It was pointed out yesterday that the FOMC announcement is actually on Wednesday and so there is another day’s grace while we wait. Ranges tend to be narrow on pre-FOMC days and I’m expecting the gap today to fill.

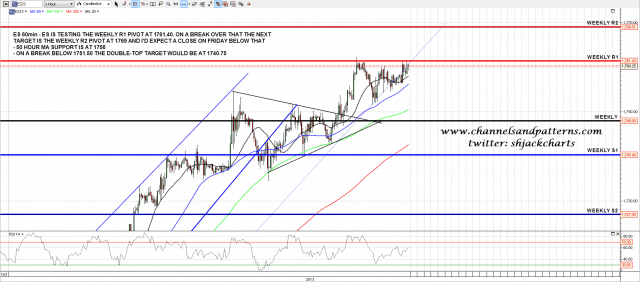

My top range for closing the week based on the weekly upper bollinger band is in the 1770-5 SPX range with a possible but lower probability spill into the 1780 area. That’s not far above of course and on the ES 60min chart I have another red line that should hold the weekly close and that is at the weekly R2 pivot at 1769 (about 1775 SPX). Support below is at the 50 hour MA in the 1756 area, and if we should see a break below yesterday’s low at 1751.5 then I have a double-top target at 1740.75. I’m leaning cautiously bullish for today though. ES 60min chart:

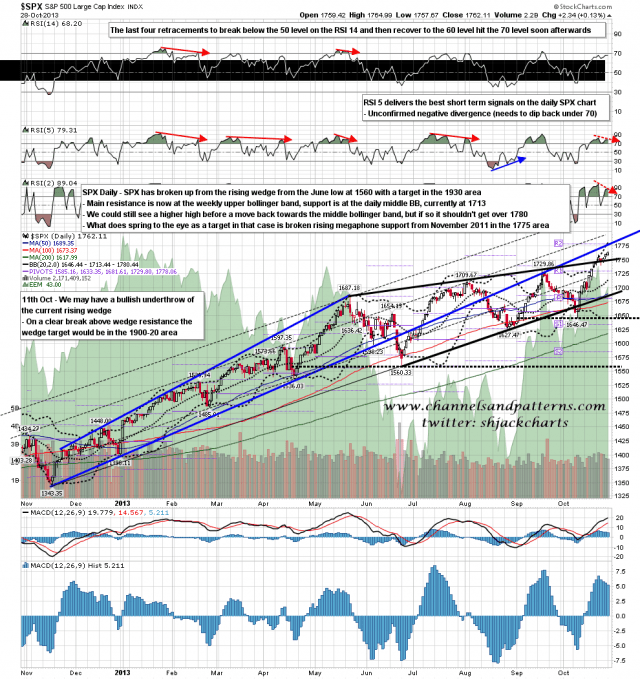

I do also have an ideal trendline target in the 1775 area, and that is at the retest of broken rising megaphone resistance that marked the August high. SPX won’t necessarily test that, but it fits well with other resistance and if we see a positive day today then we could well see that tested. I would be leaning strongly short at that test. SPX daily chart:

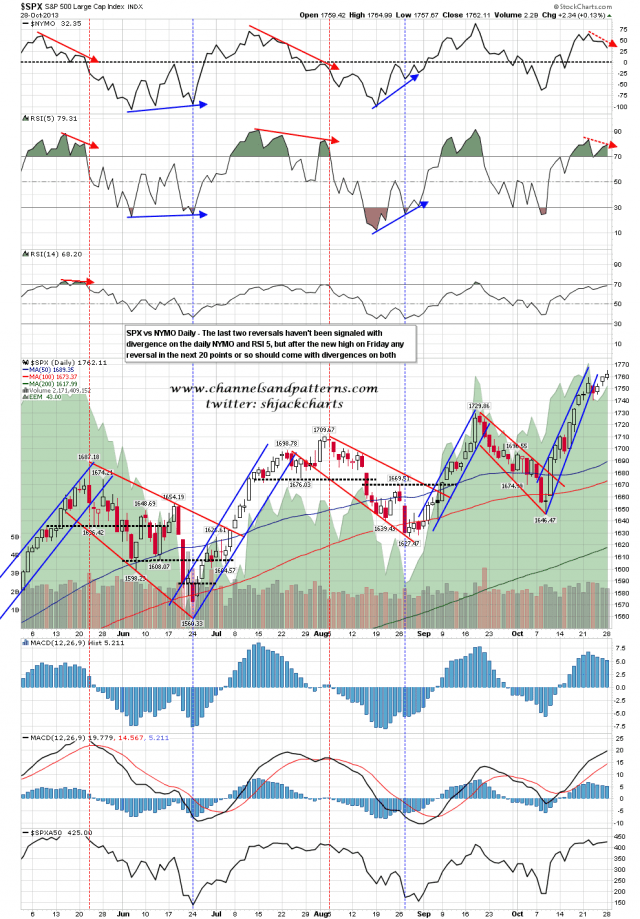

The daily SPX chart is ready to peak and roll over here with clear negative divergence on the daily NYMO and RSI 5. These are generally reliable signals. SPX daily chart vs NYMO:

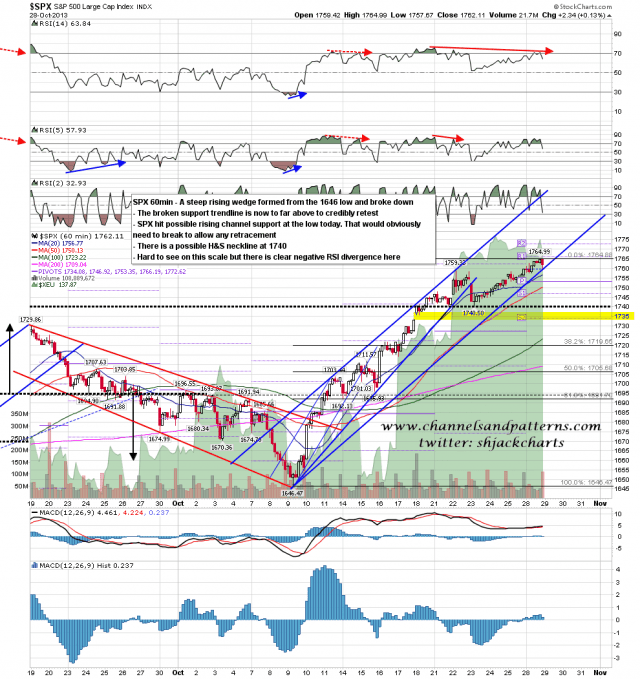

On the SPX 60min chart I have possible rising channel support established yesterday. Otherwise this is a very toppy looking chart, but that possible channel support is worth bearing in mind. SPX 60min chart:

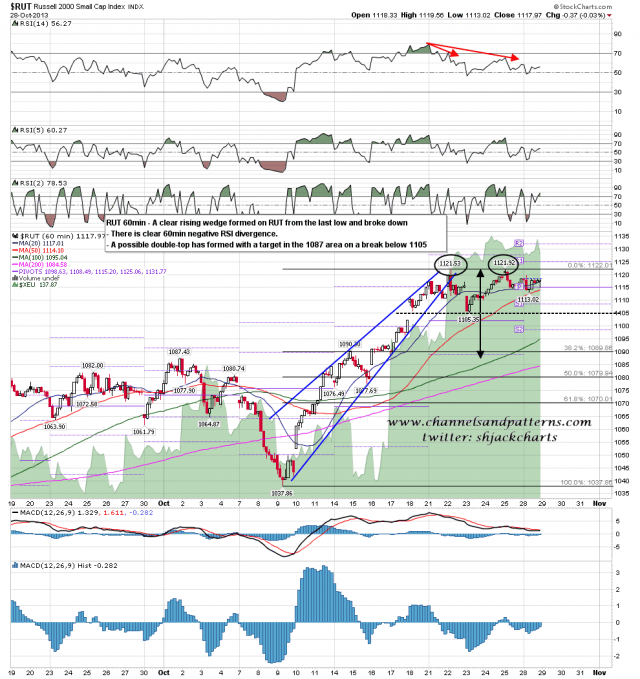

Looking through other US equity markets RUT is showing a similar setup to SPX here, with a rising wedge from the last low that has broken down, negative 60min RSI divergence and a possible double top that has formed at a retested support level. RUT 60min chart:

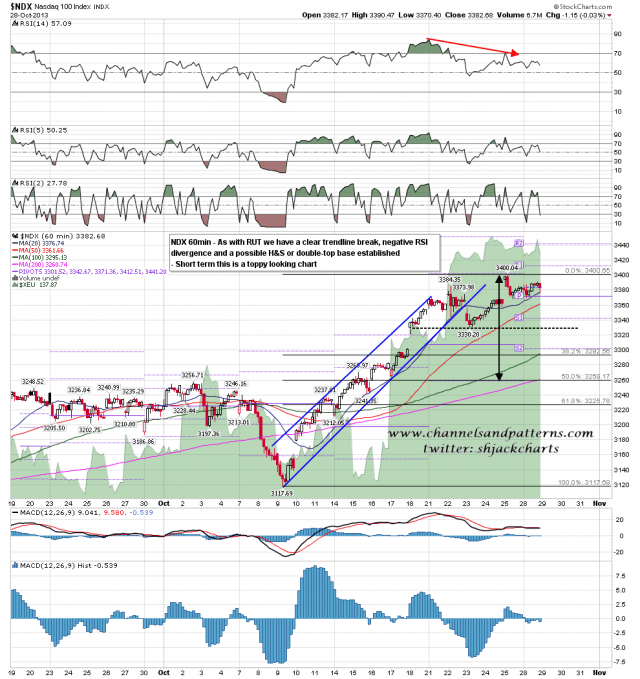

There is another similar setup on the NDX 60min chart:

On other markets CL is rallying as predicted on Friday morning, GC is forming a topping pattern as predicted yesterday morning. I’ve been talking about a likely reversal on GBPUSD soon and the setup for that is on the chart below with two tests and fails at declining channel resistance from 2010 on strongly negative daily RSI divergence and a possible double-top that has formed with a downside target in the 1.55 area on a break below 1.589. GBPUSD daily chart:

I am expecting to see a short term top this week, most likely tomorrow but possibly today. I’ll be looking for a retracement into the 1700-20 area before the main winter event starts with a move towards 1900 SPX. I would like to see the current high made in the 1775 SPX / 1770 ES area but it’s possible that we’ll see reversal below that. I wouldn’t expect to see a strong move over that level.