It was a wild week on Wall Street!

The government shutdown led the charge, which put the fear into most investors. Not options traders, more specifically options sellers.

Options sellers rejoiced as the investors fear gauge known as the VIX pushed significantly higher. And an increase in the VIX or implied volatility has a direct influence on the price of SPY options (and most other options)…it increases the price.

The increase in the price of options allows us, as options sellers, to obviously sell credit spreads like verticals or iron condors for much higher prices. Needless to say, we’ve been waiting for implied volatility to pick up since it pushed back to near historic lows back in late September.

We’ve already added one position for the November expiration cycle and will be adding several more this week due to the recent increase in IV.

Check out in the section below how I typically approach, say, a bear call spread.

Some people will try to take a simple concept and sprinkle it with some mumbo jumbo to make it seem complicated and then claim only they can explain it to you! Don’t listen or don’t buy into any such load of bunk!

Take options. Yes, a lot of people, maybe even your stockbroker, will tell you options are too complicated and confusing. What they may really be telling you is options are something they don’t want to spend the time to properly understand, so they don’t want you to trade them either!

It was only twelve or so years ago, that a privileged few investors who could take advantage of things like streaming quotes and real-time options chains. Options were shrouded in mystery and deemed too complex for the average Joe – to be traded only by the so-called “sophisticated” professional investors.

Since then, however, seismic changes in the options world have leveled the playing field for individual traders and investors. Thanks to advances in technology, innovative trading tools, and better access to what was once privileged information, the self-directed investor is now equipped with the ability to trade like a professional options trader.

So, now that we as self-directed investors have the same technology as professional traders why aren’t we applying the technology in the same way?

We all know that a stock or ETF only has a 50/50 statistical chance of success. That’s right, no better than a coin flip. But, what most self-directed investors don’t know is that there is a way to increase the statistical chance of success to well above 50/50. Professional options traders do, and they have been using powerful, statistically-based strategies for years. But, as I stated before, now we have the same technology. Now it is up to us to use it to our advantage.

If I could choose one of the more powerful tools offered in today’s options trading software it would be the option theoreticals offered. Probability of Expiring (ITM or OTM) is the most informative data point among the options theoretical and one that I employ every day for my readers at Crowder Options.

The Power of Probabilities

Probability of Expiring out-of-the-money is the chance an option will expire worthless at options expiration…thereby making a max profit on the trade.

So, the real question is, how can you use Probability of Expiring OTM to your advantage?

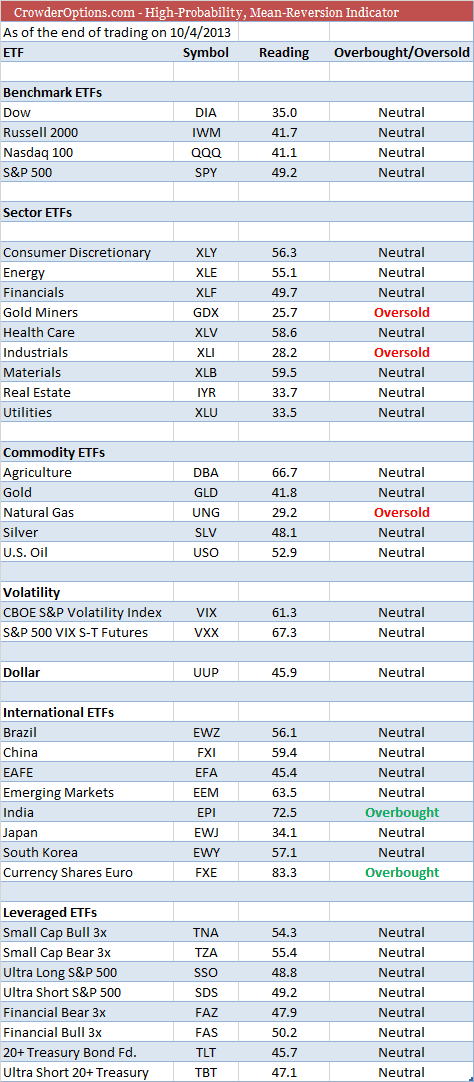

Say, I believe that the S&P 500 (SPY) is currently in a short-term overbought state and the market is due for a sell-off and I want to place a trade that has roughly an 85% probability of expiring out-of-the-money, or as I like to refer it as the probability of success.

I realize that some of you do not have access to trading software that gives you the probability of success, but any worthy trading software will provide you with the delta of any given option.

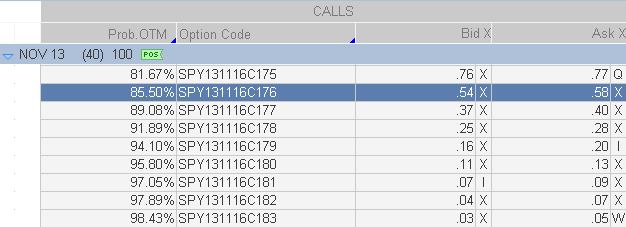

Just look above and you will notice that how delta the probability of expiring out-of-the-money minus 100. The formula 100-delta = POE OTM.

So, let’s look at how we can apply probability of expiring out-of-the-money or delta to the real world.

Hypothetically speaking, I want to place a defined-risk, bearish trade with an 85% chance of expiring out of the money.

A bear call spread fits the bill.

As seen in the option chain above the 176 calls have a probability of expiring out-of-the-money of 85.50%. That means there is only a 14.50% chance that SPY will close above 176 at November options expiration. In other words, the trade has an 85.5% chance of success because you want a credit spread to expire worthless by not climbing above the 176 strike.

I could sell the 176/178 bear call spread for roughly $0.26. A return of 14.8% if the trade closed at or below $176 at November expiration.

Not bad for a trade that has an 85% probability of success.

If you choose a trade with a lower probability of success, such as 67% you will be able to bring in more premium with less capital at risk. But, it is important to realize that when you give up probability for premium your chance of success declines.

Simply stated, the greater the risk, the greater the gain. You must always take that into consideration because…is it worth making an extra 10% to give up 20% in your probability of success? Sometimes yes, sometimes no – it truly depends on your risk profile and conviction. In my case, I almost always side with probabilities. I want consistent income on a monthly basis. I don’t want the stress involved with lower probability trades. It just doesn’t make sense in most cases.

No glitz or glam here – just straight trading.

There is no doubt that we’re at a special time in history. I think we’ll see statistically-based trading absolutely explode over the coming decade. Early adopters like you and I will be sitting in the driver’s seat as wave after wave of novice options investors come into the fold.

If you are a believer in a statistical approach towards investing please do not hesitate to try my options strategies. I use simple mean-reversion coupled with probabilities for each and every trade. Give it a try, it’s free for 30 days.

If you haven’t, join my Twitter feed or Facebook.

Kindest,

Andy