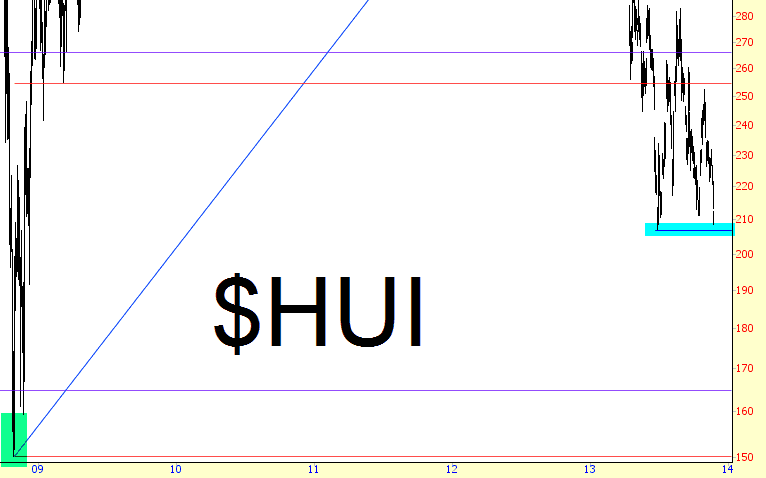

It seems hard to imagine that there could be anything resembling a fully intact bear market in this environment, but of course, there is: gold and the miners. The gold bugs index peaked over 26 months ago and has been falling, more or less, ever since. Can you imagine? 26 months. Equities can’t stay in a downtrend for more than 26 hours.

At present levels, we are challenging multi-year lows. I have tinted in cyan the whisper-thin shelf of support standing between present price levels and oblivion. Breaking this, we could well be on our way to challenging the greatest depths of the financial crisis, five painful years ago. I guess precious metals is just about the only thing that the Fed doesn’t care about. But then again, Yellen doesn’t see any bubbles, so it’s all good in the ‘hood.

Special Bonus: a reprise of one of my favorite hate mails, sent to me in September 2012, just before the $HUI was going to fall nearly 60%:

Hello Timmay.

Thanks for your wonderful posts on Zero Hedge, they are so interesting.

Yes, I especially liked the one where you were predicting a crash in gold stocks.

Excellent work, enjoy your losses, and I don’t mean your trading losses.

The US is going down, the dollar will collapse, and your business will become redundant. A fool and his money are eventually parted. Good luck dummy. Franca.