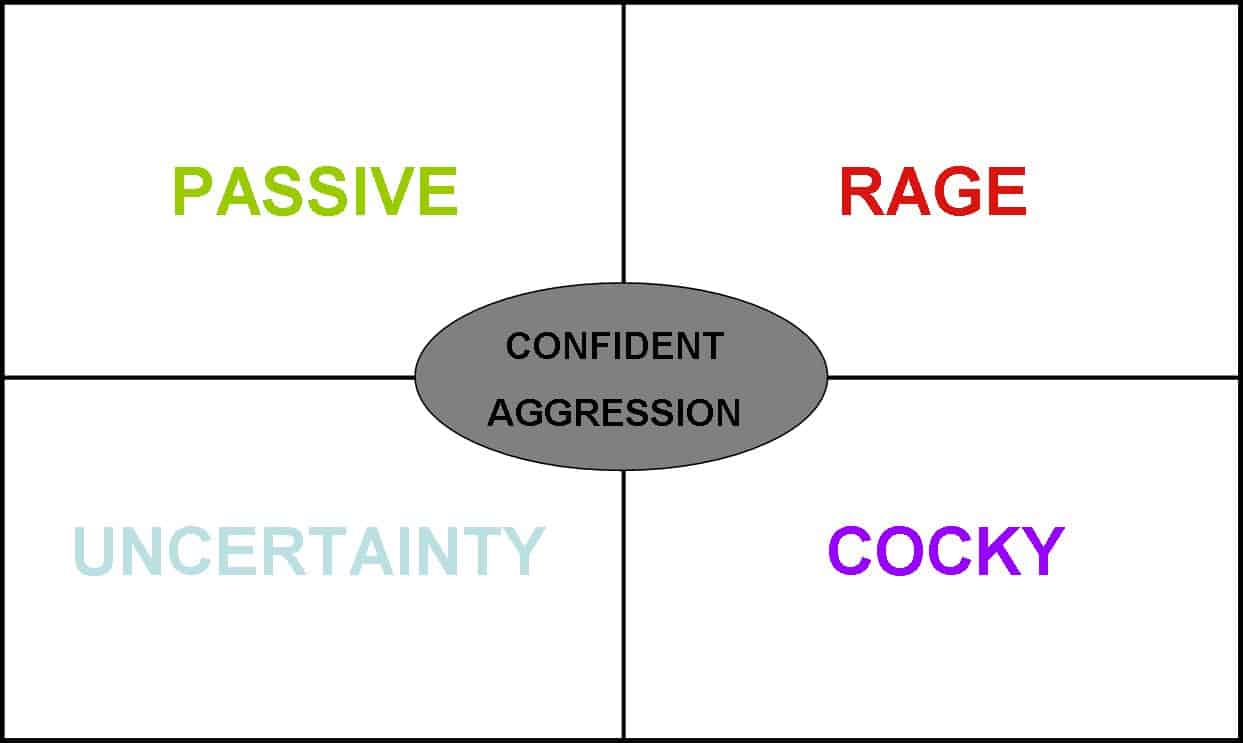

To adapt a quote from the great Yogi Berra, “trading is 90% mental, the other 50% is physical.” Huh? Simply, mastering the psychological aspects of trading is vastly more important than the physical act of charting and executing trades. The most difficult part of dealing with the markets on a daily basis is controlling the mind as opposed to controlling trades (which we have no influence over). Therefore, I’d like to explore the four quadrants that make up a trader’s psychology.

PASSIVE: Every single trader in the history of the markets has worked hard to identify a trade only to let the market move on, as expected, without actually having a position. This is passivity at its worst. We see the market yet for some reason we just don’t pull the trigger. We lack the aggression to hit the bid and just get in the trade. Sure losses kill traders, but so does passing up too many obvious trades. Passivity is deadly as it marks a lack of enthusiasm for trading.

RAGE: This devilish attribute leads us to trade angry. We enter almost every trade we see with a blind vendetta against the market. Once in a blue moon a trade based in pure rage can be cathartic, virtually every other time Mr. Market laughs and rips the market against the trader, which leads to more rage. Rage also leads to trading much bigger than intended (I’ll show this market; I’ll put on a position four times normal size). Rage is deadly as it marks a total lack of self control.

UNCERTAINTY: After a few losses or bad analysis of the tape we shake hands with uncertainty. Nothing we see seems right anymore as confidence is at an absolute low. Up is down, down is up, and we are awash in our own self-doubt. Every trader has said, during a losing streak, “I should just do the opposite of what I think is right.” The worst part is that a career trader knows they are smart enough but the human condition blesses us with crippling self-doubt every so often. Uncertainty is deadly as it takes us fully out of analytical rhythm.

COCKY: Nothing we do can lose money! We are Trading Gods! We make Jesse Livermore seem like a pauper! Get to this psychological point and Mr. Market will not only hand us a loss but it often is one of those losses that erases weeks or months of profits. Being cocky makes us think we are “absolutely right” about a trade which is another way of saying “I’m applying zero discipline anymore.” Cockiness is deadly as it leads the trader to extremely high risk trades which ends with a final location called the poor house.

The Holy Grail of trading psychology is what I call Confident Aggression. We act decisively when executing trades and we are cool, calm, and collected when analyzing the tape. Personally, I look back to my baseball days to create the image. A hitter can’t hold the bat too tightly as it slows down the swing (rage) or too loosely as the swing has no power (passive). A hitter can’t swing at every pitch or they will consistently strike out (cocky) but they can’t get a hit if they don’t swing at all (uncertainty). So grip that bat just right, look for the pitch you love, and let it rip. See the trade, hit the trade. End of story.