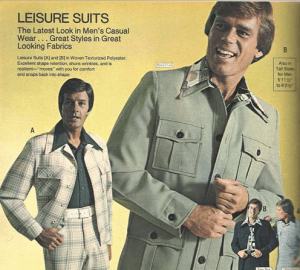

I’ve got surprisingly little to say tonight, but i wanted to at least sign off with one market-related thought. Even though JC Penney is lingering around its multi-decade supporting trendline, it seems to me the trendline is badly broken. Subjectively speaking, it seems to me that JC Penney’s future is pretty grim. Even when I was a kid, eons ago, JC Penney was hopelessly out of style (to say the least), and in 2013, I think it is going to suffer to same fate as Montgomery Ward: relevant in a bygone era, but basically doomed on multiple fronts. I tried to short it today, but I couldn’t even find a single share. (more…)

I’ve got surprisingly little to say tonight, but i wanted to at least sign off with one market-related thought. Even though JC Penney is lingering around its multi-decade supporting trendline, it seems to me the trendline is badly broken. Subjectively speaking, it seems to me that JC Penney’s future is pretty grim. Even when I was a kid, eons ago, JC Penney was hopelessly out of style (to say the least), and in 2013, I think it is going to suffer to same fate as Montgomery Ward: relevant in a bygone era, but basically doomed on multiple fronts. I tried to short it today, but I couldn’t even find a single share. (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

You Better Be Wide Awake

I have a veritable mountain of “catch up” stuff to do, so I won’t have to do a post for a while. In the meantime, I want to celebrate the forthcoming end to the season of the year I hate the most – summer – and the beginning of my favorite – autumn. Here’s my favorite Elvis Costello song……..(whose killer lyrics can be found here):

Consumer Bounce at Hand

A generally-downtrending market has basically two phases: (1) the “ride out the storm”, in which a countertrend bounce is happening; (2) the “enjoy the ride down”, in which there’s a general sell-off. Tuesday of this week was a good example of type (2), and it was one of my best days of the year. Today is definitely the type (1) variety. (more…)

Crude Oil Cycle Review

If crude oil has a dominant cycle, then does this mean world conflict has a cycle? Crude oil cycle watches new an upswing in 2013 was coming soon. We all know the correlation with $100 oil and instant recession that follows in the USA. Well what happens when you have $120 oil and 10 year interest rates higher by 30% at say 3.25%. Consumer squeeze coming. Get the feeling that he commodity bull run is about to start again. Metals, energy and grains have been hitting higher prices recently. This of course means the US Federal Reserve can never stop printing as the US has large bills to pay. (more…)

Fool Me Twice?

What’s going on right this second is precisely what happened exactly a week ago: the market is playing the “Mideast War, Tapering, Seventeen Trillion in Debt and Looming Debt Ceiling Really Doesn’t Matter Compared to Spiffy Electric Cars” game. (Milton Bradley tried to make a board version of the same entertainment, but the name wouldn’t fit on the box). I’m not buying it. On the contrary, I’m selling it. Watch the gap on the IWM closely. (more…)