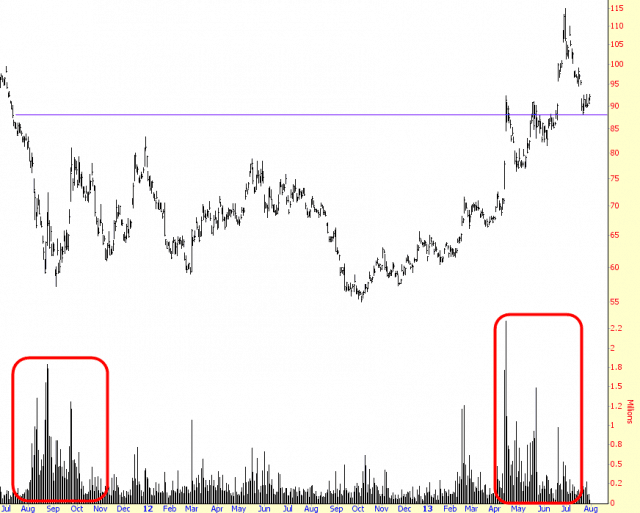

I’ve left out the customary gigantic ticker symbol on the chart below, since I’d like you to look at it objectively. To my eyes, it has many of the elements of a good-looking “buy” – strong volume on each end of the pattern; a clean breakout; a retracement to a well-defined support line. It looks like a stock that’s headed higher.

The thing is, it’s not a “stock” at all, but GLL, the double-inverse ETF for gold. It’s pretty-thinly traded, but it caught my eye as something you might want to consider, particularly for folks who can only take long positions, such as in a self-directed IRA account.