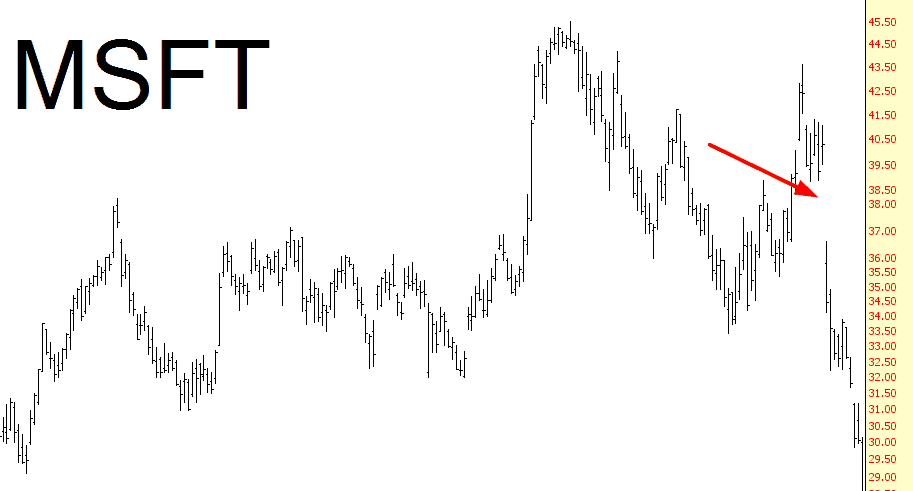

The last time I remember Microsoft shocking the market with disappointing earnings was early in April of 2000 (yes, these kinds of things actually stay stuck in my head). The stock slumped on huge volume, and it really kicked off the monster bear market in NASDAQ and the complete deflating of the Internet bubble:

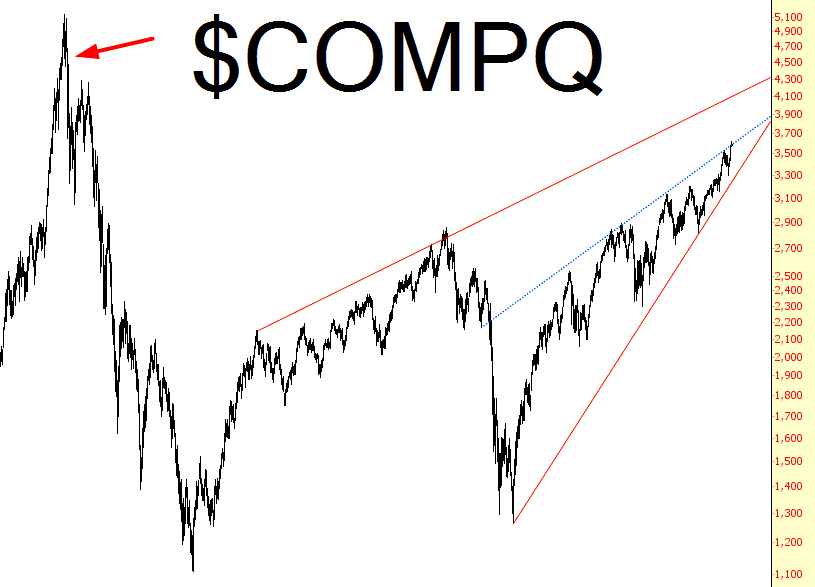

Below I’ve marked where the “gap” took place for Microsoft on the NASDAQ Composite graph……

By no means am I suggesting one company’s earnings is going to have the same effect it did in 2000. Let’s face it – – Microsoft is big, but it isn’t the bellwether that it used to be. What struck me, though, is how similar the volume was – about 220 million shares in 2000 and about 250 million shares today. Clearly the drop in Microsoft was a big deal in both instances.

But on a day where Microsoft got killed, Google slumped, and the Nikkei had been down as much as 600 the night before, it was more than a little disappointing (but at this point hardly surprising) that the S&P actually went up. So bad economic news doesn’t bring the market down. Nor does a gridlocked government with $16 trillion in debt. Nor, it seems, do sucky company fundamentals.

Still, let’s all remember the old Klingon proverb how revenge is a dish best served cold.