Just a quick post this morning, as I still have guests requiring attention and I’m unlikely to do much actual work today.

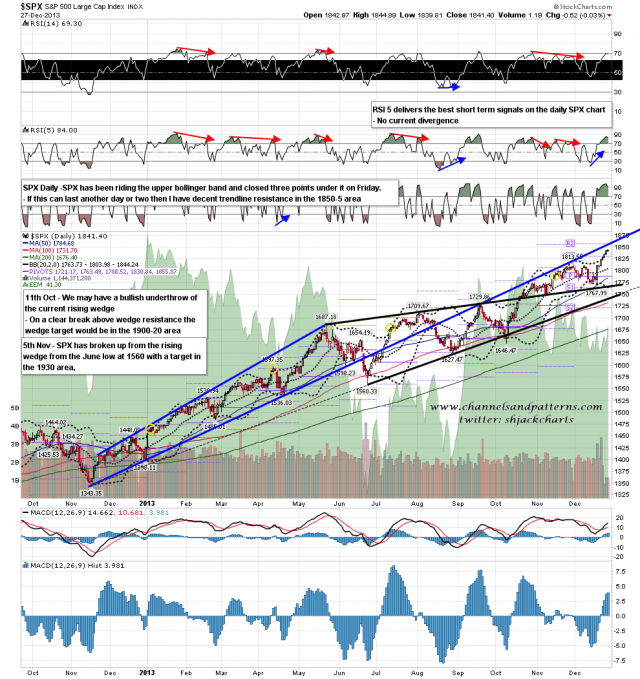

SPX had a weak day on Friday but still closed the day within 2 handles and change of the daily upper bollinger band, so it was nonetheless another day riding the band up. I am expecting a retracement soon to establish the main support trendline for the move to my 1965 target, but there’s no strong evidence yet that retracement is starting. SPX daily chart:

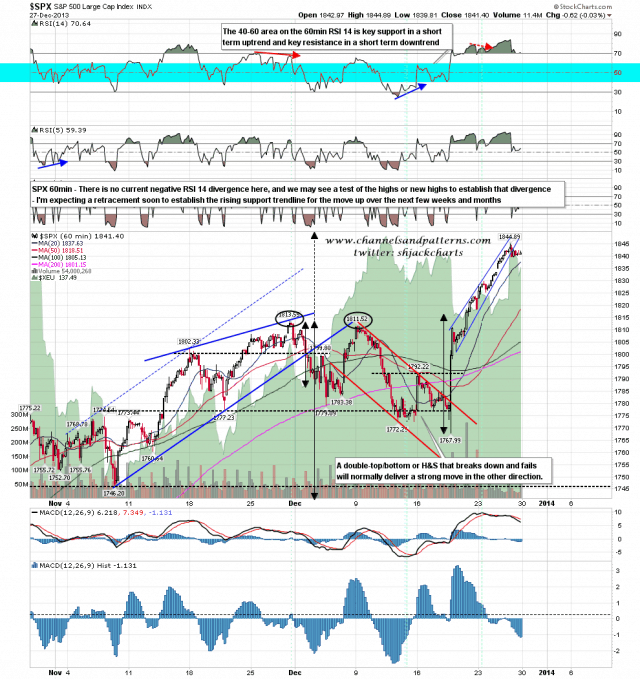

On the SPX 60min chart there is no current negative RSI divergence, and to establish any we would need at least a test of the current highs, which might then run quite a bit further. What I’m also looking for is a small double-top or H&S to form at the highs, and I’m not seeing that yet either. Overall I’m leaning towards seeing at least a test of the highs regardless of whether SPX is topping out short term. SPX 60min chart:

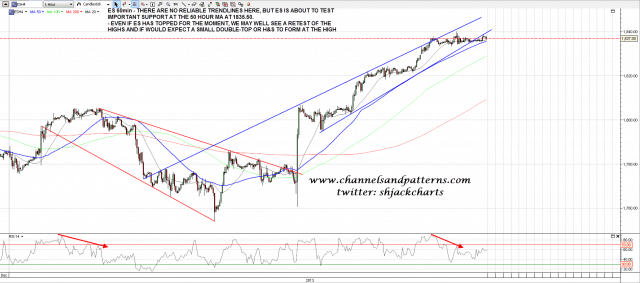

On Friday morning I was looking at the ES 50 hour MA as the key support level to watch and ES is now testing that at 1835.5. A test break below before a high isn’t unusual however, so if we see a break below then it needs to hold as resistance before there can be any confidence that the short term high is in. ES 60min chart:

On balance I’m expecting to see a test of the current SPX highs at least and some sort of topping pattern form before we see the retracement that I’m expecting to see start in the near future. As soon as I can identify that topping pattern I’ll post it on twitter if I can. I’m planning to take my children to see the new Hobbit film later though so I’ll be a long way from my desk for much of the trading day.