Clearly there’s a shock wave going on with energy markets and crude oil in particular. The past couple days offer some great examples of how sometimes, there is no such thing as too high or too low. But how does this week’s Syrian conflict oil spike compare to prior conflicts?

We dug up the last conflict within recent times to see what happened and decided the Iraq War, which began mid-March 2003, would serve as an interesting example. When the Gulf War broke out in August 1990, oil was trading at around $20/barrel. So, we decided to use a more recent example with the Iraq War since we had more relevant oil prices.

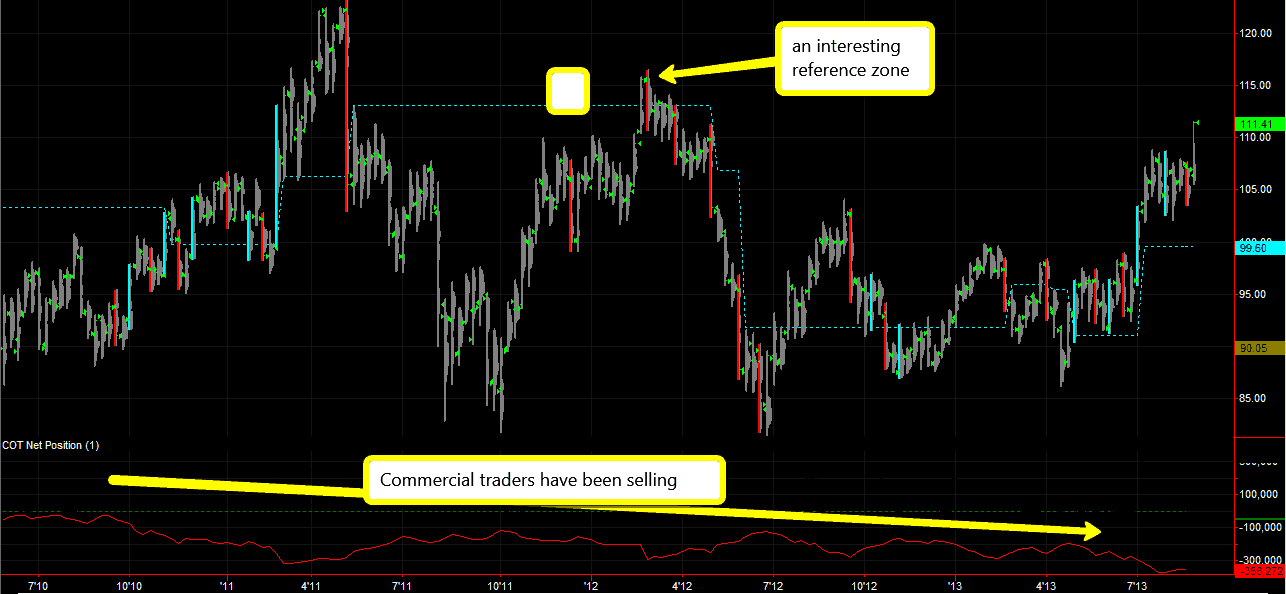

The following are weekly charts of oil futures, with the red line at the bottom showing the weekly net positions of Commercial Traders from the Commitment of Traders (COT) reports. We can see how in the weeks leading up to the Iraq War, insiders, producers, and sophisticated hedgers were loading up on grease. As the war officially broke, they took the opportunity to take profits and unload, only to accumulate some more and gather more fuel into the subsequent bull market.

The contrast with CL’s current structure is interesting. Commercial traders have been selling in anticipation of declining stimulus and unfrackingly believable advances in hydraulic fracking.

Does this mean oil will roll over in the coming weeks? Who knows.

Does this mean we blindly short like crazy back down to 100s and hope for the best?

Of course not.

War creates unpredictable consequences and there’s no telling how high CL can go before the eventual decline. Either way, oil traders will want to stay cautious if buying at highs and keep an eye on price discovery behavior when support levels are retested.