I love it…

“Ian, you’re an idiot,” I was told in February 2013. “Anyone with half a brain will buy shares of Twitter when it IPOs. It’s a guaranteed winner.”

“But you’re buying Groupon and FPX instead? When they blow up in your face, I’ll be asking for my money back.”

I found my reader’s e-mail quite amusing at the time.

Because as much as I love fan mail, I love the hate mail even more…

Especially once you consider this was the same reader that bashed me for trading the short side of Facebook shortly after IPO.

History told me I was right…

Months before Facebook went public, floundered and briefly died off, the FPX ran from a low of $21 to more than $28. That was a gain of 33% in months. Those that bought the Facebook IPO watched shares plummet from $45 to $19 – a loss of 58%.

We simply traded on anticipatory momentum… and won.

Last I heard my “fan” lost about $8,200 on his decision to buy Facebook instead.

When Twitter announced it would IPO, I went for it again.

On February 7, 2013 in these very pages of Slope of Hope, I said the FPX was likely to move higher. That’s when my “fan” wrote in again.

Nine months after buying the FPX around $30, it now trades at $41.90.

Meanwhile, your average investor bought Twitter’s IPO between $48 and $50 a share. They’re now losing money as the “guaranteed winner” runs to $40.

But I’m the idiot…

As we noted in February, Twitter is likely to flounder and die as other social networking names did initially. Just take a look at the initial outings of Facebook and Groupon.

With growing concern that Twitter is heavily reliant on advertising sales – with few other revenue sources – we’re looking to trade the short side of Twitter this Friday with put options.

Fear alone will keep Twitter grounded…

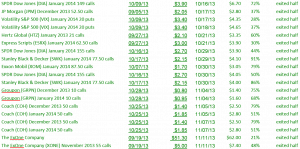

I’m also the same “idiot” that just helped readers realize these gains in no time at all…