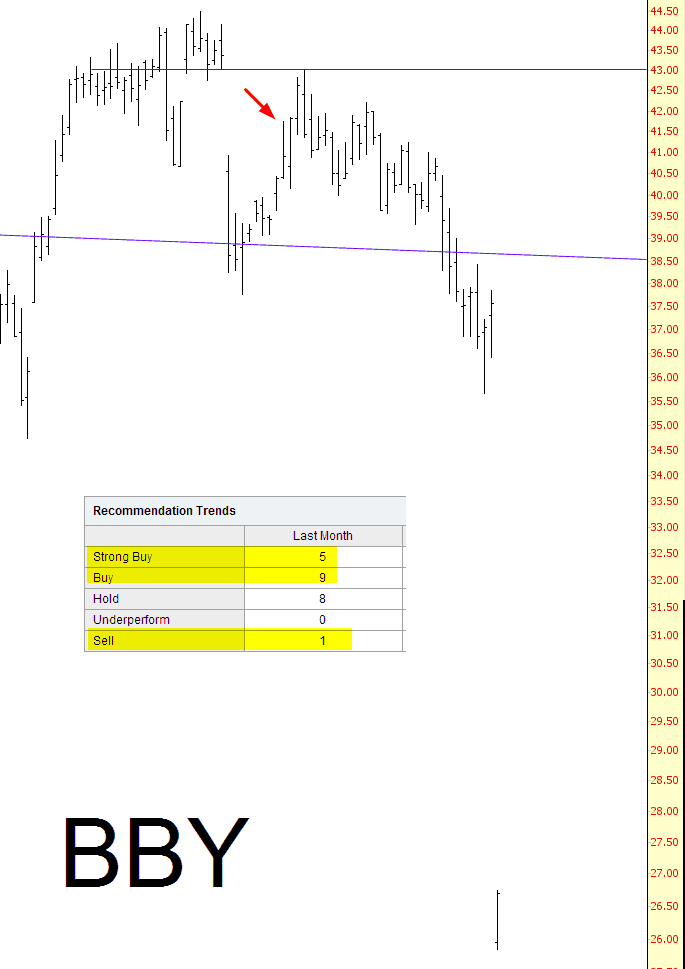

On December 2nd, I did a post called Best Sell for my Slope+ members (it was at that time someone suggested making the URLs a little less obvious as to the content). I started off by saying:

Best Buy has benefited mightily from the insatiable desire of the American public to spend money they don’t have on stuff they don’t need. I would suggest that the company is, shall we say, richly valued, in spite of its break of a major descending trendline.

More specifically, I was focused on it closing a gap, and I wrote:

More specifically, I have shorted BBY with a stop at 43.22, which is just above an important gap. It might be prudent to sit tight a little more for the price to get closer to the gap, but I’m not feeling especially patient today, so I’ve gone ahead and put myself in position.

Well, I was right about the gap; the stock climbed for three more days after my post (although not by much; the gap from November 18 was at $43.03, and the high price three days after my post was $43.01, an incredible 2-cent proximity!

Anyway, here’s the follow-up, with an arrow marking my post, including a bonus table showing how amazingly prescient and useful those Wall Street analysts are.

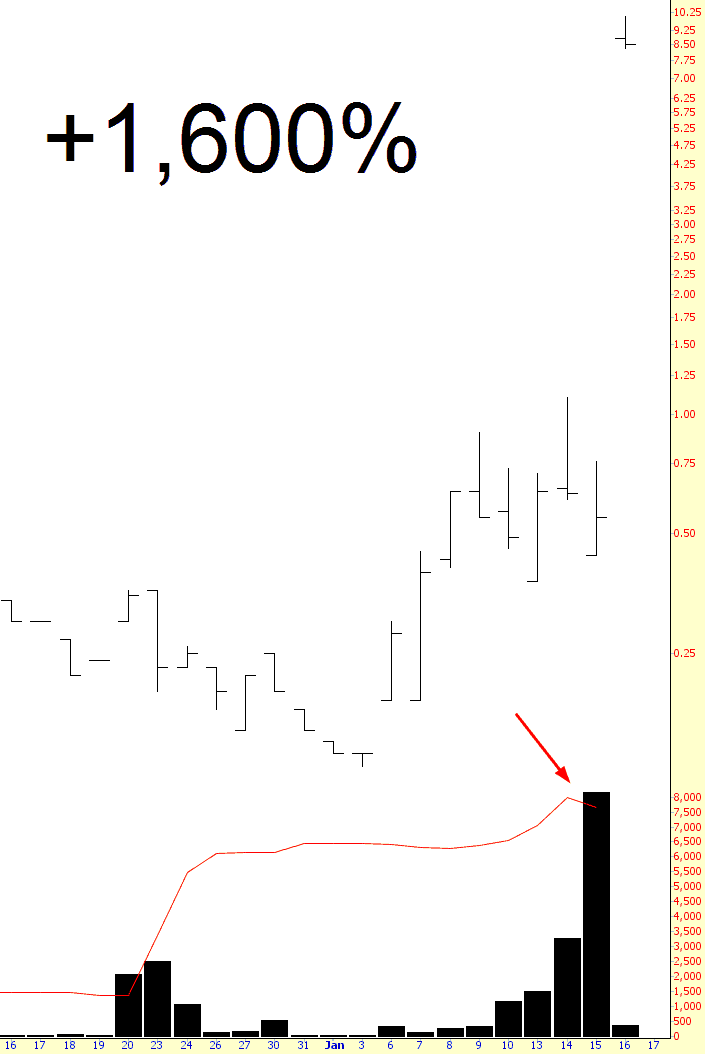

Bonus chart of one of the weekly options. Check out the volume. Any chance anyone knew something in advance? Eh?