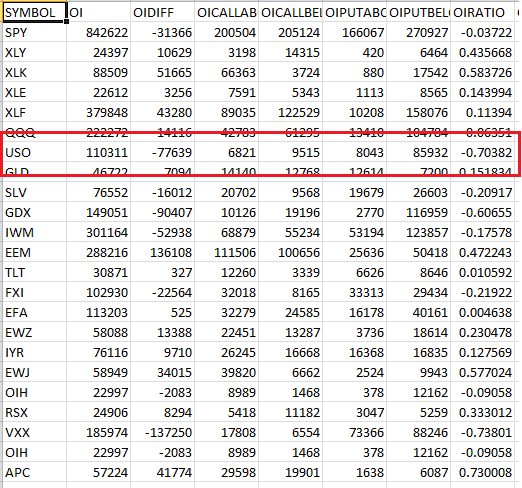

My options scanner has picked up a USO options imbalance for August. Check out the August options scan below. USO has a reading of -0.70382 on decent open interest.

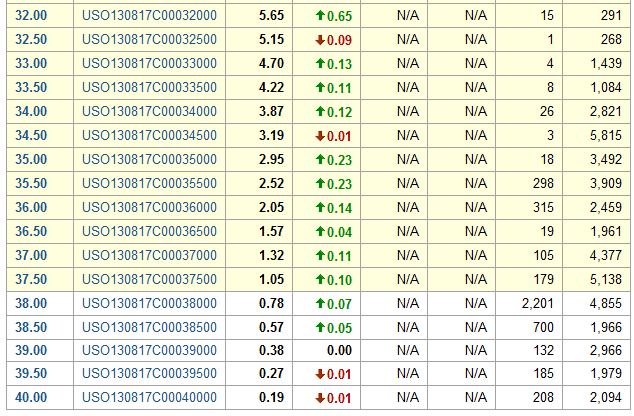

Turning to Yahoo Finance we see indeed, USO has a large August put open interest compared to the August call open interest. First the call sheet:

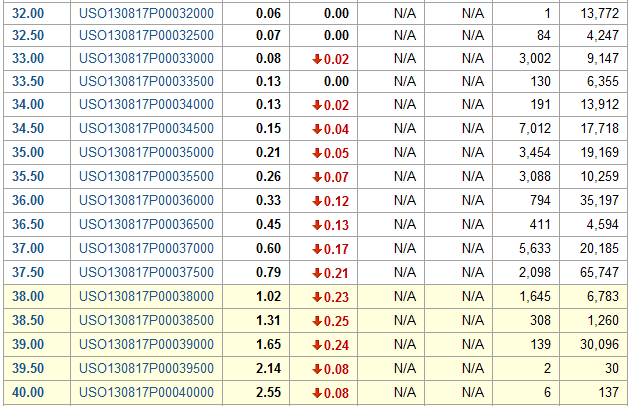

And then the put sheet:

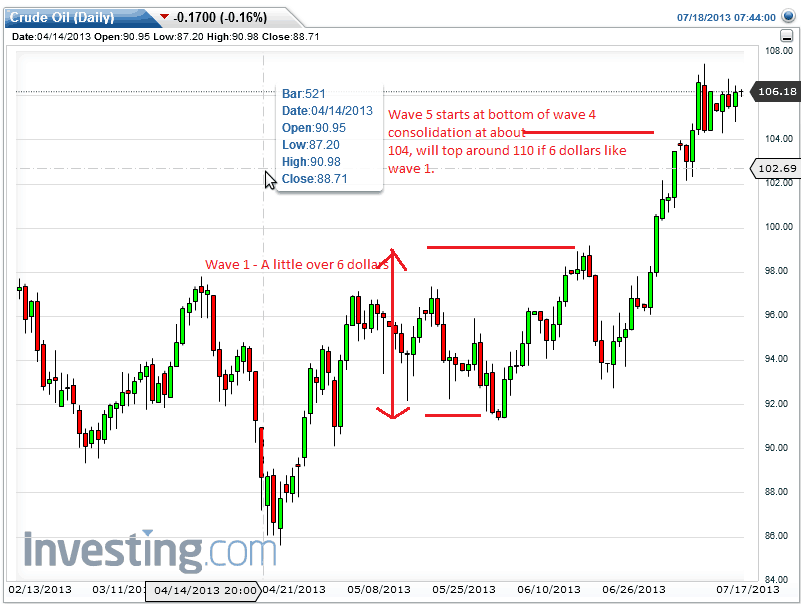

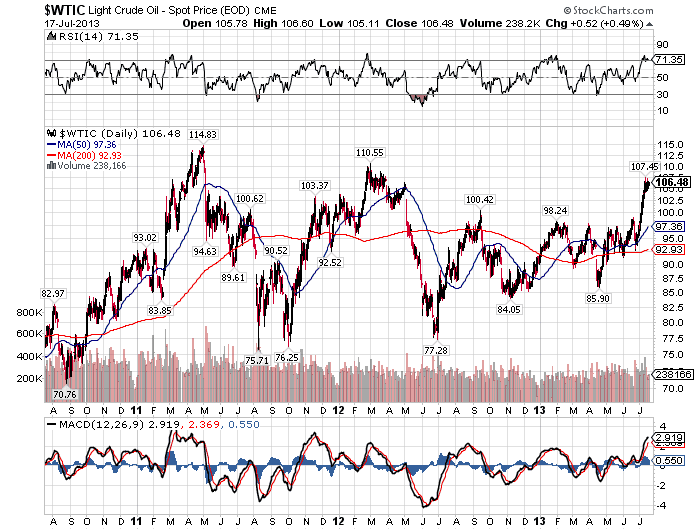

So far, what I have presented is fact. But now the mind games begin. What do we do with this information? First, let’s look at a couple of charts on USO and WTIC. The first chart is the short ascent of WTIC. Note that if wave 5 equals wave 1, WTIC should top around 110 (110.5).

Now observe the 3 year chart of WTIC. It so happens that WTIC last topped out at 110.55. An amazing coincidence, no?

As an added reinforcement for WTIC to go up, notice the large put options positions extend up to USO 39, which is about 109 and change on WTIC. I am sure you are familiar with the Max Pain theory of options. What if the options brokers neutralize the put positions for August, therefore also guaranteeing that WTIC is headed for 109 and change or 110 sometime in August (August options expire August 17th)?

So if this theory (and it is only a theory) holds, it means you have a guaranteed long on USO from here to over 39 and then a setup for a short on USO after the August options expiration (or at least from 110.5 WTIC in terms of price). The only fly in the ointment about WTIC holding up until August 17th is that 110.5 may be hit long before then. Anyway, the price objective looks good.

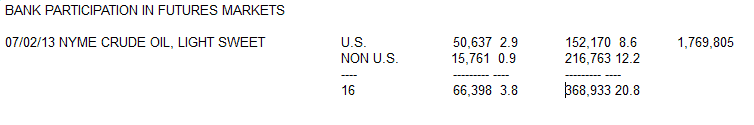

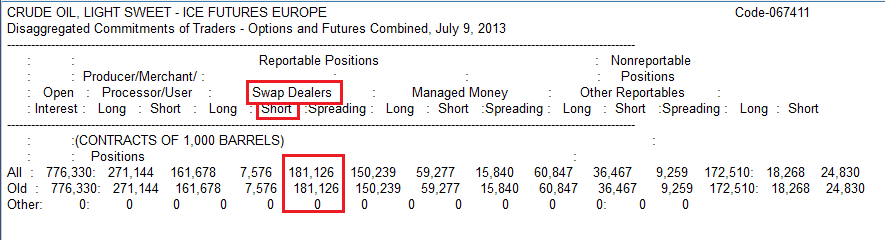

By the way, if you need an incentive in believing oil is going down, check out the Bank Participation report and the Commercials positions.

My crazy theories aside, I hope you find the data I have presented useful in your trading.