A generally-downtrending market has basically two phases: (1) the “ride out the storm”, in which a countertrend bounce is happening; (2) the “enjoy the ride down”, in which there’s a general sell-off. Tuesday of this week was a good example of type (2), and it was one of my best days of the year. Today is definitely the type (1) variety.

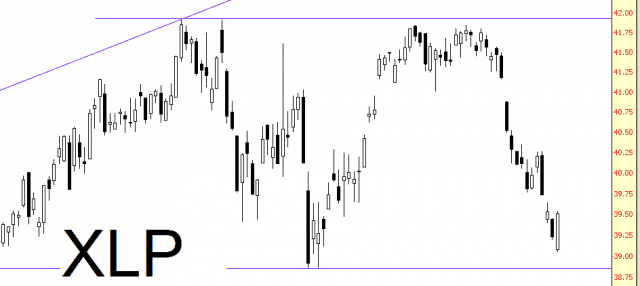

It is tempting durings days like this to look for “oversold” items (and I am deliberately using those quotation marks). If you are inclined to do so, I would suggest XLP, which is the consumer staples exchange-traded fund. It is quite close to its major supporting trendline as well as its June 24th low. I’m not touching it myself, but if the market does indeed bounce, I think this one is a pretty reliable leader.