A funny thing happened to the financial markets since the new year. Suddenly, a great many unicorns are pulling up lame, and what about the rainbows they were paraded across you might ask? Well, they seem to have been painted with watercolors, for the reign of reality has shown they were far from anything naturally weatherproof. Let alone permanent. (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

“Yellen is Going to Talk the Markets Up to New Highs”

Oh man, it just piles up higher and higher.

Yellen is Going to Talk the Markets Up to New Highs

If you can get past the photo that leads this story with your breakfast intact, you will be treated to…

“Asset purchases are not on a preset course,” Yellen told Congress , “and the committee’s decisions about their pace will remain contingent on its outlook for the labor market and inflation.”

Actually the Treasury bond market’s decisions about their pace will remain contingent on yields. (more…)

ES Short

Ultra-brief post, to confirm that as the ES keeps rising and rising, the odds for a trend reversal are nearing very extreme limits.

Here below you can see a table where we have highlighted the fact that if today the market would close up it would be a quite rare event (7 days up in a row). (more…)

My Newest Book Is Finally Here

Well, it bloody well took long enough, but I finally have my newest book in my hot little hands. It’s  called Panic, Prosperity, and Progress: Five Centuries of History and the Markets

called Panic, Prosperity, and Progress: Five Centuries of History and the Markets, and one of my dogs is modeling with my first author’s copy here. I am very proud of this book – in a sense, it’s the first “real” book (out of a couple dozen) that I’ve written, since it’s not about computers or ProphetCharts. I’ll probably be selling signed copies from the blog in the next couple fo weeks, or you can get an unmarred one from Amazon with the link above.

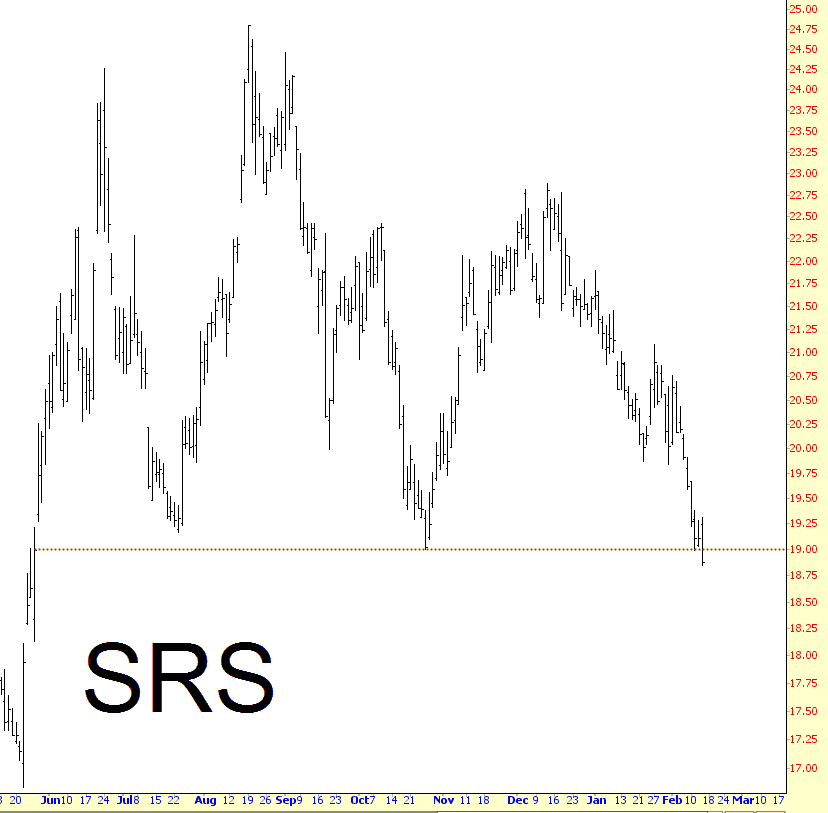

Board the Real Estate Victory Train

It seems hard to believe, but real estate is still surging. If you want to take advantage of this in a somewhat curious way, you could short the ultrabearish-on-real-estate ETF symbol SRS, shown below. It is sporting an extremely clean head and shoulders pattern, which spells doom for SRS and good times ahead for real estate.