This will be a short post on this vacation weekend (it is a long weekend here in Canada). This post shows a continuing tale two markets. One moving up and the other moving down.

Monthly Charts: These are charts that are interesting for really long-term positions and probably are not to concerning for most of the folks here on Slope. However, the larger trends are in place.

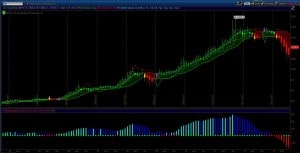

The monthly SPX is in bull mode having set a new monthly high (the highest ever). The last HA candle has no lower wick which is a strong candle. The long stop has moved up to 1521. Buying momentum also has been strong. This is an understandably difficult place for the longer term investor to enter but the reality is that there is no way to know how long this trend will be in place. It could end this week or years from now. Scaling in can be done using position sizing against that stop line (i.e., if you want to risk $xxx on the long side, you know where the stop is and can buy SPY’s accordingly).

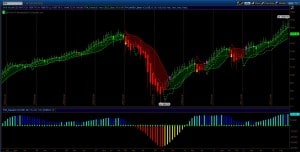

The monthly chart of Gold shows just how much the character of gold has changed. The chart shows approximately 10 years of data and at no time did the monthly momentum go negative. Until recently that is. There is sufficient directional volatility (green dot on the Squeeze) during the last three months to confirm the selling momentum. Also, There have been no upper wicks on the HA candles for 7 months making for a pretty consistent trend.

Here the SPX is also in bull mode. Pull backs have been weak and the last four weeks show HA candles with no lower wicks and all higher highs – a strong trend.

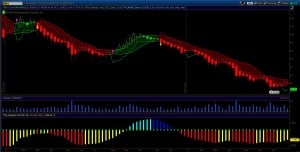

GC, GDX and GDXJ are all in bear mode but are presently not shortable anymore. As I said in my previous post, I expected both GDX and GDXJ to trigger their short stop lines and that is what they did. There are no buy signals so it is a waiting game.

That’s it for this week.

Good Trading!

-Dr.G