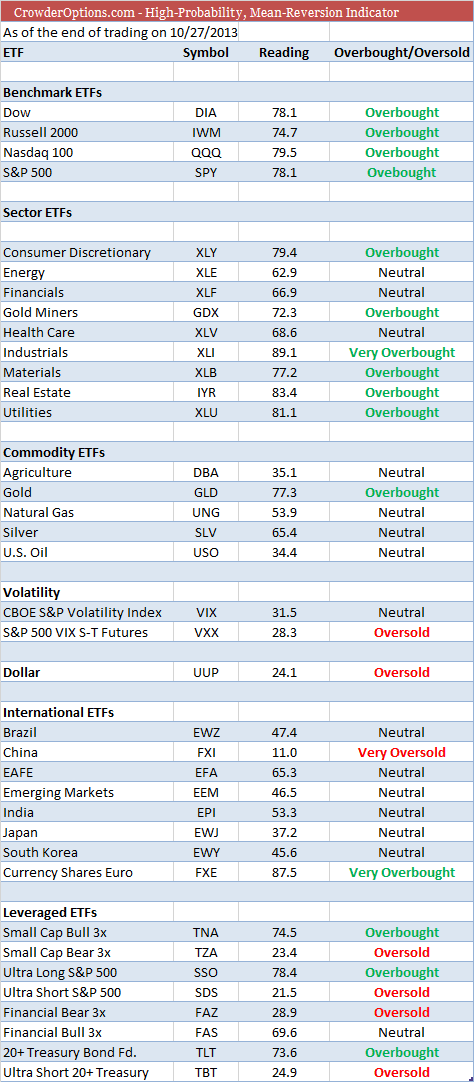

We are in a very similar situation as we were last week…an overbought to very overbought market with two unclosed gaps. Typically, when we see this type of market a short-term reprieve is right around the corner.

We were able to take advantage of this set-up the last time by entering into an aggressive, short-term, directional trade.

We exited the trade for roughly 74% last week and now look to have an opportunity to add another short-term directional trade to the mix.

I typically don’t buy options. My bread and butter is selling options to speculators, thereby creating a high-probability of success with each and every trade I place, but right now the market is giving us an opportunity to not only sell options, but to take advantage of the short-term extremes by buying options…in our case, puts.

All of the benchmarks are in an overbought state and several sector ETFs have pushed into a very overbought state. If we open Monday relatively flat, or higher, I will most likely look to these ETFs for potential trades.

If you are a believer in a statistical approach towards investing please do not hesitate to try my options strategies. I use simple mean-reversion coupled with probabilities for each and every trade. Give it a try, it’s free for 30 days.

If you haven’t had a chance, please join my Free Weekly Newsletter, Twitter feed and/or Facebook page.

Kindest,

Andy