Regrettably, my Bastille Day festivities have rendered me utterly incoherent and completely unfit to articulate an Evil Plan capable of producing credible chaos of any kind. In lieu of my powerfully potent prose, I leave you with the following piece on Portugal’s politically pressing putrid paper pandemonium, passionately penned by pecuniary pressman Pritchard. Please pass the poignant Pakalolo.

“Yields on 10-year Portuguese bonds jumped more than 100 basis points to 7.85pc in a day of turmoil, kicked off by a government request to delay the next review of the country’s EU-IMF Troika bail-out until August.

President Anibal Cavaco Silva set off a constitutional crisis on Thursday when he vetoed a reshuffle by the two conservative coalition parties, insisting on a red-blue national unity government with greater legitimacy to see through austerity cuts until mid-2014.

Socialist leader Antonio José Seguro has so far refused to take part, demanding fresh elections to clear the air. “We must abandon the politics of austerity, and renegotiate the terms of our adjustment programme. The prime minister must accept that his austerity policies have failed,” he said.

Some Socialist leaders have threatened debt repudiation as a way of fighting back at Germany and the creditor powers, though that is not the party position.

Standard & Poor’s downgraded Banco Comercial, and placed a string of banks on negative watch. The agency appeared to endorse warnings that austerity overkill was making matters worse, saying continued fiscal cuts “are eroding the resilience of the private sector”. It said banks were building up a “high volume of problem assets”.

Ricardo Santos from BNP Paribas said it was unclear whether Portugal could withstand a further €5bn of cuts ordered by the Troika. “The bottom line is that the policy is not reducing the debt ratio. We think public debt will reach 130pc of GDP in 2014. The country is near the tipping point,” he said.

“Everybody has been saying that Portugal is so different from Greece but if this political crisis goes on for long, that won’t be so clear anymore.”

President Cavaco Silva has limited powers to force a deal on recalcitrant parties, but experts say it is hard to see how the current government can soldier on after such a blow to its authority. He may have to resort to the “nuclear option” of snap elections, opening the way for a fragmented parliament.

Sovereign bond strategist Nicholas Spiro said the events of the past 10 days had left premier Pedro Passos Coelho a “political cripple”, and brought reforms to a “screeching halt”. The crisis was prompted by the exit of finance minister Vitor Gaspar, the chief architect of Portugal’s crisis strategy, who stormed out complaining that he had been undercut by the junior CDS party in the coalition.

“Gaspar did make strenuous efforts to curb the budget deficit, but Portugal’s debt ratio kept on rising. There has to be a risk of another macroeconomic calamity on the scale of Greece and Cyprus,” said Tim Congdon from International Monetary Research.

Portugal has until now been held up as a poster-child of EMU austerity, praised for sticking to its bail-out terms. Failure at this stage would be a grave indictment of EU strategy itself. It would also force the eurozone to clarify its own crisis policies, exposing deep rifts. Europe’s leaders have vowed never again to force a sovereign debt haircut on banks and pension funds, deeming the experiment in Greece to have been calamitous.

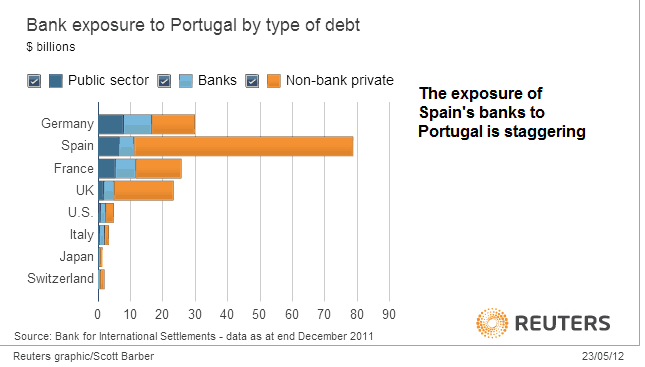

This means they may have to violate the pledge or impose losses on their own taxpayers for the first time if Portugal needs debt relief. A study by Eric Dor from IESEG business school in Lille says an orderly debt restructuring by Portugal would cost taxpayers €16bn in Germany, €13bn in France, €11bn in Italy and €7bn in Spain, and twice as much in an EMU exit crisis. “There is a big probability that Portugal will need debt relief, unless you believe in fairytales,” he said.

The sheer scale of public and private debt leaves the country acutely vulnerable to deflation. Nominal GDP has fallen in each of the past two years. This has pushed net external debt to a record 230pc of GDP.

Portugal’s exports have done well, growing 5pc over the past year, with sales in Latin America, Africa and China making up for the weak picture in Europe.

Yet the International Monetary Fund warns in its latest Troika review that the debt outlook remains “very fragile”, with a credit crunch still eating away at small business. Any external shock could push the country over the edge.

The Fund said contingent liabilities of the state risk adding a further 15pc of GDP to public debt, and a growth shock could add another 7pc. A “combined shock” would push debt to “clearly unsustainable” levels.”

Bear in mind, the Troika’s recent report which Ambrose Pritchard refers to above was written before this latest EU periphery political crisis broke out, and before the US Federal Reserve pushed up global bond yields by nearly 100 basis points. The shock scenario risks are becoming very real. Brace yourselves you malignant malfunctioning momo minnows!

Not a good look for the bad ass banksters of Spain, Germany, France and the UK.

Enjoy the fried sardines as the entire Iberian peninsula sinks into an ocean of Spanish debt. Oh, and speaking of peninsulas, keep your eyes on the one in Egypt called Sinai, it’s about to be blown sky high. Say hi to Mr. WTI !

Andalusia!!!

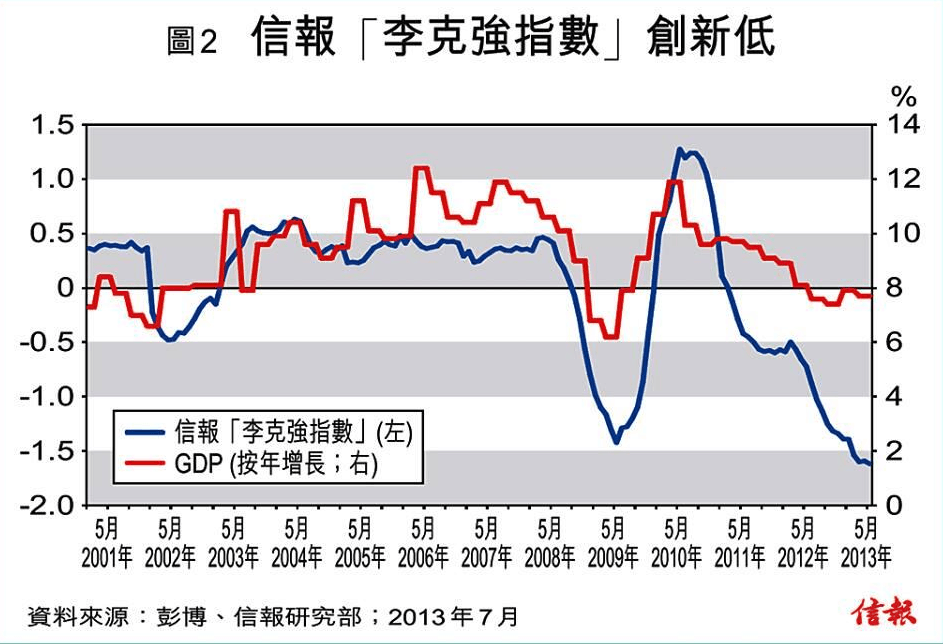

China GDP? – The “Keqiang Index”

The Keqiang index measures economic progress via increases in power consumption, rail freight and bank lending and has diverged significantly since 2011 from official GDP readings. According to Patrick Chovanec, the managing director and chief strategist at Silvercrest Asset Management, the index could be worse than during the global crash of 2008.

Planned Periphery Protests Pending

Greek workers will walk off the job in a 24-hour general strike next week, unions announced yesterday, in the first major protest against the government’s latest plan to cut thousands of public sector jobs to please international lenders. The July 16 strike could coincide with a parliamentary vote expected next week on the policies Athens agreed to with the Troika. Among the measures included in the multi-pronged bill are job cuts for school guards, municipal police and other local government posts. A date for the vote has yet to be set, but the government hopes to put it to deputies by July 19.

Happy Bastille Day!!!

BDI Slope of Hope’s Idiot Savant