I’m not going to post the ES chart today, as not much has changed since yesterday morning and I’m short on time. ES is trading around the 50 hour MA (currently at 1825), which is saying that the retracement may be ending or ended. Bulls need to break back over 1833 ES confirm that the retracement is over and trigger a double-bottom target targeting new highs.

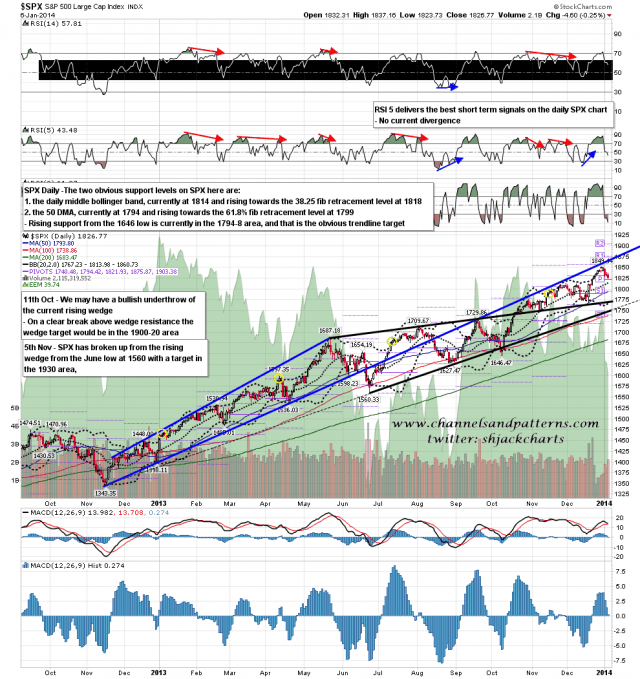

On the SPX daily chart there are still two obvious targets if this is the retracement I have been looking for, and they are:firstly the daily middle bollinger band, currently at 1814 and rising towards the 38.2% fib retracement level at 1818, and secondly the 50 DMA, currently at 1794 and rising towards the 61.8% retracement level at 1799. This deeper target is given extra weight by the obvious trendline support being in the 1794-8 area. SPX daily chart:

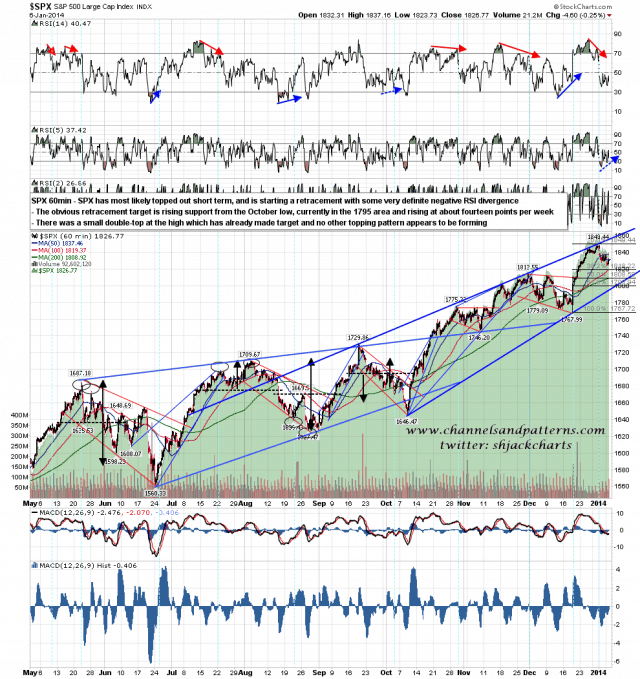

The reason I like the lower target is that I am looking for a support trendline on SPX to match the strong resistance trendline from early July, and the obvious candidate is rising support from the 1646 low. That’s not necessarily going to be hit, but it is a higher probability target here. SPX 60min chart:

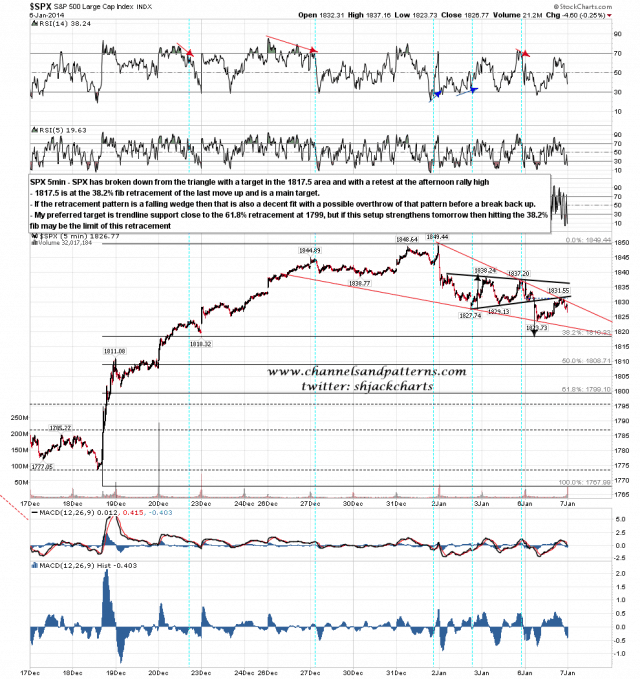

The SPX 5min chart I posted last night on twitter is however suggesting that SPX may only retrace into the 38.2% fib retracement level at 1818. I’m not 100% happy with this setup as the falling wedge upper trendline is weak, but yesterday morning’s triangle is targeting the 38.2% fib at 1818, and the overall falling wedge supports that target and (70% bullish pattern) likely reversal there. We’ll see how this goes today. What I would add though is that if that falling wedge should break up and SPX should then get back over broken triangle resistance not much higher, that would be a strong bullish break that would negate the triangle’s downside target. SPX 5min chart:

On other markets EURUSD recovered yesterday back to retest the broken double-top trigger level. Double-tops can fail, but this is a decent odds short entry for what could develop into a very large move. EURUSD 60min chart:

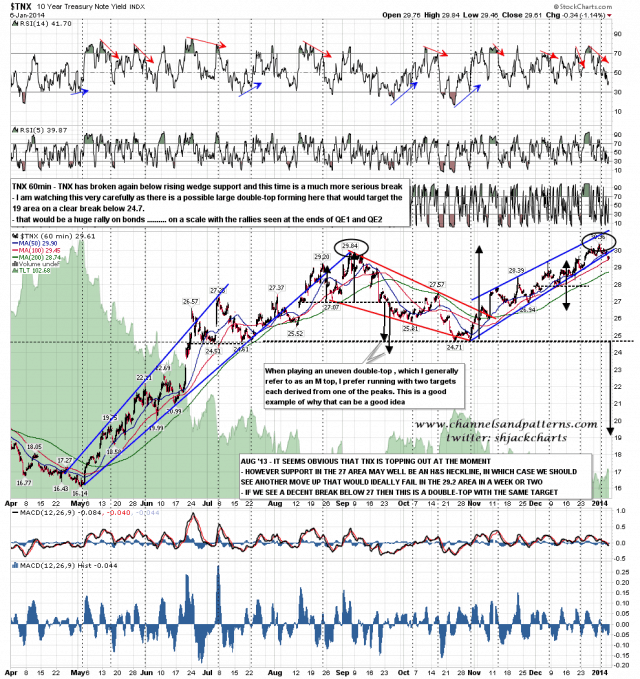

On TNX the break below rising wedge support that I have been concerned might happen has now happened. This has potentially huge implications as there is now a possible major double top forming that would target the 19 area on a clear break below 24.71. How likely is such a huge move? Well huge rallies on bonds (and declines in yields) were seen at the ends of QE1 and QE2, and if QE3 is really winding down then there would therefore be every treason to expect another face-ripper rally on bonds at the end of QE3. I’d be very surprised to see a 10% taper deliver the same result though so I’m reserving judgement until we have more evidence that such a rally may be starting. TNX 60min chart:

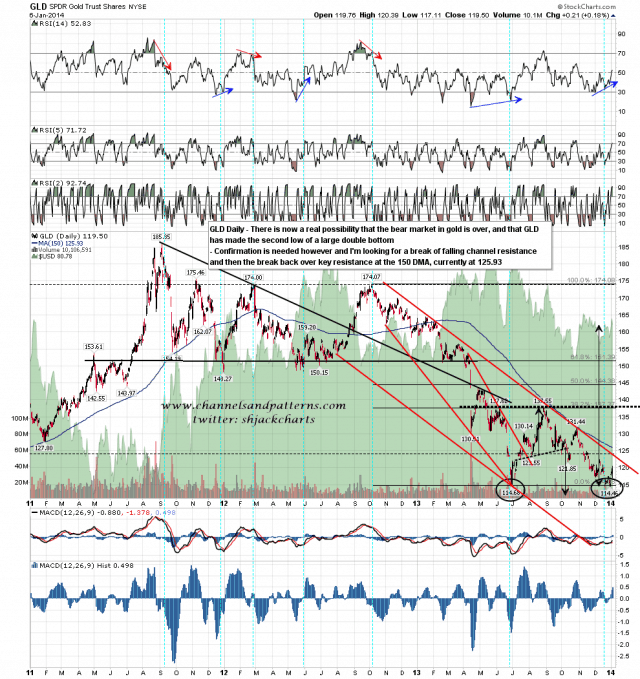

I’ve been mentioning that gold may have made the second low of a major double-bottom and would mention that there would most likely be decent confirmation of that well before that double-bottom broke up. That would be a break over falling channel resistance on the daily chart and also more importantly a clear break back above the 150 DMA, currently at 125.93. GLD daily chart:

I am on alert for a possible break up to retest the SPX highs here. An open above 1826 ES would be a serious blow to the bears and a break above 1833 ES would most likely trigger at least a test of the highs shortly thereafter. Apologies for the late post this morning, I’m still struggling with a heavy cold.